Will Yellen and Draghi Offer Insight into Rate Hikes and Tapering?

After kicking off the week with two record closes, US indices are currently seen opening marginally lower on Wednesday as we prepare for speeches from Federal Reserve Chair Janet Yellen and ECB President Mario Draghi.

While the two central banks are in very different phases of the tightening cycle, both heads are facing very similar problems in that there is a strong desire within the banks to become less accommodative before the end of the year but the data is making life difficult. Inflation in particular is a massive headache for many central banks around the world, with the normal models proving ineffective in determining when it will return to target.

The longer the central bank’s models fail to correctly anticipate price increases, the more likely it is that policy makers lose faith in the forecasts and withdraw their support for tighter monetary policy, something traders appear to be banking on next year when it comes to the Fed. The ECB may have a little more time given they’re much earlier in the cycle, they’re expected to move much slower and the amount of remaining slack is still significantly higher.

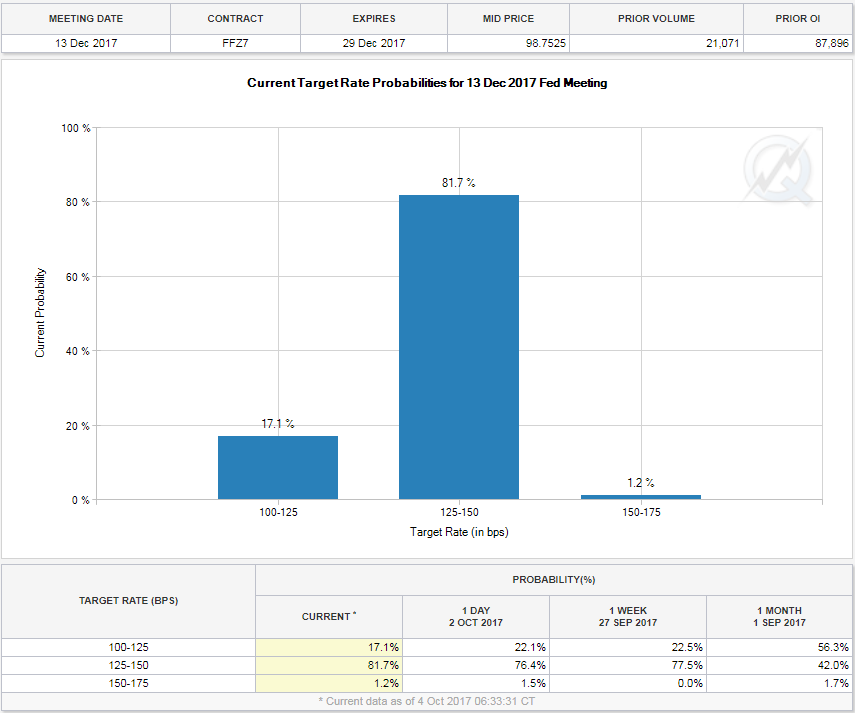

It will be interesting to get the views of the two central bank heads today and traders will likely be paying very close attention to what they have to say regarding meetings later this year. With the Fed currently indicating that one more rate hike is likely and the ECB giving the impression that a further asset purchase reduction will happen, traders are naturally curious about whether these views are changing in light of recent data. As it is, traders have only recently become convinced that we’ll see another Fed rate hike this year and the possibility of more next year is only just being priced in.

ADP May Offer Important Insight into Friday’s NFP

Central bankers aside, we’ll also get some noteworthy US economic data today. The ADP employment report is always followed closely, with it intending to be an estimate of Friday’s NFP number. This may be the case more so this month, with its reputation but not being entirely reliable possibly being set aside as traders look for any insight into what impact the hurricanes had on hiring last month. Fewer than 100,000 jobs are expected to have been created last month but the reality could be very different and today’s ADP may offer some insight on this.

Spanish IBEX Down as Catalonia Prepares to Declare Independence

Markets in Europe have mostly traded in the red this morning, particularly the Spanish IBEX which is down more than 2%, with yields on the countries debt also climbing after the head of Catalonia’s devolved government claimed they will declare independence from Spain at the end of this week or the beginning of next. The handling of the referendum at the weekend by Spanish authorities has already seen the situation deteriorate more than it may have otherwise done and as we near the weekend, it could deteriorate much further again creating more uncertainty for Spanish investors.

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.