Typically when things are going great, I think about just how low things could go or how bad things could get. I’m going to do just the opposite today, since Janet Yellen has a way of mucking up all my plans, and instead will think about danger points for bears tomorrow (that is, Friday).

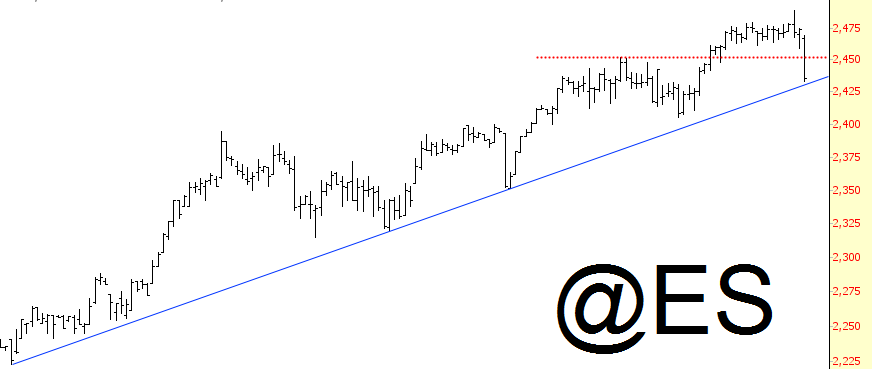

I am presently short seventy-three different positions, almost all of which are deeply in the green. However, looking at the ES, it is approaching a supporting trendline that spans back for many months.

Likewise, the small caps ETF has been cycling within a broad range for months now, and it is extremely close to its own support level. It would take a rupture of these lines to give a new lease on life to the down-move. (I will take this moment to congratulate myself once again for doing a post which timed the reversal of the small caps almost to the second).

Taking an even longer view, this trendline on the S&P 500 cash (anchored to the early 2016 low) has historically been a very reliable level of support.

Last, and perhaps the most worrisome, the “fear index” is approaching its own trendline, which for years has been an area of extremely sharp reversal (e.g. Trump announces Friday morning that he’s been bluffing, and Kim’s a smart cookie, and it would be an honor to meet him).

So there we have it. I’m incredibly short, and that’s been fantastic recently, but as equity bulls consider getting back into the action (shown below, in their natural habitat), I remain vulnerable.