Talking Points:

- Yen May Fall While Aussie Dollar Bounces Amid Recovery in Risk Appetite

- NZ Dollar Down as Asian Markets Chase Wall St. Lower, Data Disappoints

- CAD Rebounds After Last Week’s Crude Oil-Related Weakness

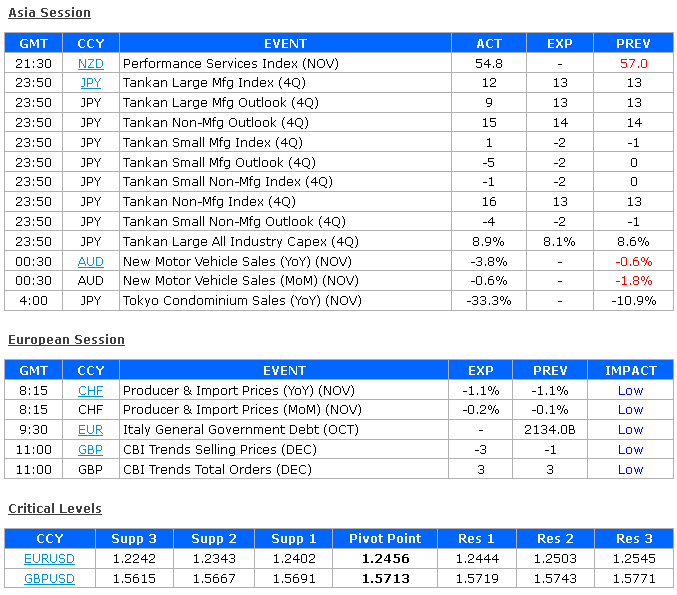

The New Zealand Dollar underperformed in overnight trade, falling as much as 0.5 percent on average against its leading counterparts. Risk aversion and soft economic data appeared to be the catalysts behind selling pressure. The MSCI Asia Pacific regional benchmark stock index slid 0.6 percent, playing catch-up to Friday’s aggressive decline on Wall Street and putting pressure on the sentiment-geared currency. On the data front, the Performance of Services Index dropped to 54.8 November, reflecting the slowest pace of sector activity growth in six months.

The Japanese Yen advanced as ebbing risk appetite drove demand for the safe-haven currency. The Canadian Dollar likewise moved higher in a move that appeared corrective after last week’s decline, when a 1.26 percent loss against its US namesake made the Loonie the weakest performer among the major currencies. Those losses may have reflected the dramatic slide in crude oil prices after BOC Governor Stephen Poloz linked the drop to a possible delay in monetary policy normalization. Poloz said crude’s plunge may curb output and curtail inflation substantially enough to delay full economic recovery for another two years.

A quiet economic calendar in European trading hours may keep risk trends at the forefront. S&P 500 futures are pointing firmly higher, hinting a reversal of overnight trends may be in the cards once Asian catch-flows are exhausted. Global shares (as tracked by the MSCI World index) dropped 3.8 percent last week, marking the worst performance since May 2012. A degree of corrective recovery to even out positioning seems reasonable after such a dramatic drop ahead of this week’s high-profile event risk (most notably, the FOMC policy announcement). That may put the Yen under pressure help engineer an intraday recovery in the Aussie and Kiwi Dollars.