Last week, I wrote about the deteriorating employment picture. This week, investors received additional evidence that the “job growth is solid” crowd is inattentive.

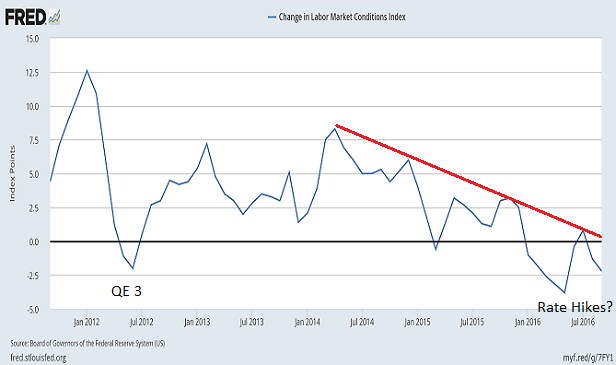

Consider the Federal Reserve’s own Labor Market Conditions Index (LMCI) – a dynamic factor model that incorporates data from 19 labor market indicators (e.g., wages, unemployment rates, layoffs, business surveys, etc.). The change in the LMCI has steadily broken down since mid-2014. The beginning of the fall from grace? It roughly corresponds to a peak in corporate profits two years ago as well as the timing of the Fed’s tapering of asset purchases.

The LMCI has fallen in eight out of the previous 10 months. It dropped -2.2 points in September, sliding further into negative territory. Neither the longer-term trend, the shorter-term trend, nor the current level of the index suggest a labor market that is “solid.”

Perhaps ironically, the last time that the LMCI toiled to this extent, the Fed provided massive stimulus through a third round of quantitative easing (QE3). This time around? Voting members on the Federal Open Market Committee (FOMC) are jawboning “full employment” to justify a face-saving quarter-point hike in December.

What difference does a quarter point rate bump make to the investment markets? It is not the size of the change in the overnight lending rate, but rather, its super-sized impact on currencies and dollar-priced commodities.

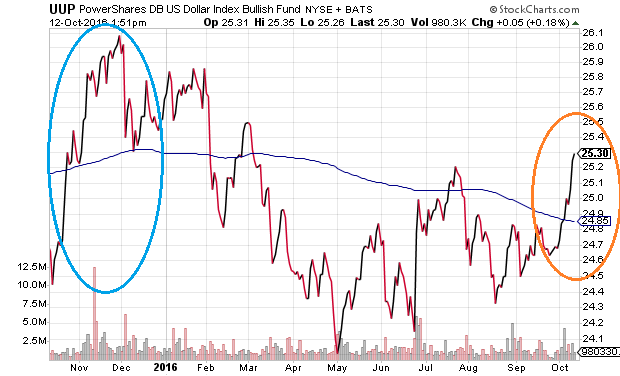

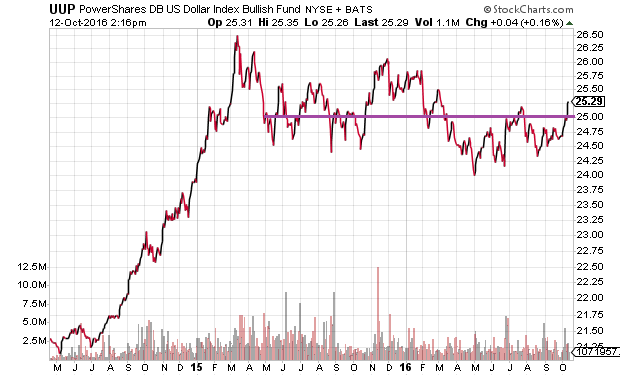

Take a look at what happened last year via PowerShares DB Dollar Bullish ETF (NYSE:UUP). The Fed signaled its intent to hike a paltry 0.25% by December of 2015. The dollar surged higher in the quarter. And commodities got crushed. By January of 2016, an elevated dollar alongside poor employment data as well as disintegrating oil prices sent stocks into a tailspin.

The current rise in the dollar via UUP is not alarming in and of itself. Nevertheless, the deterioration in corporate revenue, corporate earnings as well as labor market conditions directly correspond to the dollar’s ascent since mid-2014. Fortunately or unfortunately, when half of the profits at S&P 500 companies come from overseas operations, a stronger dollar means that those companies are likely to earn fewer “bucks.”

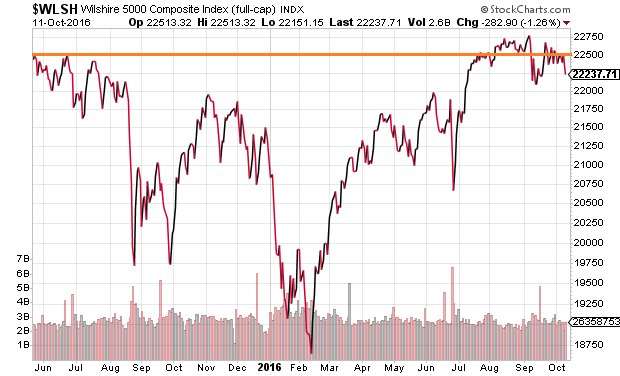

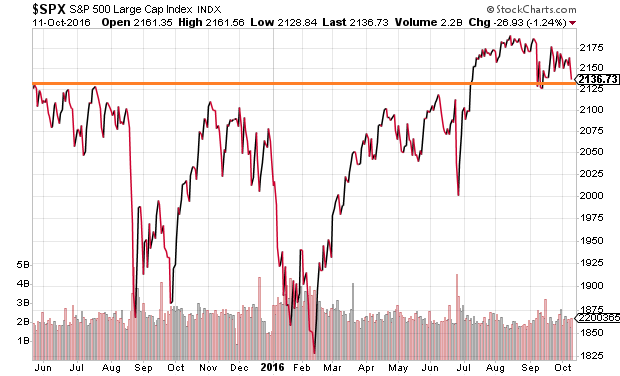

Equally worthy of note, the stock market has made very little progress since May of 2015. Might the Fed’s effect on the dollar be the culprit? With the Wilshire 5000 and the S&P 500 relatively restrained?

Bottom line? Corporate profits have fallen for six consecutive quarters. Economic growth via GDP continues to struggle. Even the labor market is far less healthy that many would like you to believe. It follows that unless the Fed is able to talk down the dollar as it moves forward with a hike in its overnight lending rate, one might anticipate an unsavory combination of dismal corporate earnings guidance and volatile stock price movement.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients June hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.