For Immediate Release

Chicago, IL Volatility investing can be a difficult concept to understand, but once traders get the hang of it, volatility can be a powerful tool. Today’s podcast takes a look at this concept and what investors need to know before jumping into this market in a successful way. To listen to the podcast, click here: ( https://www.zacks.com/stock/news/253906/the-key-things-to-know-when-trading-volatility-with-etfs )

With markets facing some turbulence as of late, volatility trading is back in focus. And with stocks at highs, political uncertainty, and a shifting rate outlook, there are plenty of reasons to think that the near term won’t see as smooth sailing as we experienced to kick off 2017.

Yet, while trading volatility can be an extremely potent tool, it is also a pretty confusing one as well. That is why I had Greg King, the CEO and co-founder of REX Shares on the Dutram Report in order to discuss this market and what traders need to know before jumping in here. Greg is a volatility expert and I picked his brain on what investors and traders need to know in order to get a better handle on the world of volatility.

Key Takeaways

First off, we discuss some basics on how the CBOE Volatility Index—better known as the VIX or the ‘fear index’—is constructed, as well as what investors should take away from movements in this benchmark and its relation to the S&P 500 (AX:SPY) . Beyond that, we also look into the ways that investors have crafted to make this an investable benchmark, namely with futures, though this creates a few other issues which we also discuss.

Volatility Investing Issues

One of the biggest that comes with using futures is the idea of contracts being in contango. What that means is that each month, when an investment must roll from one contract to the next, it must buy at a higher price point. This sort of hurdle makes it tough to profit in a long-term setting from volatility, and especially if a contango trend continues for quite some time.

This can be particularly troublesome for products like VXX—though its inverse cousin, XIV, has definitely benefited since it is riding these trends—as products like VXX must roll contracts each month, time and time again, and into higher price contracts when the market is in contango.

Another major issue is that there can be a bit of a breakdown between what the spot VIX is doing, and how some funds in this market are trading. This can be frustrating to traders if the spot deviates too much from the investable futures or Exchange-Traded Products, and it can really dull the appeal in certain market environments.

A Better Way?

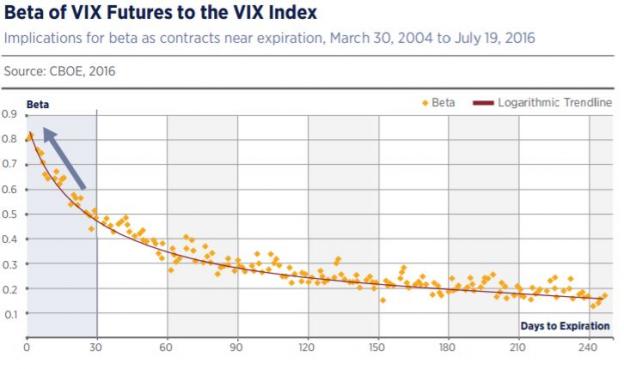

However, Greg’s funds may have gotten around some of these issues by focusing on weekly futures contracts, which could help to cut down on contango a bit, but look to especially help with the second issue. These include the REX VolMAXX Long VIX Weekly Futures Strategy ETF VMAX and the inverse counterpart, the REX VolMAXX Short VIX Weekly Futures Strategy ETF VMIN. According to their fact sheet , the correlation to VIX is right around 0.93 for VMAX, while the beta to the VIX is also better than what we see in products that only focus in on longer term contracts, as you can see in the chart below (since VMAX is primarily focused on the shaded region).

And while there is just a difference of a few days between the benchmark underlying VMAX and the S&P 500 VIX Short-Term Futures Index, it is clear that this focus on a lower time to expiration can end up having a dramatic impact in terms of beta, and potentially make it a product that is more in line with what investors are looking for when they are tapping into the volatility market.

This focus on weekly contracts is certainly a novel concept, and it could be the ticket for some traders looking for a different way to attack the world of volatility. We discuss the basics of the approach, why an ETF structure was used, and how an average investor might utilize this technique in their portfolios too.

So, is this a better way to play volatility for traders out there? Listen to this edition of the Dutram Report and be the judge yourself. Feel free to write us in at podcast @ zacks.com or find me on twitter @EricDutram to let me know what you think of this interview, and volatility investing as well.

Bottom Line

With spiking worries, you will no doubt hear more about the concept of trading volatility in the weeks and months ahead. However, before you jump into this difficult to understand market, it is vital to understand the ins and outs of the space first. Greg is definitely an expert in volatility and this podcast should help you to better understand—and trade—the concept in the future too.

So, make sure to listen to this edition of the Dutram Report for a closer look at volatility and the keys to trading in this quickly-moving market. And if you have any thoughts or comments, reach us on SoundCloud or at podcast @ zacks.com for email. We’d love to know what you think of this chat, and if you have any other topics you’d like us to cover in the future too.

But for more news and discussion regarding the world of ETFs, make sure to be on the lookout for the next edition of the Dutram Report , and check out the many other great Zacks podcasts as well!

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc., which was formed in 1978. The later formation of the Zacks Rank, a proprietary stock picking system; continues to outperform the market by nearly a 3 to 1 margin. The best way to unlock the profitable stock recommendations and market insights of Zacks Investment Research is through our free daily email newsletter; Profit from the Pros. In short, it's your steady flow of Profitable ideas GUARANTEED to be worth your time! Click here for your free subscription to Profit from the Pros .

Follow Eric on Twitter: https://twitter.com/ericdutram

Join us on Facebook (NASDAQ:FB): https://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

https://www.zacks.com/performance

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performance for information about the performance numbers displayed in this press release.

SPDR-SP 500 TR (SPY (NYSE:SPY)): ETF Research Reports

VEL-INV VIX ST (XIV): ETF Research Reports

IPATH-SP5 VX ST (VXX): ETF Research Reports

REX-L VIX WFS (VMAX): ETF Research Reports

REX-INV VIX WFS (VMIN): ETF Research Reports

Original post

Zacks Investment Research