With a positive view of the crude oil price and the S&P 500 over the next month, we see some upside in XLE (Energy Select Sector SPDR ETF (ARCA:XLE)).

At around $82.20 currently, XLE is 141% above the low end and 18% below the high end of its six year trading range of between $33.92 (mid 2009) and $99.47 (mid 2014).

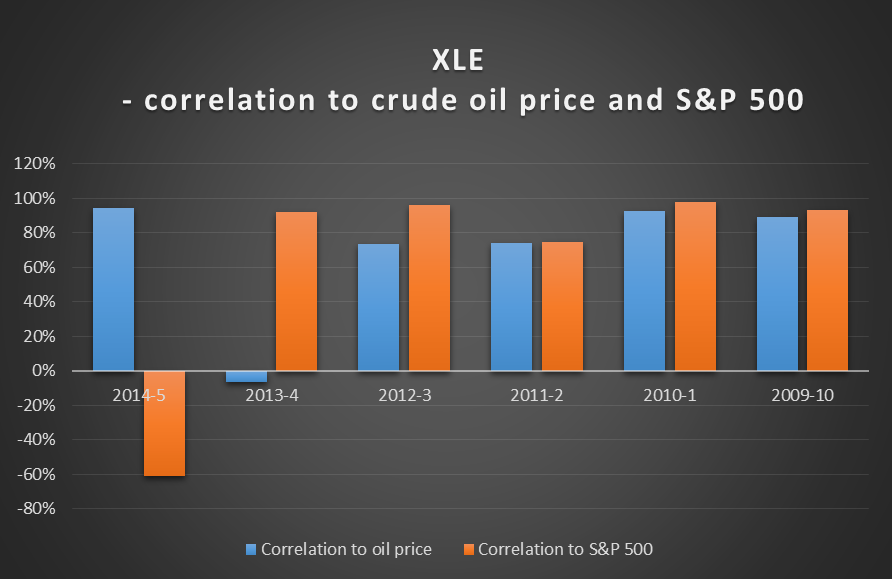

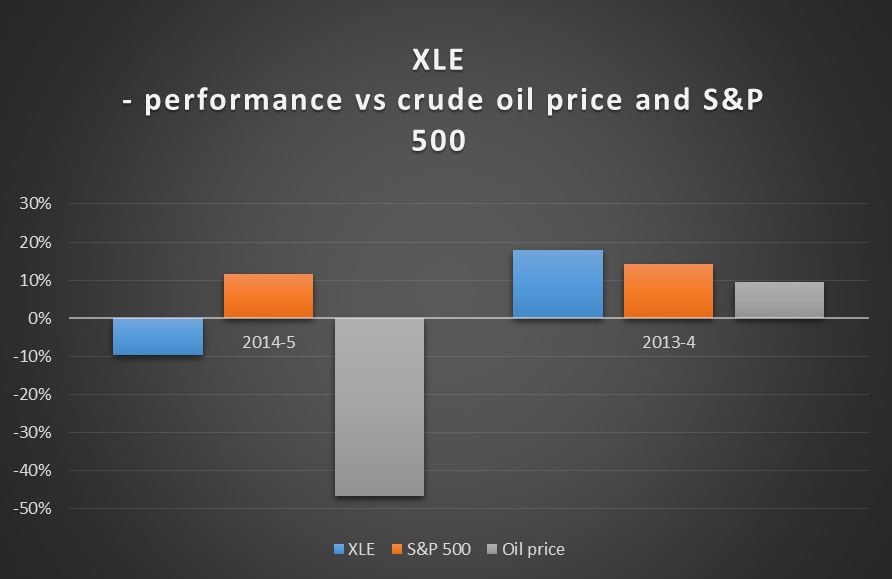

XLE has historically been a blended equity/oil price play, but with the divergence between the oil price and S&P 500 in the last two years, correlation has been mixed.

The oil price and S&P 500 were highly positively correlated (coefficient 0.74) for the four years from 2009-10 to 2012-13. This tight relationship has since broken down, moving to negative correlation in 2013-4 (coefficient of -0.2) and further in 2014-5 (-0.8). As can be seen, XLE followed the S&P 500 in 2013-4 but moved in the direction of the oil price in 2014-5.

