Although we would never dispute that markets often pivot on external catalysts, as we noted recently (see here) - they often are just instigators of larger forces at play. For every time that it's perceivd to be that a market is largely driven by breaking news or geopolitical events, we could reference fifty other occasions in which a similar development had no material influence.

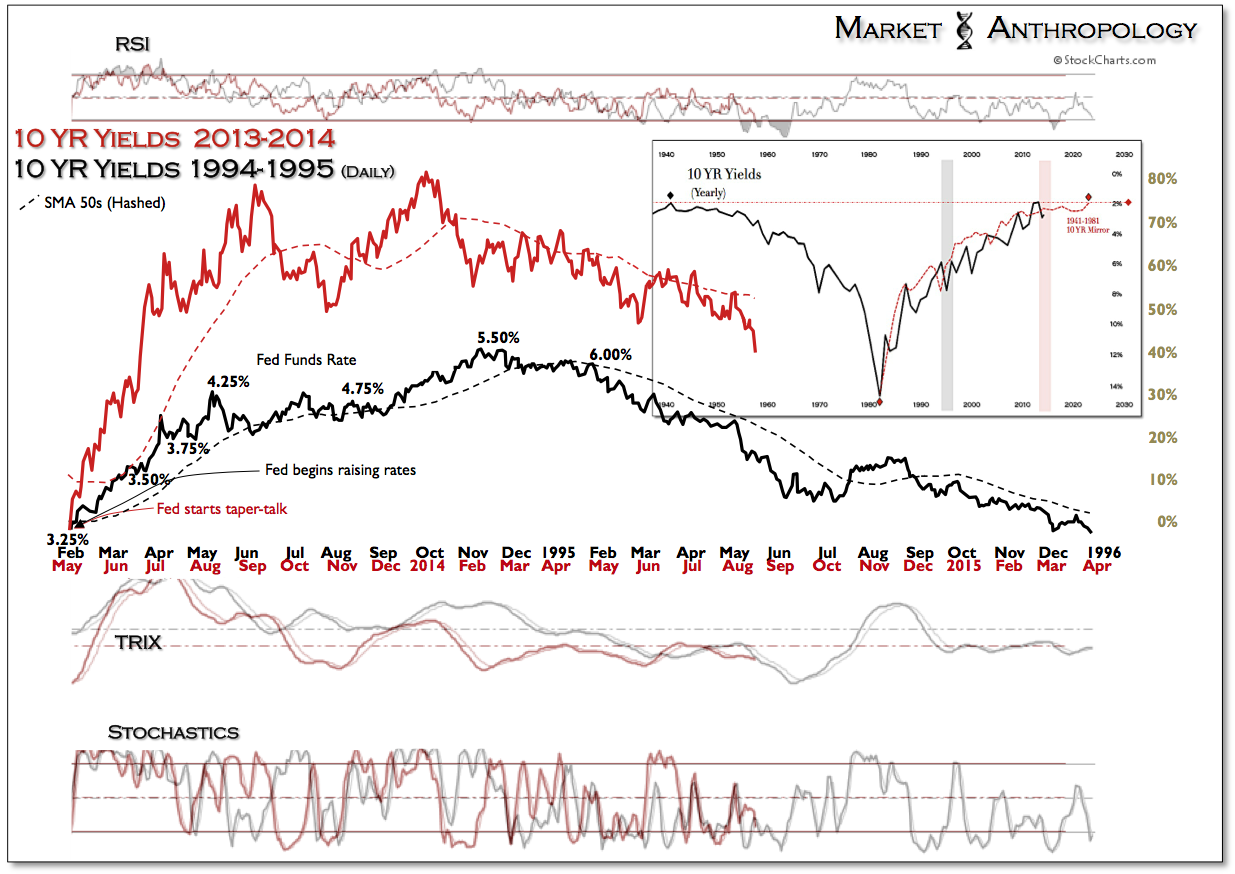

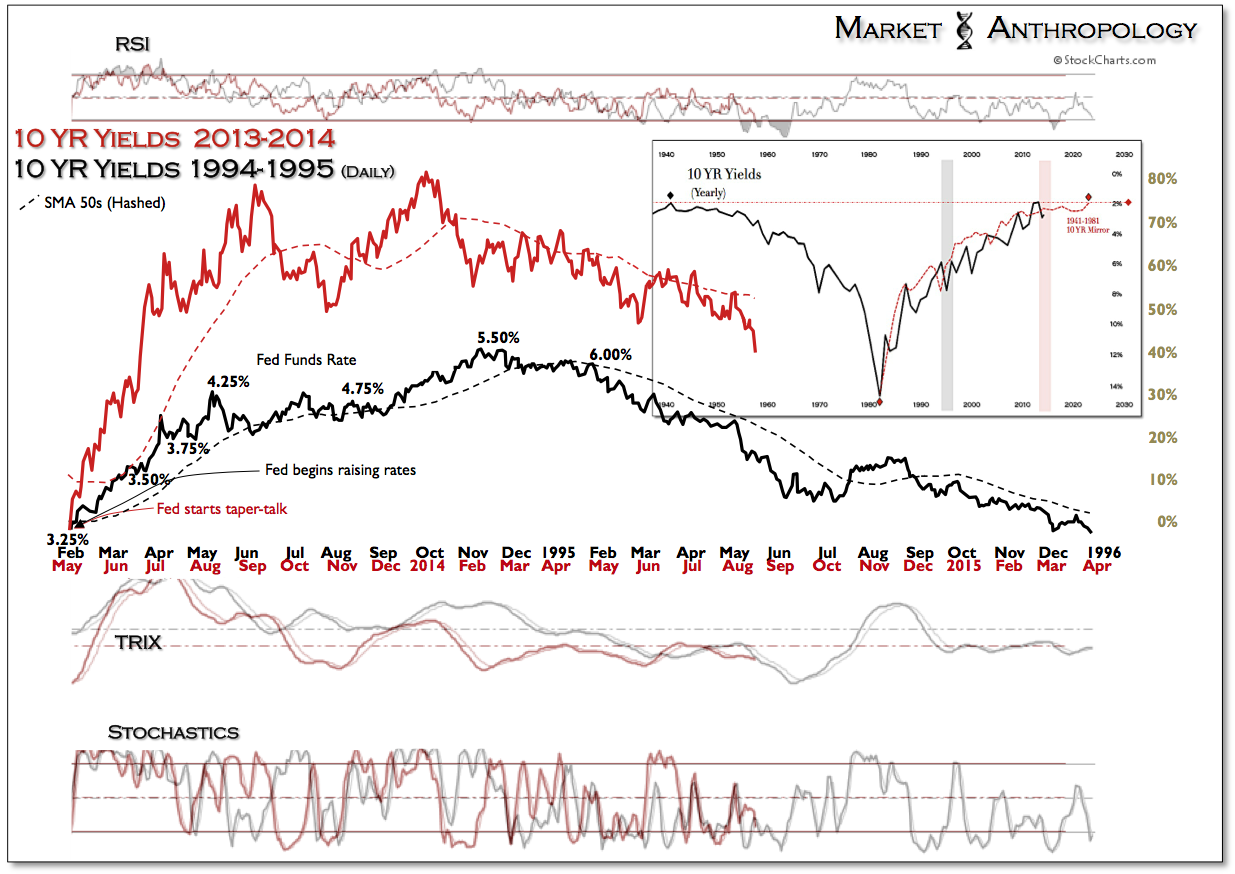

From our perspective, Friday was a perfect example in which an exogenous event in Ukraine, motivated pre-existing conditions in the Treasury markets. Based on our comparative analysis of U.S. 10-Year yields developed months before (see here), the current breakdown truly comes as no surprise. In fact - it arrived right on schedule.

