In late August 2015, the US stock market tumbled sharply, unleashing a year of heightened volatility that seemed to anticipate the worst for the economy. But the volatility turned out to be a false alarm and equities rebounded, reaching new all-time highs in recent weeks. Mr. Market’s warning, in short, was a dud. In fact, the S&P 500’s various swoons over the past year turned out to be buying opportunities. That’s obvious now, but uncertainty reigned supreme in real time, at least from a markets-only perspective. By contrast, it’s useful to point out that Mr. Market’s tantrums were never verified by real-time monitoring of US macro risk. The lesson: filtering market volatility through a macro prism is essential for separating the signal from the noise.

Recall that on Sep. 1, 2015 I discussed the bearish warning that was bound up with the stock market’s tumble at the time. “Markets are pricing in the heightened probability of slower growth,” I noted. The following February, a markets-only view of recession risk pointed to a high probability that a new recession had started, as outlined here. But in that late-February analysis I also pointed out that “the hard economic data has yet to formally signal that a recession has started.” The macro trend did in fact slow, as shown by the weak GDP gains in this year’s first and second quarters. On that score, the market’s implied warning proved to be correct. But it’s also noteworthy that a formal recession signal was never confirmed by a broad measure of economic indicators—a simple but powerful fact that set the foundation for the market’s recent rally to new highs.

On Feb. 12, 2016, near the height of stock market gloom, I reviewed the upbeat data in the Philly Fed’s ADS Index, which indicated that recession risk was still less 2%. A week later, a broader profile of the economy using data available at the time confirmed that it was premature to conclude that a recession had started. As I explained in that late-February post, “One thing that’s remained constant is the lack of a clear-cut recession warning in The Capital Spectator’s proprietary business-cycle benchmarks.”

In the months to come, the US macro trend wobbled, but a broad survey of key economic data never reached the tipping point that signaled that an NBER-defined downturn had arrived. On Mar. 17 of this year, for instance, I wrote that “the probability is low that a recession started last month and the near-term outlook suggests that the economy will continue to sidestep a new downturn, based on current data.” The theme continued in the April and May macro updates and in the weekly analytics via the US Business Cycle Risk Report (US-BCRR).

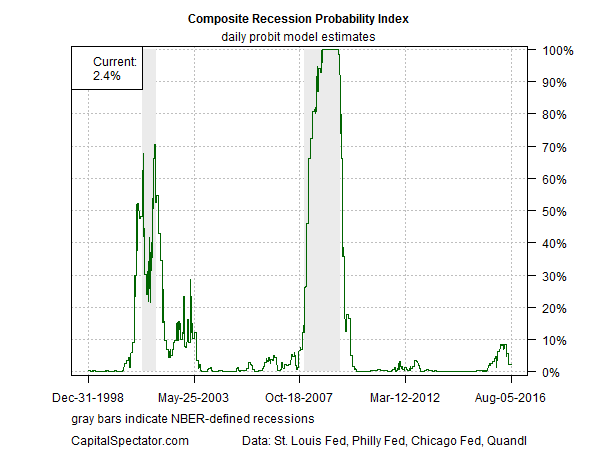

To bring this tale up to date, the Aug. 7 edition of US-BCRR advised subscribers that recession risk remained virtually nil, in part due to the solid gain in employment for July. As a summary, here’s a composite chart that was published in the latest newsletter that aggregates several business cycle benchmarks (see here for details) for estimating the probability of US recession risk:

Mr. Market is once again on board with the notion that recession risk is low and that the near-term outlook implies a modest firming in the macro trend. But one can argue that the stock market arrived late to this party. In any case, you can be sure that the market’s optimism will waver again at some point. The implied warning may or may not be genuine. How can we decide if the next tumble in equity prices is a buying opportunity or a genuine warning of macro trouble ahead? There are no flawless metrics, but verifying (or rejecting) Mr. Market’s gyrations via a broad-based macro prism is invaluable.

Indeed, the real-world test over the last 12 months speak volumes. The business cycle metrics reviewed on these pages and in US-BCRR never wavered in casting doubt on the recession-is-fate forecast that flowed from a markets-only perspective. True, the future looked wobbly at times, even via a diversified set of macro benchmarks. But the bottom line is that a formal recession signal never arrived, even if the stock market suggested otherwise at times.

The lesson is clear: relying on markets-only signals for evaluating recession risk is the equivalent of rolling dice. For a higher level of reliability, and one that passed the smell test over the past 12 months, it’s necessary to look deeper and wider via a diversified set of business-cycle benchmarks.

But there are no free lunches. Higher reliability comes at a price in the form of a time lag. Economic data is published after the fact and is subject to revision. We can minimize this embedded risk to a degree by casting our data net far and wide, and generating near-term forecasts that carefully model an array of indicators. Market data, by contrast, is available in real time on a tick-by-tick basis. Timeliness, however, has limited value if reliability is low, as events over the past year remind.