The approach of the Christmas weekend and New Year holidays are accompanied by a fall in market liquidity making them more sensitive to any news. It looks like we risk a correction this year after a seven-week rally since early November.

Global markets managed to shake off most of the initial fears and rebounded from much of the initial decline on the day. The S&P500 fell 0.44% over Monday, although intraday futures were down 3.2% at one point. The situation is similar in the FX market, where EUR/USD ended the day with a symbolic decline of 0.1%, although intraday losses exceeded 1%.

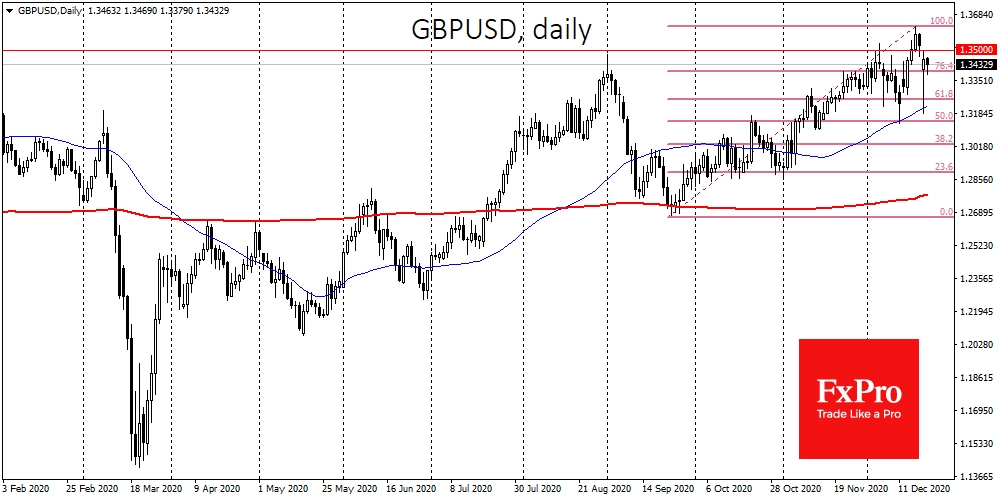

GBP/USD, the anti-hero of the day, reduced its losses to 0.5% by the end of Monday vs a 2.5% decline in the middle of the day. From a technical analysis perspective, it managed to gain support on the dip to the 50-day moving average, which has acted as support over the past two months and has earned a reputation as a short-term trend signal line.

The persistence above the 50 and 200-day averages clearly shows the superiority of the buyers, but the situation could change rather quickly. A decline in the GBP/USD under 1.3200-1.3250 area would overrule the optimistic scenario.

The pessimistic - correctional - scenario is on the table for this week. On Tuesday morning we see further caution prevail in the markets; key indices are back in the red zone and the dollar is adding, pushing GBP/USD, at one point, below 1.3400.

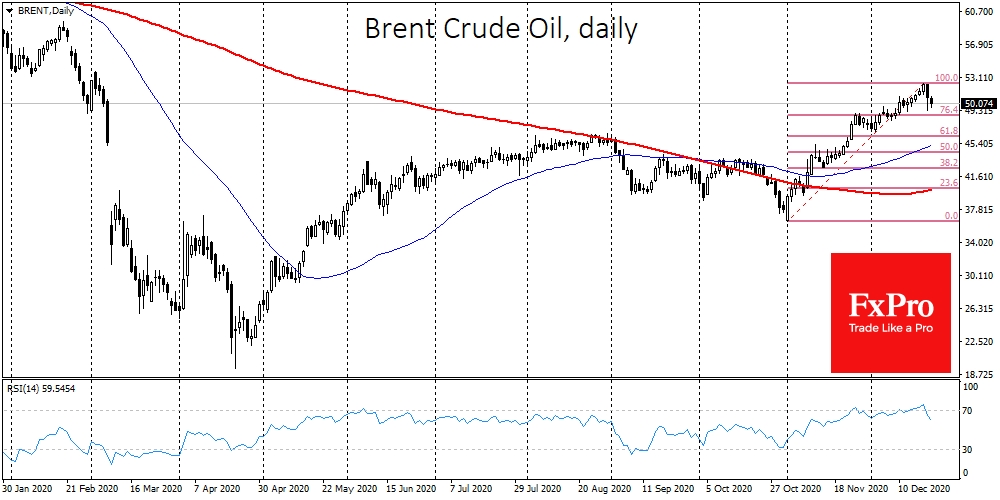

Traders should have even more caution toward Crude Oil. Brent is now trading at the $50 line, having lost more than 4.5% from Friday's highs. That said, there are few signs of a reversal in oil on Tuesday.

Buyers' weakness there is easy to understand as a new strain of the novel coronavirus in the UK and South Africa has led to a sharp tightening of lockdowns around the world, putting fears on the prospects for oil demand recovery. On the daily charts, the RSI climbed into overbought territory late last week, and a sharp reversal to the downside yesterday gave an informal start to a corrective pullback after the euphoric rise from the beginning of November.

For Crude Oil, the nearest target for the correction may lay around $49. A deeper, albeit very likely, target for the pre-New Year correction is the $46.5 area, where prices consolidated in early December and where the 61.8% Fibonacci rally line runs.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Year-End Correction For Crude Oil And Pound Blues

Published 12/22/2020, 05:09 AM

Updated 03/21/2024, 07:45 AM

Year-End Correction For Crude Oil And Pound Blues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.