The yen was in hot demand as traders sought safety after the Chinese stockmarket imploded. The gains were short lived as the dollar returned to form, but that has only let to a rejection off some solid resistance. The yen looks set to gain back some of the lost ground.

Headlines last week were dominated by the Chinese stock market which opened the week down 8.5% followed by a 7.6% fall the following day. US stocks took a hammering on the open of the week with the Dow falling 1,000 points for the first time ever. This led to sharp US dollar weakness and strong demand for the yen, sending the USD/JPY pair tumbling over 500 pips at one stage.

The data took a back seat but gave an interesting look at the state of the Japanese economy. The CSPI improved to 0.6% y/y, from 0.4% and Core CPI beat forecasts of -0.1% to post 0.0%. The BoJ remains eternally upbeat about the economy, but it will take a fair bit of hard slog to get any sort of meaningful inflation to remain.

A rebounding USD later in the week led to the yen giving up all of the gains. The market was relieved the selloff was largely contained to the Asian markets, causing the US dollar to rally on the optimism. There is still plenty of scepticism surrounding the 17th September Fed meeting and whether they will raise rates or not, so the US dollar could weaken over the coming weeks on those bets.

Keep an eye on JPY cash earnings later this week with the market expecting a lift from -2.4% to 2.1% y/y. However, the focus will once again be China as it announced it will cease propping up the equity market which is likely to lead to another round of sharp falls. That could very well impact US equities again and with it the USD. The Yen will likely benefit from this as the volatility will hit the USD.

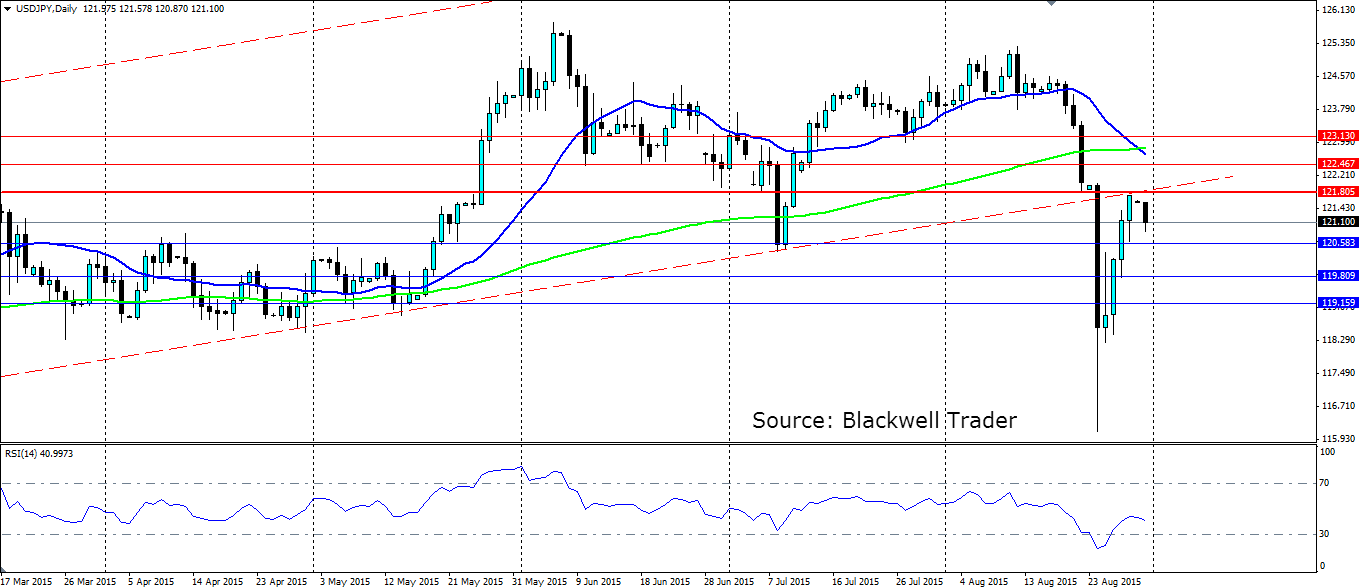

Technicals show the wild ride the yen was on after the breakout of the channel, with a pull back to find resistance at the lower level of the channel. This coincided with the solid resistance at a level which has acted as a swing point on numerous occasions. We are likely to see this level hold firm, with price rejecting lower off it. Resistance is found at 1221.80, 122.46 and 123.13 with support at 120.58, 119.80 and 119.15.