Today’s Update: Feb. 28 2019

Ripple (XRP) continued to be one of the most resilient coins throughout 2018 and into the new year. Currently, XRP is trading for $0.31 and is ranked third overall with a total market capitalization of nearly $13 billion—$1.5 billion less than the second-ranked Ethereum. XRP has done especially well with its value compared to Bitcoin (BTC).

‘Competition’ has heated up for Ripple as the investing giant JP Morgan unveiled plans for an in-house instant payment settling ‘cryptocurrency’ which it has dubbed JPM Coin. It is unlikely that the two digital currencies would have much market interaction as JPM Coin aims to be a pegged stablecoin used within its platform while XRP is a tradable asset for cross-border payments.

XRP was recently listed on Coinbase Pro, with trading pairs against BTC, USD, and EUR. The listing thus far has had a very limited effect on the price. Questions and accusations of insider trading have already been launched at Coinbase, which had been on the fence about listing XRP for more than a year. The listing by the reputable exchange does, however, further legitimizes and bodes positively for the longevity of the currency.

TL;DR — Jump to Our Prediction

Overview

Ripple (XRP) is a powerful blockchain based cryptocurrency created by Ryan Fugger, Jed McCaleb, and Chris Larsen. It offers a strong digital coin that is unique to other crypto offerings in that it is regulated. This key difference has enabled the Ripple company to partner with traditional financial institutions, who require more stringent regulatory compliance than typical cryptocurrencies are capable of doing. Together, Ripple and various fiat entities are attempting to achieve real-time financial transactions at a very low cost.

Ripple (XRP) prices have not been immune to the cryptocurrency market fluctuations in spite of its overall strength. Coming off a market cap high of $130 billion USD in January 2018, the XRP coin continued to hold strong throughout the 2018 market.

While it didn’t maintain January highs long term, XRP did outperform most other coins. Ripple (XRP) prices even beat Ethereum (ETH) a few times in September 2018, momentarily taking the spot just behind Bitcoin as the second largest cryptocurrency.

Ripple (XRP) remains a strong liquidity solution for real-time, low-cost transfers through the cryptocurrency and fiat markets alike, and is a solid investment option. Click To Tweet

The true strength of Ripple (XRP) lies in its fast transaction speeds. The average Ripple transaction takes approximately three seconds to complete. This blows Bitcoin out of the water, given that Bitcoin not only has a 20 minute average transaction time, that average is also extremely volatile and unreliable. Ripple’s only competition is Stellar, boasting two to five-second transactions, Nano, with instant transfers and zero fees, and SWIFT, a Belgium-based payment facilitator.

Fundamental Analysis

From a fundamental perspective, Ripple (XRP) is still one of the most exciting competitors at the top of the cryptocurrency market. XRP is so fast and easy to use, mainly due to its unique consensus protocol, it has the undivided attention of banks and financial institutions worldwide.

The average Ripple network XRP transaction time is approximately three seconds. That, coupled with the fact that XRP transaction fees are a fraction of a cent, Ripple is more competitive with traditional fiat options like Visa (NYSE:V), Mastercard (NYSE:MA), and American Express (NYSE:AXP) than other crypto platform payment systems.

In an effort to bring its unique platform to mainstream financial markets, Ripple has entered into strategic partnerships with over 150 banks internationally over the past five years. The goal of these partnerships is to enable widespread instant or near-instant transactions available at very low cost. Ripple has ties to major financial institutions such as American Express, Bank of America (NYSE:BAC), RBC, Santander (MC:SAN), and most recently, J.P. Morgan.

TL;DR — Jump to Our Prediction

In the current international transaction market, cross-border payments can take days or even weeks, costing annual fees in the trillions. XRP token-based payments have the potential to cut those costs by up to 60 percent.

Ripple regularly releases new products into the blockchain network, including xCurrent, xRapid, and xVia. These, and Ripple’s consensus mechanism protocol, which validates balances and transactions while stopping malicious entries, have also strengthened its market value.

Technical Analysis

Ripple (XRP) remained strong through the 2018 bearish year, retaining and securing its place as the third largest cryptocurrency in the world, and a strong contender for second place. The XRP token is currently experiencing positive movement on the charts.

Over the past year, starting at XRP’s low of $0.257 USD almost a year ago, there has been much movement. January 2018 brought prices of $3.28 USD, the clear high for the year. Ripple dropped again to just over $1.00 USD, where it stayed until May, where, in keeping with industry trends, XRP saw a slight upswing before dropping back down to below $0.50 USD. Prices stayed low until September 2018, which brought XRP up to $0.59.

It is difficult to say exactly how much of this volatility could have been avoided without cryptocurrency’s bear conditions. But they have most certainly been a factor in the price of Ripple (XRP) over the past year.

Specialists’ Perspective

As both a platform and a cryptocurrency, the ability to attract and retain big-name clients is one of the things Ripple does best. It does this by offering strong solutions to existing struggles in the financial world.

