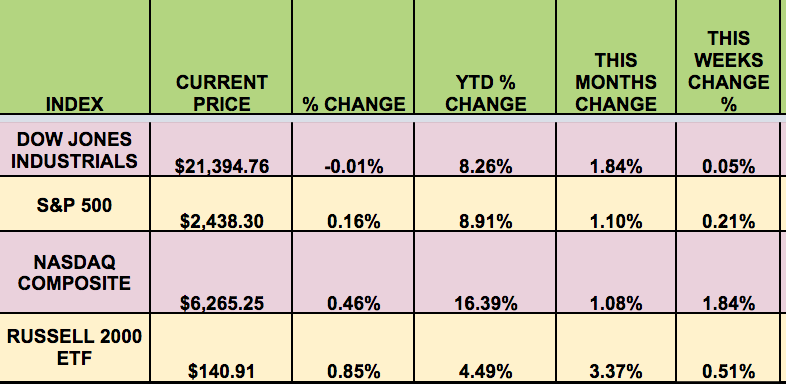

Markets: The market reversed its order this week, with the NASDAQ and the RUSSELL small caps leading, the S&P and the DOW flat. The S&P did make another all-time high however.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: AHH, CVA, CIM, DCUC, PK, VER, WIN, MHLD.

Volatility: The VIX fell 3.5% this week, finishing at $10.02.

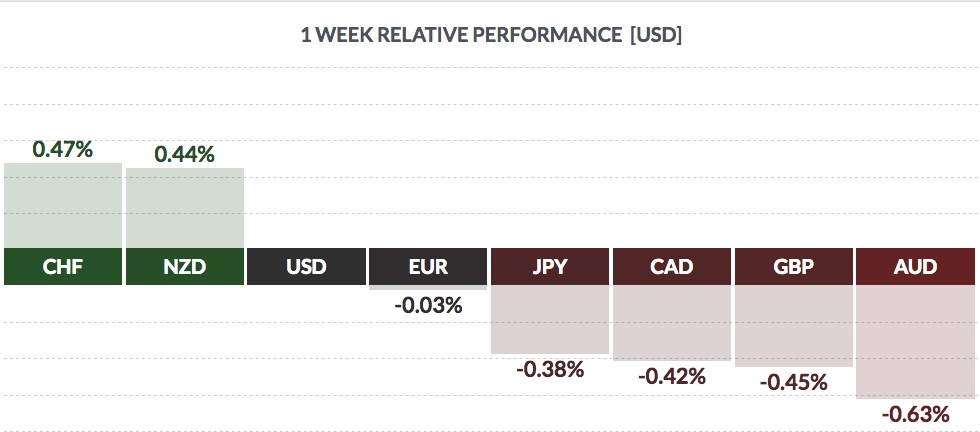

Currency: The $ rose vs. most other major currencies, and fell vs. the NZ $ and Swiss Franc this week:

Market Breadth: 14 of the DOW 30 stocks rose this week, vs. 16 last week, and 40% of the S&P 500 rose, vs. 60% last week.