From our perspective, Friday was a perfect example in which an exogenous event in Ukraine, motivated pre-existing conditions in the Treasury markets. Based on our comparative analysis of U.S. 10-Year yields developed months before (see here), the current breakdown truly comes as no surprise. In fact - it arrived right on schedule.

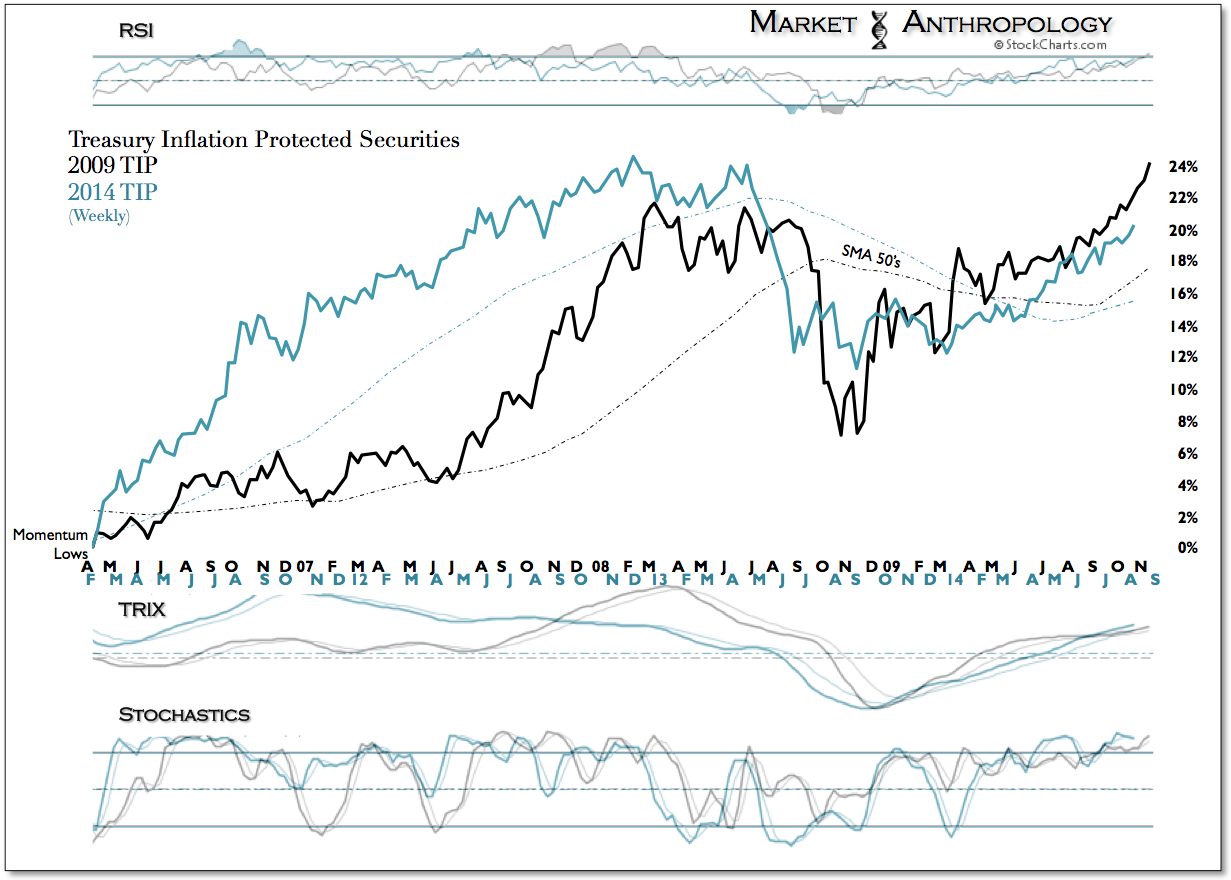

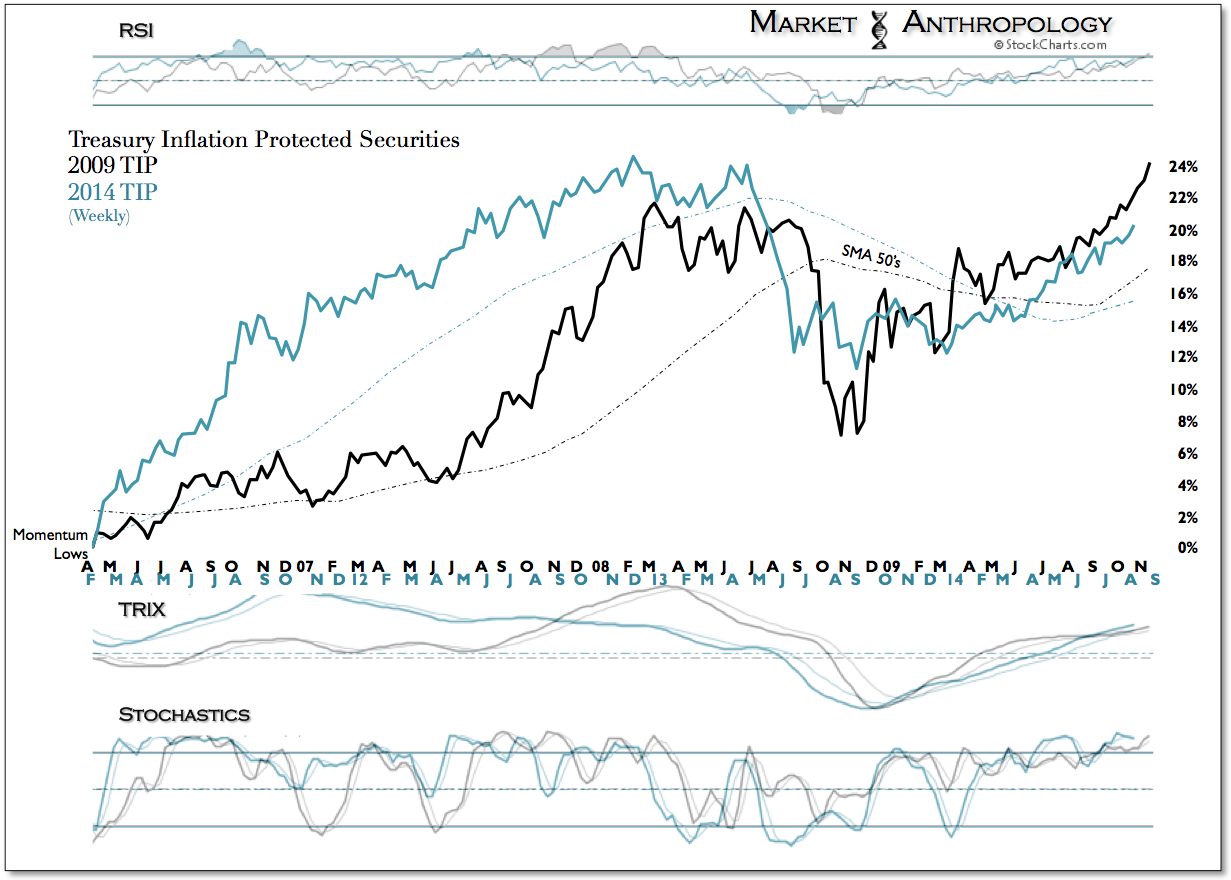

A similar research approach has been prescient with tangential trends, as depicted below with our work with the iShares Barclays TIPS Bond Fund (ARCA:TIP) the past January (see here), which highlighted both the pivot and proportional recovery path the asset has followed.

