After growing on Friday morning in view of news about the US missile strike at a governmental air base in Syria, gold quotes dropped down under the influence of ambiguous labor market statistics from the USA. According to the release, the nonfarm payrolls number reduced to 98K in March against 219K a month earlier. In line with the outlook, the average salary growth rate slowed down and made up 0.2% in March against 0.3% a month earlier. The unemployment rate unexpectedly decreased to 4.5% in March from 4.7% in February, which is the best result in 10 years.

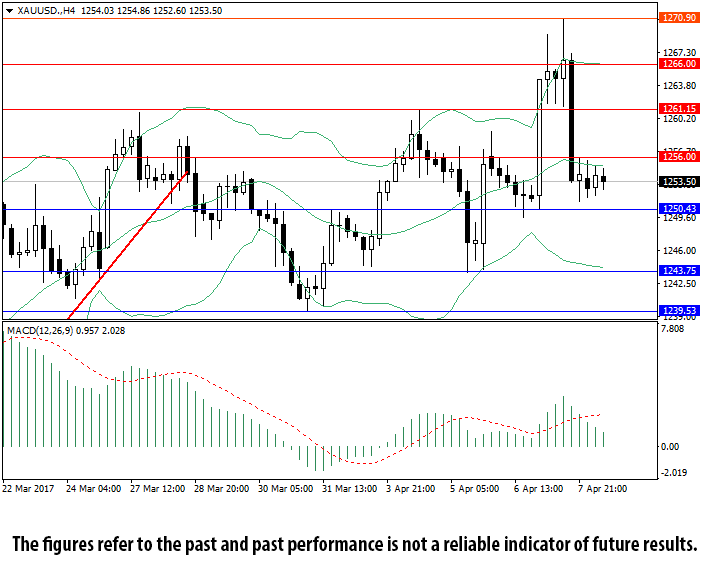

The investors reacted to weak salary data and nonfarm payrolls by buying gold, but quite quickly switched their attention to positive releases on the unemployment rate. As a result, gold quotes quite quickly fell from the peak of 1270.90 to the level of 1250.40.

Today's macroeconomic calendar contains no important releases that may influence the dynamics of gold, and its prices are consolidating around the reached levels after increased trading volatility on Friday.

On the H4 chart Bollinger® Bands are directed sideways indicating side market movement. MACD histogram is located in the positive zone, but its volumes are decreasing, which means the influence of the sellers is preserved.

- Support levels: 1250.43, 1243.75, 1239.53.

- Resistance levels: 1256.00, 1261.15, 1266.00.