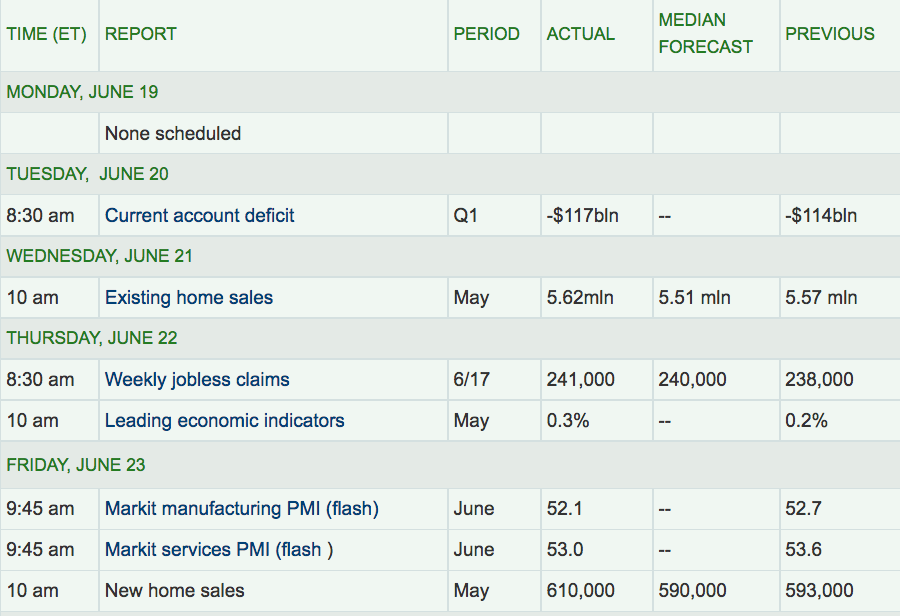

Economic News: The big US banks passed the Fed’s stress tests this week. Next week gives us part 2 – the final decision for their capital plans. New Home Sales surprised to the upside, with record prices, and April’s numbers were revised upward by 24K.

Week Ahead Highlights: We may see the Senate vote on their highly controversial Healthcare bill. Both Fed chair Yellen and ECB chief Draghi will give speeches in Europe next week. Big banks will see if their capital plans are approved on Wed.

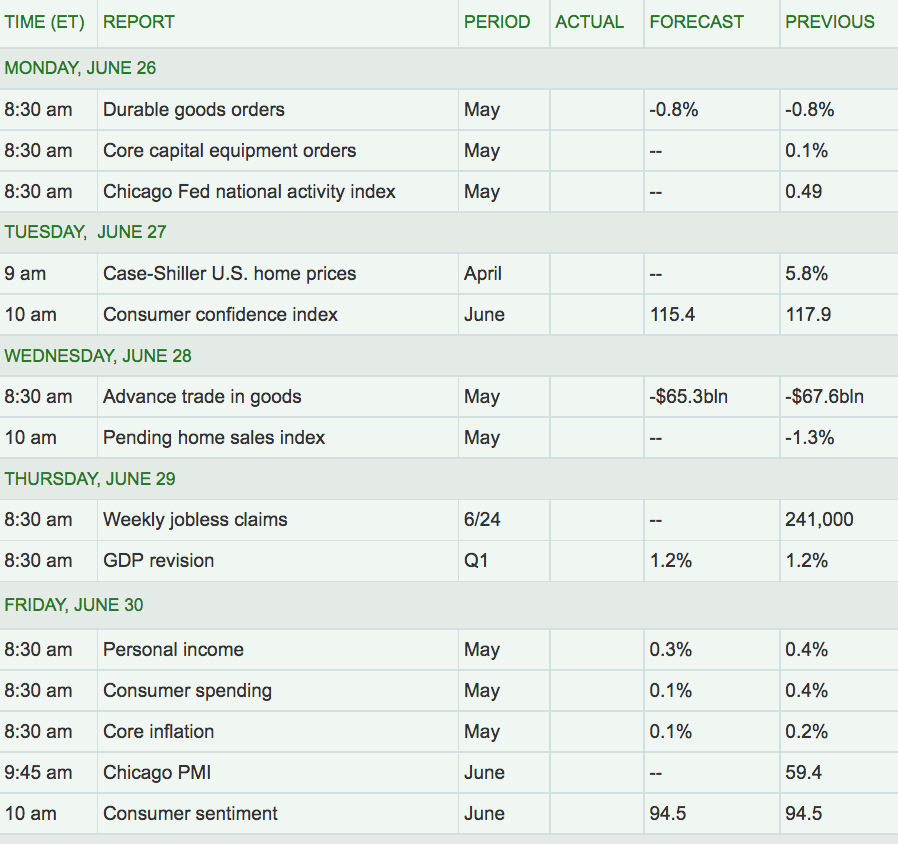

Next Week’s US Economic Reports: Consumer data will be the highlight next week, with reports on Consumer confidence, sentiment, and spending due out.

