Wokday Inc. (NYSE:WDAY) reported fiscal second-quarter 2018 non-GAAP earnings of 24 cents per share, which beat the Zacks Consensus Estimate of 15 cents.

Revenues of $525.3 million increased 39.1% year over year and beat the consensus mark of $507.4 million. The figure was much better than the guided range of $505–$508 million.

Subscription revenues (82.7% of total revenue) soared 42% year over year to $434.5 million, driven by strong net new customer wins and renewals. The figure surpassed the guided range of $420–$432 million. Professional services revenues (17.3% of total revenue) grew 34% from the year-ago quarter to $91 million and were better than the guided figure of $85 million.

Notably, Citigroup Management Corporation (NYSE:C) , Nordstrom (NYSE:JWN), Qualcomm (NYSE:C) and Humana (NYSE:HUM) were added as human capital management (HCM) customers in the reported quarter. The company’s financial management application was chosen by the likes of Ohio Health Corporation, The Children’s Hospital of Philadelphia, Giant Tiger Stores and Carlyle in the reported quarter.

Geographically, revenues outside the U.S. (20% of total revenue) increased 59% to $106 million, which is indicative of the company’s growing international foothold. Reportedly, Munich Germany-based manufacturing giant Siemens replaced their current HR system with Workday HCM. Additionally, in Europe and Asia Pacific’s Japan region, the company added Shell (LON:RDSa) and Johnson Electric, respectively as customers.

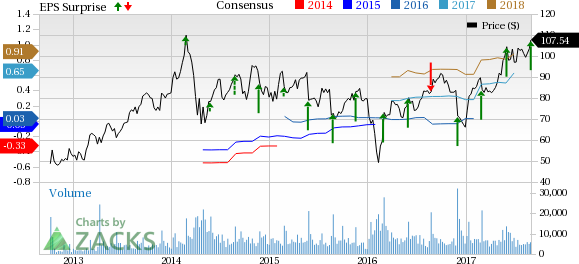

Notably, shares of Workday have gained 62.3% year to date, substantially outperforming the industry’s18.1% rally.

Operating Results

The company reported non-GAAP operating income of $49 million compared with $6.1 million in the prior-year quarter.

Non-GAAP operating margin expanded 770 basis points (bps) from the year-ago quarter to 9.3%.

Balance Sheet

Workday exited the quarter with total cash and cash equivalents (including marketable securities) of $2.01 billion compared with nearly $2.0 billion as on Jan 31, 2017.

Workday’s cash from operating activities for the quarter ended Jul 31, 2017 was $15.1 million compared with $6.5 million in the year-ago period.

The company’s free cash outflow was $23.4 million in the quarter, greater than an outflow of $20 million in the prior-year quarter.

Outlook

For fiscal third-quarter 2018, Workday expects revenues in the range of $538-$540 million. Subscription revenues are anticipated in the range of $450-$452 million, while professional services revenue expectation is $88 million.

Workday anticipates non-GAAP operating margins to decline sequentially and be in the range of 5-6%.

The Zacks Consensus Estimate is currently pegged at earnings of 9 cents per share on revenues of $522.05 million.

Buoyed by the encouraging first-half results, the company raised its guidance for fiscal 2018. Revenues are anticipated to be in the range of $2.093-$2.1 billion, up from the prior guidance of $2.04-$2.05 billion. The company now expects non-GAAP operating margin for the full year to be 8%, up from the previous guidance of 6-7%.

Additionally, Workday now projects subscription revenues to be between $1.750 billion and $1.757 billion compared with the prior guidance of $1.705 billion to $1.720 billion. Professional services revenues are anticipated to be about $343 million in fiscal 2018.

The Zacks Consensus Estimate is currently pegged at earnings of 65 cents per share on revenues of $2.05 billion.

Our Take

Workday’s revenue growth continues to be driven by high demand for HCM and financial management applications. The company continues to win new customers, which demonstrate high demand for its applications. We believe Workday’s high customer satisfaction rate bodes well for its long-term business strategy.

Workday’s HCM suite of applications demonstrates strong growth momentum driven by the transition of organizations to the cloud. Per management, Workday has been selected for core HR by more than 30% of Fortune 500 companies. We, therefore, see much room for expansion here. Also, the company’s traction in the international market is also a positive.

The company’s growing clout in the HCM market is evident from market research firm Gartner’s latest “Magic Quadrant for Cloud HCM Suites for Midmarket and Large Enterprises” report where it put Workday in the “Leaders” quadrant.

The company’s dominance in the financial management sector is also increasing, which is evident from Gartner’s June 2017 “Magic Quadrant for Cloud Core Financial Management Suites for Midsize, Large, and Global Enterprises” report where Workday was again placed in the “Leaders” quadrant. Moreover, Workday Planning application is also doing well with more than 170 customers including Qualcomm and Bank of America (NYSE:C) .

Workday’s intention to foray into the platform-as-a-service market by launching the Workday Cloud Platform is expected to further boost the company’s top line in our view.

However, increasing competition in the HCM and financial software market could lead to pricing pressure and affect Workday’s margins. Also, increasing marketing spend remains a concern.

Zacks Rank & Stocks to Consider

Workday has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (NYSE:BAC): Free Stock Analysis Report

Workday, Inc. (WDAY): Free Stock Analysis Report

QUALCOMM Incorporated (NASDAQ:QCOM): Free Stock Analysis Report

Original post

Zacks Investment Research