The Ripple protocol consensus algorithm was developed with a node structure that isn’t exactly a blockchain. This may work to its advantage, as it suits the goals of the platform perfectly.

Because Ripple was carefully designed to be used by banking institutions, it fortuitously falls under the regulatory oversight of those banks. It also avoids the messy, sometimes expensive regulatory attempts of the SEC and other governing bodies to keep cryptocurrency investors as safe as possible in such a volatile environment.

TL;DR — Jump to Our Prediction

On the Ripple consensus protocol, financial institutions have the capability to conduct very fast, very low-cost currency exchanges from anywhere in the world. This is a valuable tool, as a traditional means of currency exchange fail to meet either the low cost or high-speed standards established by Ripple.

XRP also just announced listing on cryptocurrency exchange Skrill, a popular London-based currency exchange. This indicates a continued commitment to a comprehensive partnership strategy that has helped Ripple grow and expand into new markets. Ripple now boasts partnerships with over 150 key contenders in finance and banking internationally.

Several potential partnerships with corporations such as Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOGL) have been forecast. If these companies integrate Ripple blockchain payment technology into their existing platforms, the XRP price will certainly skyrocket.

Ripple Price Prediction 2019

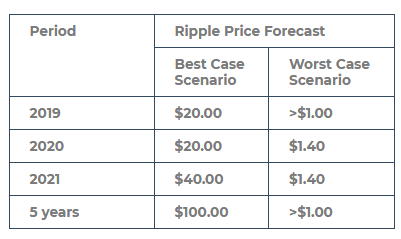

Ripple (XRP) 2019 prices are confidently predicted by experts such as Investing Haven to reach highs of $20 USD. This confidence stems from a firm belief in Ripple’s place as the cryptocurrency with the highest potential out of the entire market. Stating an appreciation for Ripple’s seemingly smooth transition to a fiat banking tool for international transactions, including fast rates and low-cost fee transfer management, experts like Investing Haven are unconcerned about Ripple’s relatively low prices.

This is, however, also an interesting position to take, as others are convinced that the future of cryptocurrency value and mainstream potential lies in DApps. Ripple has focused almost exclusively on its place as a payment methodology. It has done this by improving protocols and strengthening existing vendor relations. It has also added promising new features and relationships.

While other experts predict lower gains, anywhere from $5 to as low as under $1, based on its strong growth activity on both its platform and throughout the financial and investment worlds, Ripple remains a good short-term investment.

TL;DR — Jump to Our Prediction

Ripple Price Prediction 2020

Ripple (XRP) may really take off in 2020. With low XRP coin price estimates around $1.40-1.50, purchasing XRP would still be a solid investment for buyers looking to hold the coin for up to two years.

Other experts predict highs of up to $20 USD by 2020, depending upon the success and widespread adoption of Ripple as an international transaction tool.

However, like every other cryptocurrency right now, XRP’s value trajectory is dependent on how quickly the bear market of 2018 corrects. If the majority of 2019 is spent in a correction without a lot of growth over and above that recovery, prices may remain relatively low into 2020.

It is important to keep in mind that cryptocurrency is notorious for surprises, both good and bad, and Ripple may continue its trend and exhibit yet another good surprise in the next couple of years.

Ripple Price Prediction 5 years

Five-year price predictions for Ripple (XRP) are all over the place, and understandably so. With a range from $0.63 USD, predicted by Wallet Investor, $2.00 USD by Cryptoground, all the way up to over $100, this range does warrant an explanation.

Ripple (XRP) has secured for itself a completely new position in the financial world. It is carving an invaluable spot directly into fiat’s well established financial world. This position is one that many digital coins have sought to achieve, albeit in different ways.

Ripple’s work with financial giants such as American Express and Bank of America, in addition to its goals to transform international financial transaction costs, are all contributing to the coin’s uncertain future value.

Lower five year Ripple predictions may also be the result of the overall instability of the current crypto market, especially for Bitcoin. Despite its status as an independent entity from Bitcoin, Ripple is not immune to these issues.

Our Prediction

At BeinCrypto, our current prediction for Ripple (XRP) is based on our belief that Ripple continues to strengthen an already solid product. Our prediction is that XRP is a solid investment, both long-term and short-term, with potential upward growth and price increase of anywhere from $2 USD to $20 USD over the next several years. As always, we are cautious in making any solid forecasts while cryptocurrency as a whole remains in the throes of this bear market. However, Ripple offerings are valuable for fiat and digital currency alike, and with few competitors showing the depth and commitment of XRP’s platform and future developments, we are confident this coin is a solid investment.

Disclaimer: This article is not meant to be used as personal investment advice, nor is it information from a qualified investment advisor. Cryptocurrency is a notoriously risky investment, and it is possible to lose everything. Please conduct your own research and investigation prior to investing in cryptocurrency.

What do you think of our Ripple price prediction for 2019? Will Ripple maintain its position in the crypto-sphere? Let us know your thoughts in the comments below!