The no- brainer, can't-miss trade coming into the first of this year was that interest rates were going to rise. 90 Days ago I said that bond prices were breaking out.

I shared with members numerous charts about a rate high/bond price low at the first of this year. One of the key reasons to establish a long-bond position was simply because interest rates have had their largest 18-month rally in the past 30-years -- up 50% more than the seven largest rallies in the past 30-years.

Market Watch reported earlier this year that 100% of economist predicted that rates would rise. Wonder how that prediction has worked out? Year to date, iShares Barclays 20+ Year Treasury (ARCA:TLT) is up twice as much as the S&P 500.

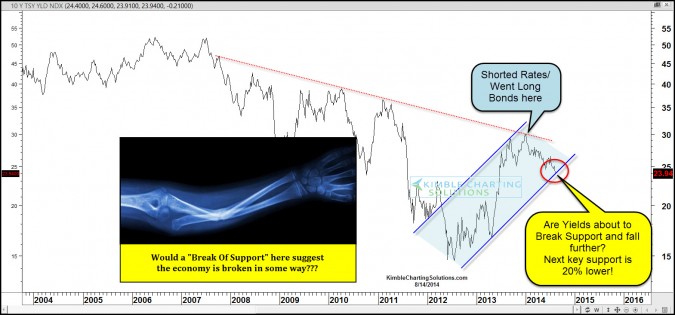

Support

The chart above shows that the yield on the US 10 Year T-Note has been falling since the first of the year and is now on rising support. IF support breaks, the next key support line comes into play around 15% below current levels.

If yields break support, would they be sending a message about the strength of the global economy? What happens here at support I feel is important to more than just the bond market!