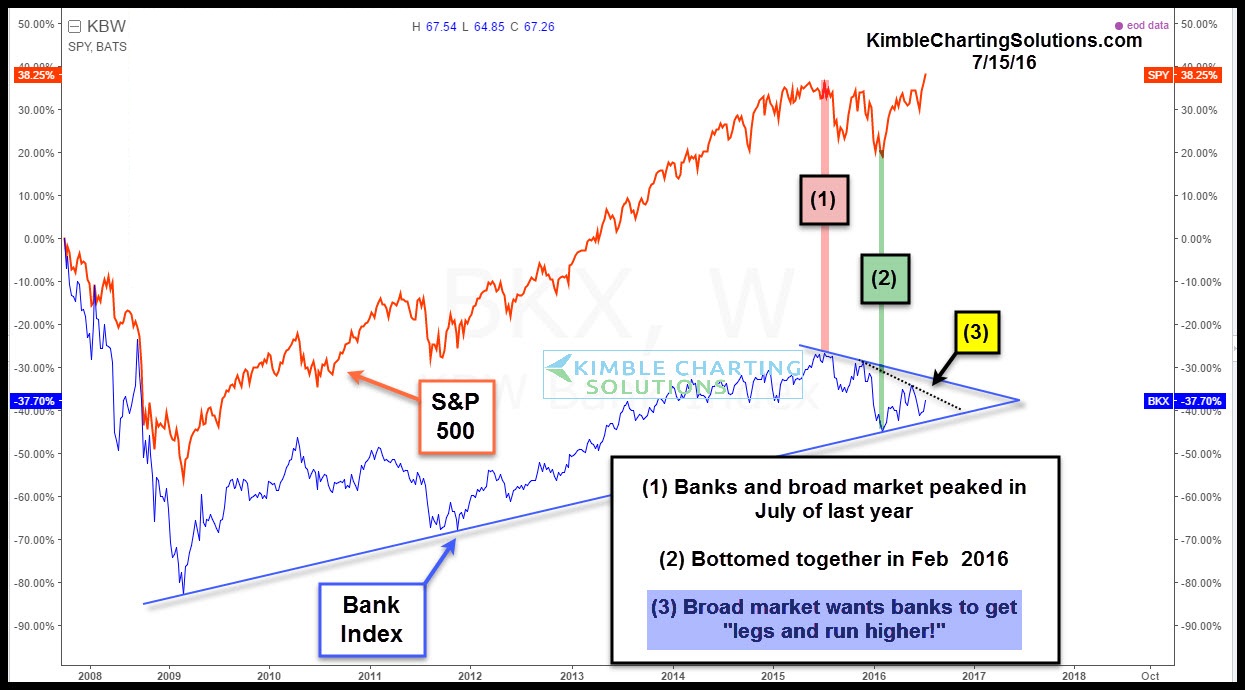

In 1983 the rock group ZZ Top released the song “Legs”, which became a hit. I am reminded of this song today, as we look at the pattern in the kbw and the S&P 500. Below compares the performance of the S&P 500 and banks since the highs in 2008.

When Banks lost footing in 2008, they and the broad markets headed south together. As you can see below, they both bottomed at the same time back in 2009 during the financial crisis.

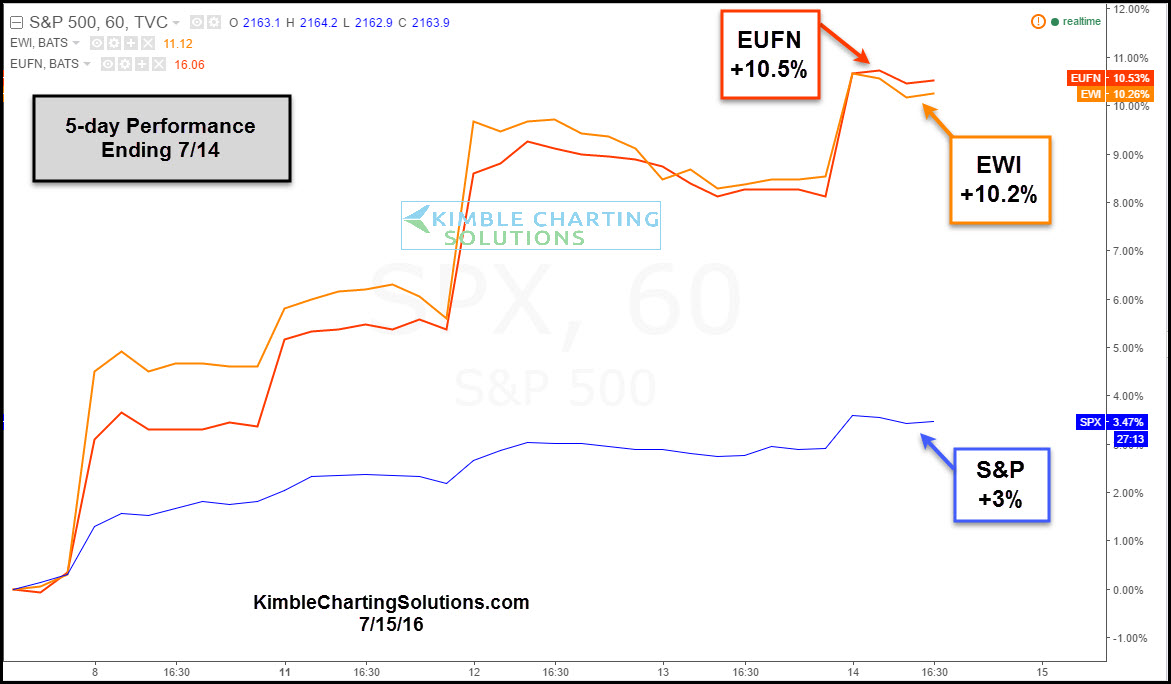

A week ago today, I noted that banks in Europe and Italy were testing key support levels and that if support would hold, the broad markets would like it in the states.

Last week I shared that the risk on trade needed banks in Europe to rally and if they did, it would be a plus for stock markets around the world. For sure the S&P has a nice rally over the past 5 days. As you can see, the hard-hit bank ETF from Europe over tripled the gains of the broad markets in the states.

Banks around the world continue to create a series of lower highs. The risk-on trade needs banks to “get some legs” and break above falling resistance to help the S&P continue to hit record highs going forward.