According to Factset, the S&P earnings growth figure for the calendar year 2015 is now expected to be just 2.9% (vs. 8.2% expected growth on January 1). Still, most people seem to believe that the S&P 500 will have a decent year. How frequently does it happen that earnings growth is weak but performance is strong?

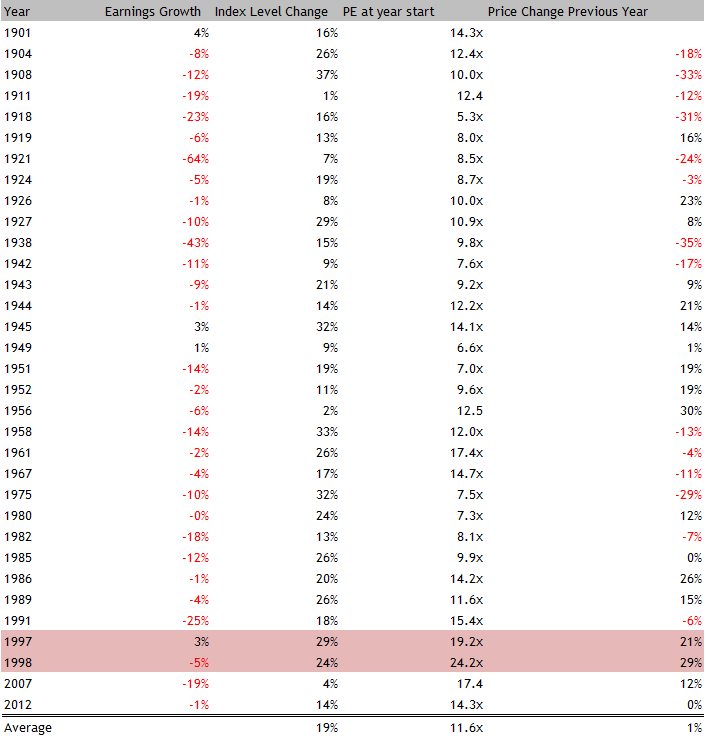

Since 1900, earnings have grown by less than 5% in 53 years. The S&P 500 has still managed to rise in 33 of those years. Below is a list of all those 33 years.

It’s not a bad record for the S&P 500 to have risen 33 out of these 53 years (especially considering that earnings growth was negative in 45/53 years), and on average it has risen by a lot. But when you factor in the starting conditions in most of the years that the S&P rose, they were much different than they are today.

Of these 33 years, the S&P was negative 14 times in the previous year (implying that stocks had discounted the negative earnings growth the year before). Additionally, the average PE multiple was only 11.6x in all years, meaning that even though earnings didn’t rise, the index was usually cheap.

There are only two years since 1900 that the S&P Composite has risen despite weak earnings growth when it was already at a high multiple and had risen by a significant amount in the year before: 1997 and 1998.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.