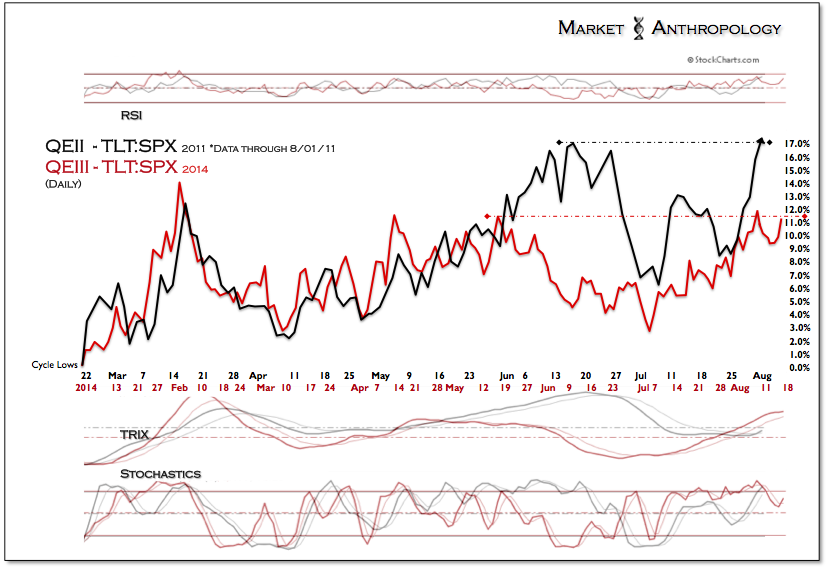

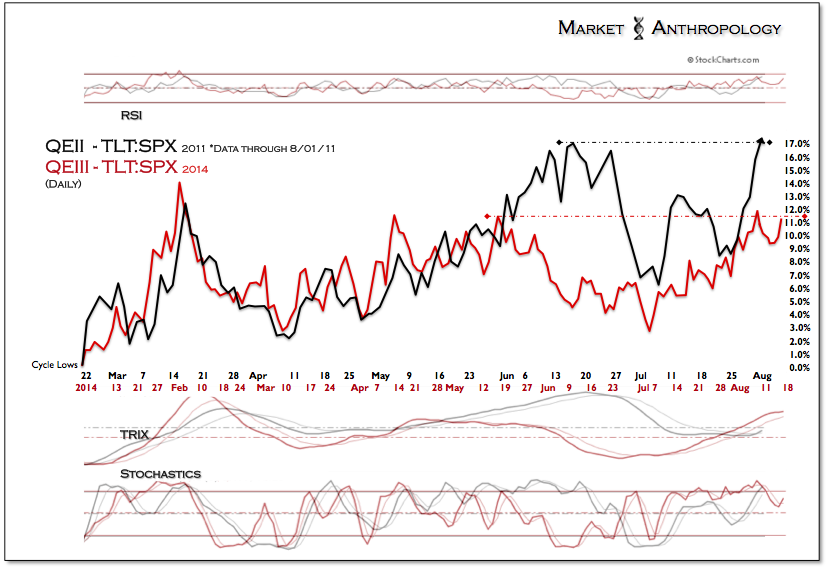

Headed into the coming week, the asset class relationship that we have favored over the course of this year, namely, long-term Treasuries relative to equities TLT:SPX - is at a potential breakout point. As shown below in a similar dynamic that developed after the markets began to normalize to structural and psychological conditions in the wake of QEII, the current set-up is feathering the hinge line of the retracement highs from this past May. Back then, it was the instigating factors of Europe's sovereign debt crisis and our own issues at home, emanating from a contentious Congress that led to a debt downgrade from Standard & Poor's that August.

Should yields continue to break down further with equities this coming week, we can guess the nature of what the headlines might read. That being said, we continue to believe there are larger forces at play, just as there were in 2011 as the Fed first attempted to wind down QE - and in the mid 1940s when the Fed ended their extraordinary support of the Treasury markets.

Should yields continue to break down further with equities this coming week, we can guess the nature of what the headlines might read. That being said, we continue to believe there are larger forces at play, just as there were in 2011 as the Fed first attempted to wind down QE - and in the mid 1940s when the Fed ended their extraordinary support of the Treasury markets.