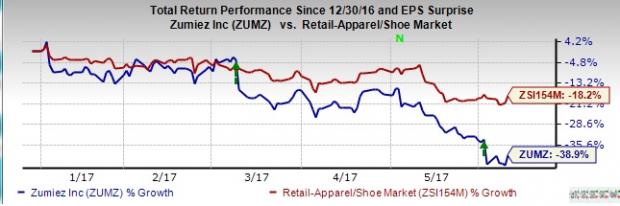

Despite delivering its seventh straight quarter of positive top and bottom-line surprise, Zumiez Inc. (NASDAQ:ZUMZ) failed to revive investors’ confidence. Evidently, Zumiez, which has been in the red zone for a while now, has lost over 6% since it reported first-quarter fiscal 2017 results on Jun 1. Moreover, this Zacks Rank #4 (Sell) stock has plunged 38.9% year to date, underperforming the Zacks categorized Retail – Apparel/Shoe industry’s decline of 18.2%.

So, what is it that’s weighing upon investors’ sentiment? Let’s find out.

What’s Dragging the Stock Down?

Zumiez continues to be troubled by a tough retail environment, characterized by sluggish mall traffic, volatile consumer spending and macroeconomic uncertainty. These factors hurt Zumiez’s first-quarter fiscal 2017, wherein the company posted a loss that was wider than the year-ago period. Also, the company witnessed a rise in SG&A expenses, which in turn resulted in an operating loss in the quarter.

Following the results, management issued a drab margin and bottom-line outlook for the second quarter. In the second quarter, gross margin is expected in a band of down 20 bps to increase 20 bps, while consolidated operating margins are projected to range from negative 1% to negative 2%. Consequently, management expects a loss of 6 – 11 cents per share, wider than a loss of 3 cents reported in the year-ago period. The company further stated that this cautious stance includes the impact from investments, as well as higher incentive compensation levels, planned for this fiscal year.

Apart from hurting investors’ sentiment, these factors have also caused a downtrend in the Zacks Consensus Estimate for second-quarter fiscal 2017. Incidentally, our estimates for the quarter have worsened considerably, from breakeven to a loss of 8 cents, over the past 30 days.

Additionally, Zumiez remains vulnerable to intense competition from other teen-focused as well as sporting goods retailers on the basis of brand recognition, fashion, price, service, store location, and quality. Further, being a mall-based retailer, Zumiez is likely to continue to face soft traffic trends, given consumers’ transition to online shopping patterns.

Can Zumiez’ Strategies Pay off?

While Zumiez remains vulnerable to the obstacles looming on the retail industry, the company remains focused on turning its performance with its strategic growth efforts. In response to the changing consumer patterns, the company is striving to expand its e-Commerce and omni-channel platforms to provide consumers with the facility of quick and easy access to its products and brands. Further, Zumiez remains committed to testing new brands, analyzing every aspect of its business across brands and geographies, reviewing its marketing and product plans, and revisiting its promotional strategies and the strategic use of private label.

While these factors may help Zumiez gain market share in the long-run, the aforementioned hurdles keeps cautious about the stock at the present juncture.

Where to Place Bets?

So, for the time being, you can shift your focus to a top-ranked stock like The Children’s Place (NASDAQ:PLCE) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Burlington Stores, Inc. (NYSE:BURL) and Target Corporation (NYSE:TGT) , each carrying a Zacks Rank #2 (Buy) can also be viable picks.

Children’s Place has an average positive earnings surprise of 36.6% in the trailing four quarters. The stock also has a long-term growth rate of 8%.

Burlington, with long-term earnings per share growth rate of 15.9%, has delivered positive earnings surprise consistently in the last four quarters.

Target has a long-term growth rate of 8.2%. Also, the company has an average positive earnings surprise of 16.5% in the trailing four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research