Gold continues to show remarkable strength. As of this writing, it remains more than 27% off its December lows.

Gold’s spike on the news of Brexit is of course very predictable. However, it has fallen back less than 2% since; the S&P 500 has advanced about 6% from the post-Brexit lows.

What is giving gold this continued strength, even as risk markets break out to new highs?

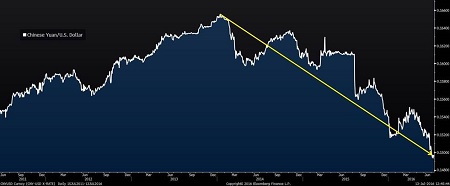

First, foreign buyers: both individuals and governments. Chinese buying is occurring, and it’s not just speculators. Chinese savers are attracted to gold due to prospects and fears about further declines in the Chinese yuan against the U.S. dollar (down 10% since the beginning of 2014). While Chinese authorities have pledged currency stability, the prospect of further yuan devaluation is not absent from the minds of Chinese or U.S. citizens.

Ongoing Decline In the Chinese Yuan Drives Chinese Individual Investors to Gold

Consumer price inflation in China has been rising from its early 2015 lows, although it remains fairly subdued. This further increases demand for gold as an inflation hedge.

Of course, Chinese consumers are not the only source of gold demand among individuals. Citizens of Europe, India, and the U.K are facing uncertainty surrounding the value of their currencies, and under such circumstances, they will buy gold as a protection and store of value. Indians are buyers for currency protection and for ornaments.

Governments Accumulating Gold

Among governments, Russia, China, and Kazakhstan are all accumulating gold reserves; Russia added 208 tons in 2015, and China is expected to add about 230 tons in 2016. Our regular readers know that we are watching Russian and Chinese efforts to construct a framework of alternatives to the west’s hegemonic multilateral institutions such as the IMF and the World Bank -- and gold accumulation is an element in that strategic process.

Besides these specific reasons, we note that although equity markets are rallying and fear has receded, that fear is still abroad. Individual investors in many parts of the world are anxious about economic volatility, and about the potential actions of their countries’ monetary authorities which may degrade the value of their currencies. Europe and the U.K. are chief examples, but far from the only ones. Political, economic, and monetary uncertainty may take a respite for some weeks, or until later in the fall -- but they are not going away, and neither is demand for gold.

Investment implications: Gold demand continues to be strong, even as stock markets are breaking out to new highs and fears prompted by Britain’s decision to leave the U.K. are receding. Individual buyers in China, India, the U.K., Europe, and elsewhere are seeking protection from currency devaluation and instability and from economic and political uncertainty. Governments eager to create alternatives to the west’s multilateral institutions are also continuing their accumulation of gold. Fears are tempered now, but still present in the background -- and even as stocks rally, gold may remain strong.