AMC Networks Inc. (NASDAQ:AMCX) is slated to report first-quarter 2017 financial numbers before the opening bell on May 4.

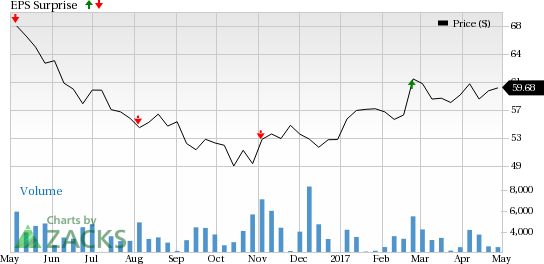

Last quarter, AMC Networks delivered a positive earnings surprise of 3.17%. However, the company’s earnings lagged the Zacks Consensus Estimate in three of the previous four quarters, with an average negative surprise of 6.22%.

Over the past three months, shares of AMC Networks returned 5.0% compared with the Zacks categorized Broadcast Radio and Television industry’s gain of 6.8%.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that AMC Networks is likely to beat estimates because it has the right combination of the two key elements.

Zacks ESP: AMC Networks has an Earnings ESP of +1.02%. This is because the Most Accurate estimate stands at $1.98 while the Zacks Consensus Estimate is pegged lower at $1.96 cents. This is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AMC Networks has a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating estimates. Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of AMC Networks’ favorable Zacks Rank and positive ESP makes us confident of an earnings beat.

What is Driving the Better-than-Expected Earnings?

AMC Networks owns and operates various cable television stations and is engaged in the production of programming and movie content. Its programming network channels include AMC, IFC, Sundance, WE and BBC America.

AMC Networks’ strength lies in programs with original content for which it holds ownership rights. In this regard, shows like Breaking Bad and Mad Men have been major hits, driving commercial success for the company. However, one of the biggest drags for the company is that its network is entirely dependent on The Walking Dead franchise.

The second half of the seventh season of The Walking Dead was ranked the number one show on television with 15.9 million total viewers and 9.9 million 18–49 adults. Total viewers were up 5% from Dec 2016, 18-49 adults increased 3% and the 25–54 cohort increased 5%. Meanwhile, horror video streaming services are doing well. The premier of the critically acclaimed programming event Planet Earth II telecast on Feb 18, gathered 2.7 million total viewers, including 1.2 million adults 25–54.

AMC Networks is also boosting its regional growth in key markets with channel launches and new distribution deals with key pay-TV operators in Latin America, Central and Eastern Europe, Iberia and Africa to serve audiences with award-winning programming across multiple genres.

In Jan 2017, the company reported a huge viewership percentage, with a 14% increase from 2015 and a 107% increase in the past two years. The company has successfully expanded its cable and DTH platforms in the Balkans region. We believe these new deals to bring new series in the entertainment world will boost its subscriber base in the to-be reported quarter.

Additionally, serious competitive threats from over-the-top (OTT) online video streaming service providers and other media companies coupled with the recent trend of the bulk of ad revenues skewed toward Internet TV are factors that may mar the quarter’s performance. AMC Networks competes in the highly competitive broadcast radio and television industry. Its major competitors include CBS Corp. (NYSE:CBS) , Gray Television Inc. (NYSE:GTN) and Entercom Communications Corp. (NYSE:ETM) to name a few.

Key Pick

Here is a company from the Zacks-categorized broader Consumer Discretionary sector — which houses AMC Networks — that has the right combination of elements to post an earnings beat this quarter.

Charter Communications Inc. (NASDAQ:CHTR) is slated to release first-quarter 2017 results on May 2. The company has an Earnings ESP of +6.06% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Charter Communications’ earnings beat the Zacks Consensus Estimate in three of the previous four quarters, with an average positive surprise of 79.71%.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500. See today's Zacks "Strong Sells" absolutely free >>

CBS Corporation (CBS): Free Stock Analysis Report

Entercom Communications Corporation (ETM): Free Stock Analysis Report

AMC Networks Inc. (AMCX): Free Stock Analysis Report

Gray Television, Inc. (GTN): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research