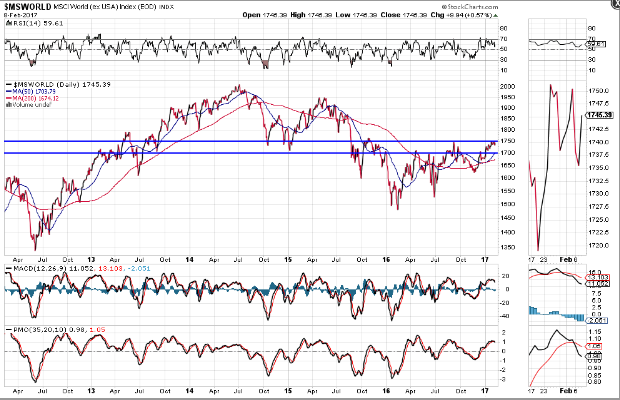

Further to my post of November 24, 2016, the World Market Index did subsequently rally and is now stuck in a trading range between 1700 and 1750, as shown on the daily chart below.

In that post, I mentioned the importance of a break and hold above 1750 as a potential signal of clear support for world equities, in the longer term, including that of the SPX.

You can see that a new "SELL" signal has just been triggered by the bearish crossovers of the MACD and PMO indicators.

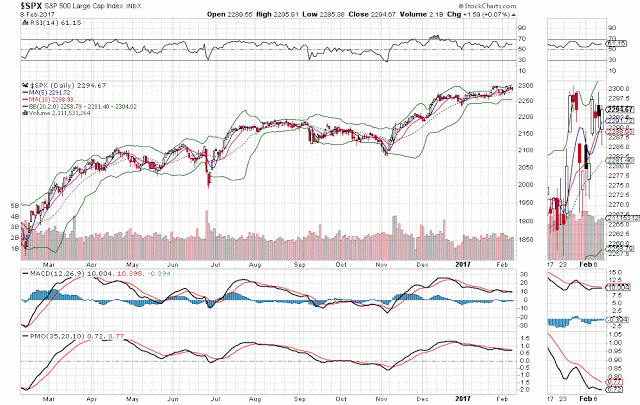

The SPX is languishing just below the 2300 level, as shown on the daily chart below, and the MACD and PMO indicators have yet to form a bullish crossover and trigger a new "BUY" signal.

Even if we see one of these indices break out, it's doubtful that sustained "buying with conviction" will prevail, unless we see the other one participate in such a rally, as well. That may not happen until both parties of the U.S. Congress begin to cooperate in a civil and bipartisan approach to move ahead with the new administration's agenda regarding the economy and security of its nation, instead of the political obstruction currently in play.