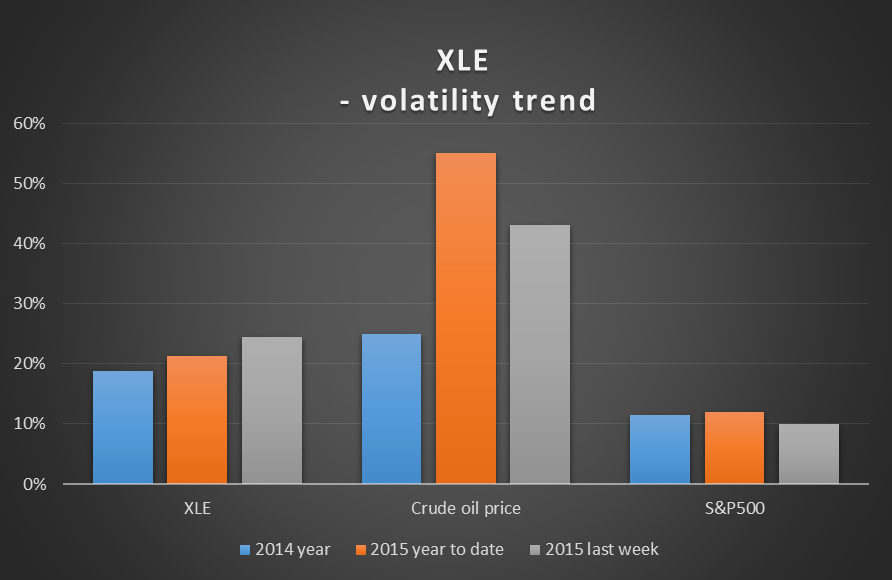

Not surprisingly, XLE’s volatility has been between that of the oil price and S&P 500, rising somewhat with the increased oil price volatility:

We have developed a fair value of XLE based on a multiple regression analysis of its price on 22 driver variables including interest rates, stock indices, commodities and exchange rates. The database is six years of daily prices.

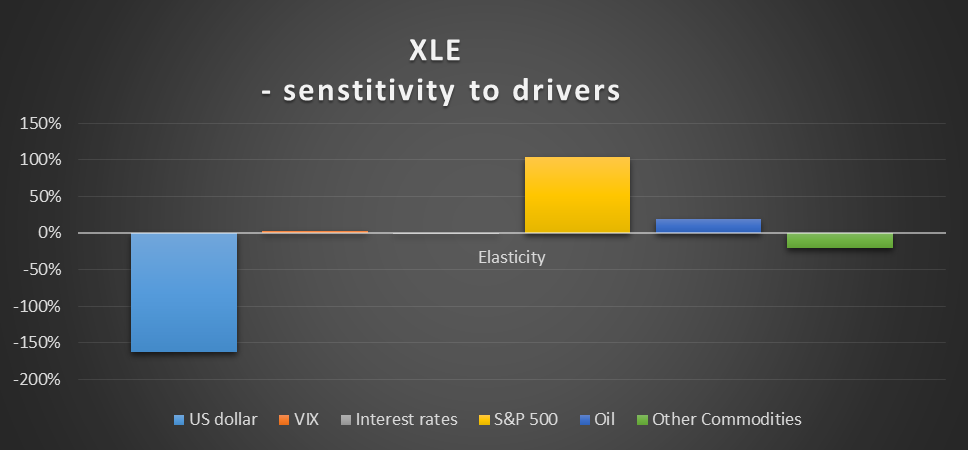

The elasticity of the XLE fair value to groups of driver variables is shown in the graph below.

As can be seen, the ETF is negatively correlated to the US dollar, which is consistent with the negative correlation of both the oil price and S&P 500 to USD.

We have also developed a prediction model based on the lead given by the change in various indices we believe to be related to the variables in the regression model referred to above.

Based on the lead given by these indices, it is possible to develop price predictions for a range of commodities, interest rates, stock indices and currencies. These can be combined with the fair value model elasticities shown above to give a predicted movement in the XLE price over the next month. We also backtest the prediction models to assess their value in a trading environment (taking a long position when the predicted price change is positive and a short position when negative).

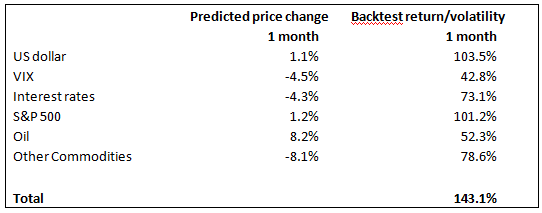

The predicted price changes for the next month, and the annualized return/volatility ratio over the last six years from trading the predictions, are shown in the following table:

The return/volatility from trading all the predictions combined (of 143%) compares with that applying to the S&P 500 over the same period, of 101%. We consider this to be reasonably robust given the period commences in mid-2009, around the start of the latest bull market in US stocks.

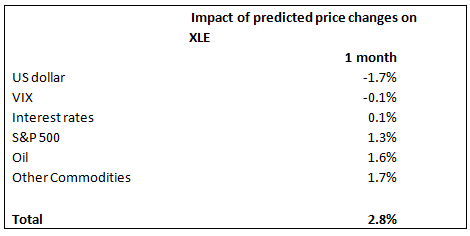

Our predicted movement in the XLE price for the next month is shown in the table below. The contribution of each driver variable to the overall increase is also shown.

As can be seen from the above two tables, we see mild upside in XLE due to strength in the S&P 500 and the oil price weakness, not offset by US dollar strength and despite continued weakness in other commodities.

We also used the index model to directly forecast the XLE price movement for the next month. A change of +1.7% resulted, confirming the signal given above. The six year backtest return/volatility ratio from trading this model was 76%.

However our fair value (from the 22 variable multiple regression model) lies about 5% below the current XLE price.

Diversification benefits could be realized from allocating a component of a US stock portfolio tracking the S&P 500 to XLE traded using the index model as outlined in this article. For a 5% allocation, the ratio would have improved from 101.2% to 104.2% for the last six years.