Forex News and Events

Markets watch US jobs data (by Yann Quelenn)

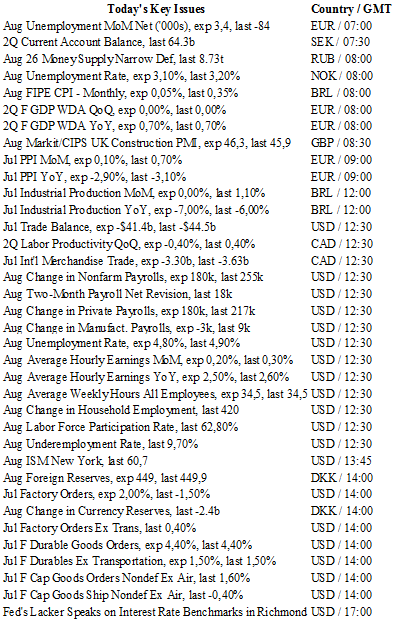

NFPs will be released today, one week after Jackson Hole and Janet Yellen’s hawkish comments, which, as expected, did not provide any hints of a concrete path for rate normalization.

In our view, we still believe there will not be any rate hike in September. Theoretically, strong jobs data today could potentially push the Fed to finally raise rates. Also, to rebuild its damaged credibility, the Fed now needs to communicate and deliver concrete direction to the public about its policy objectives. Today’s NFPs are expected to print at 180k vs 255k in July.

We feel that overly strong jobs data could provide Donald Trump with an advantage in his bid for presidency and to a certain extent, question the independence of the Fed. Recently, Fed Member, Lael Brainard donated $2,700 to Hillary Clinton. On top of this as a private central bank with very close ties to the American private bank sector, it is well known and documented that Hillary’s Clinton campaign has been financed by major banks. Some even refer to Hillary Clinton as, “the Wall Street candidate”.

However, from our vantage point, the US economy’s health is largely overestimated and we do not predict a strong figure today. Rate hike expectations will move towards the end of this year and the stock market will celebrate the good news: free money will continue to flow in and the S&P 500 should continue to trade around its recent year-highs. Basically, the status quo continues.

ECB next week… don’t expect much (by Peter Rosenstreich)

It has been almost three months since the UK Brexit referendum and economic data in the eurozone seems largely unaffected. Given the general assessment that the eurozone has dodged a bullet, we suspect that the ECB will only marginally tweak forecasts and will be less likely to expand its easing program. We expect that Draghi will opt for a wait-and-see strategy based on the impact of the Fed policy decisions. In the absence of any sudden shifts in Europe’s economic outlook, the ECB will stay on the sidelines with its current policy mix. ECB economic projections could however be adjusted lower to reflect the less optimistic consensus read. Expectations for significant growth shock sent the 2017 growth forecast down to 1% from 1.2% (2016 unchanged at 1.6%) however, so far, fears have been unwarranted. Given the ECB's current growth projections of 1.7%, we could see a marginal adjustment to 1.4%-1.5%. Considering the weaker state of the Euro due to Fed raising policy rates, the currency competitive valuation should help backstop a deeper correction. Inflation remains a concern for the ECB at its current persistently low level. The conversation at the ECB over the reasons for weak inflation dynamics has heated up with many suggesting that the ECB's own bond buying program is the root cause of the depressed long term inflation outlook. Despite the downward adjustment to growth, we suspect that inflation will remain basically unchanged for the next two years. The ECB’s policy mix of negative interest rates, asset purchases and unlimited cheap funding to banks has achieved good results for the European economy. If not at this meeting, it’s highly likely that the ECB will signal an extension of its bond purchasing programme through March 2017 (to reduce market uncertainty). We anticipate that the ECB will wait for the December meeting before announcing any official extension to QE and combine it with further adjustments to economic projections. By December's meeting, the longer-term effects of Brexit should begin to become more apparent.

GBP/USD - Growing Bullish Momentum.

The Risk Today

Yann Quelenn

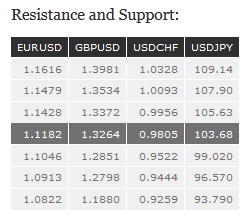

EUR/USD has bounced back towards 1.1200. Yet, the short-term technical structure suggests further weakening. Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Hourly support lies at 1.1046 (05/08/2016 low). The road is wide-open for further decline. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD has exited its hourly range by breaking hourly resistance at 1.3279 (26/08/2016 high). Last significant low can be found at 1.2866 (15/08/2016 low). Closest support is given at 1.3024 (19/08/2016 low). As expected the low volatility was indicating that selling pressures were fading. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY short-term bullish starts to pause below 104.00. Hourly resistance can be found at 104.00 (01/09/2016 high). Hourly support is given at 103.06 (01/09/2016 low). A key support lies at 99.02 (24/06/2016 low). Expected to show further strengthening. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF keeps on pushing higher. The road is definitely wide-open for further strengthening. Hourly resistance at 0.9844 (09/08/2016 high) has been broken. Next resistance lies at 0.9956 (30/05/2016 high). Key support can be found at 0.9522 (23/06/2016 low). Expected to show further bullish move. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.