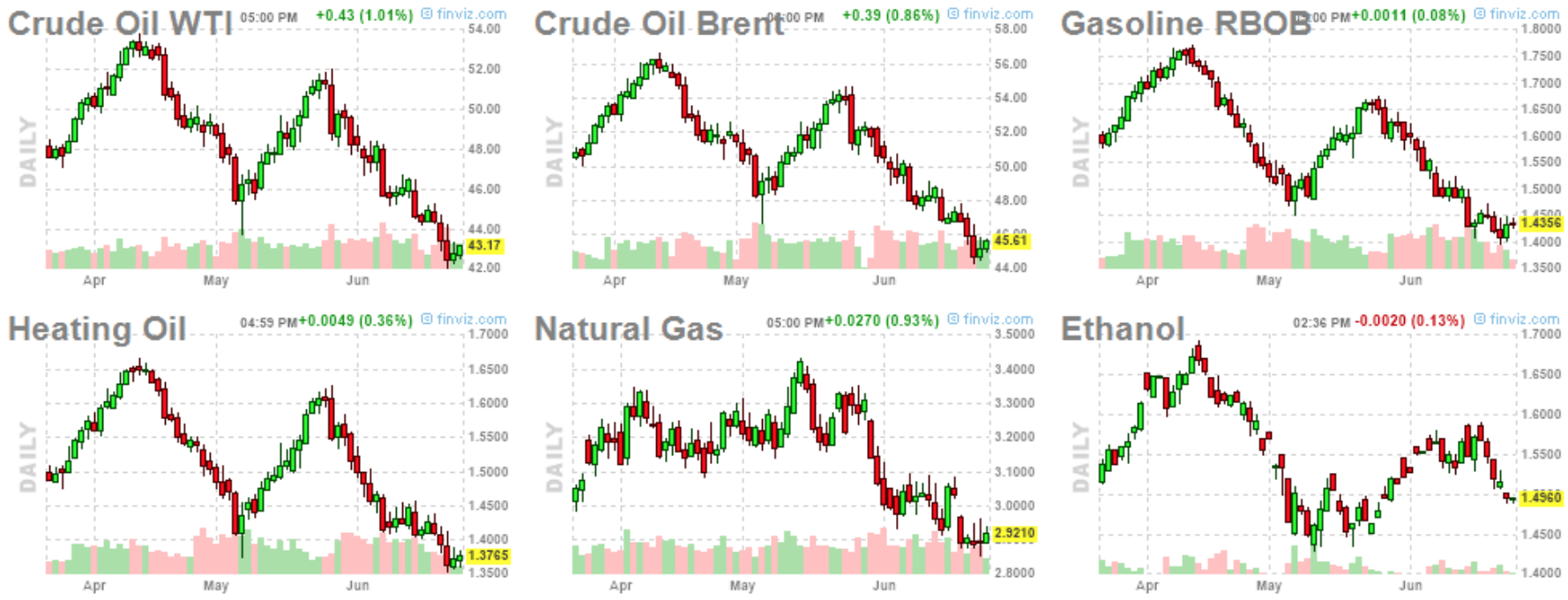

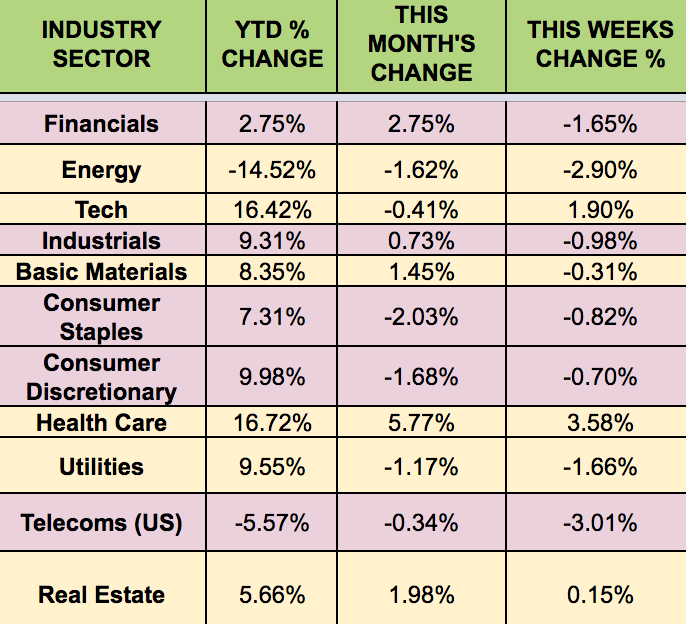

Sectors & Futures: Healthcare led this week, while Energy and Telecoms trailed.

WTI Crude futures fell again, down -4% for the week, as Oil hit a 7-week low. and Natural Gas fell -3.82 this week. Here’s a look at Energy prices over the past few months: