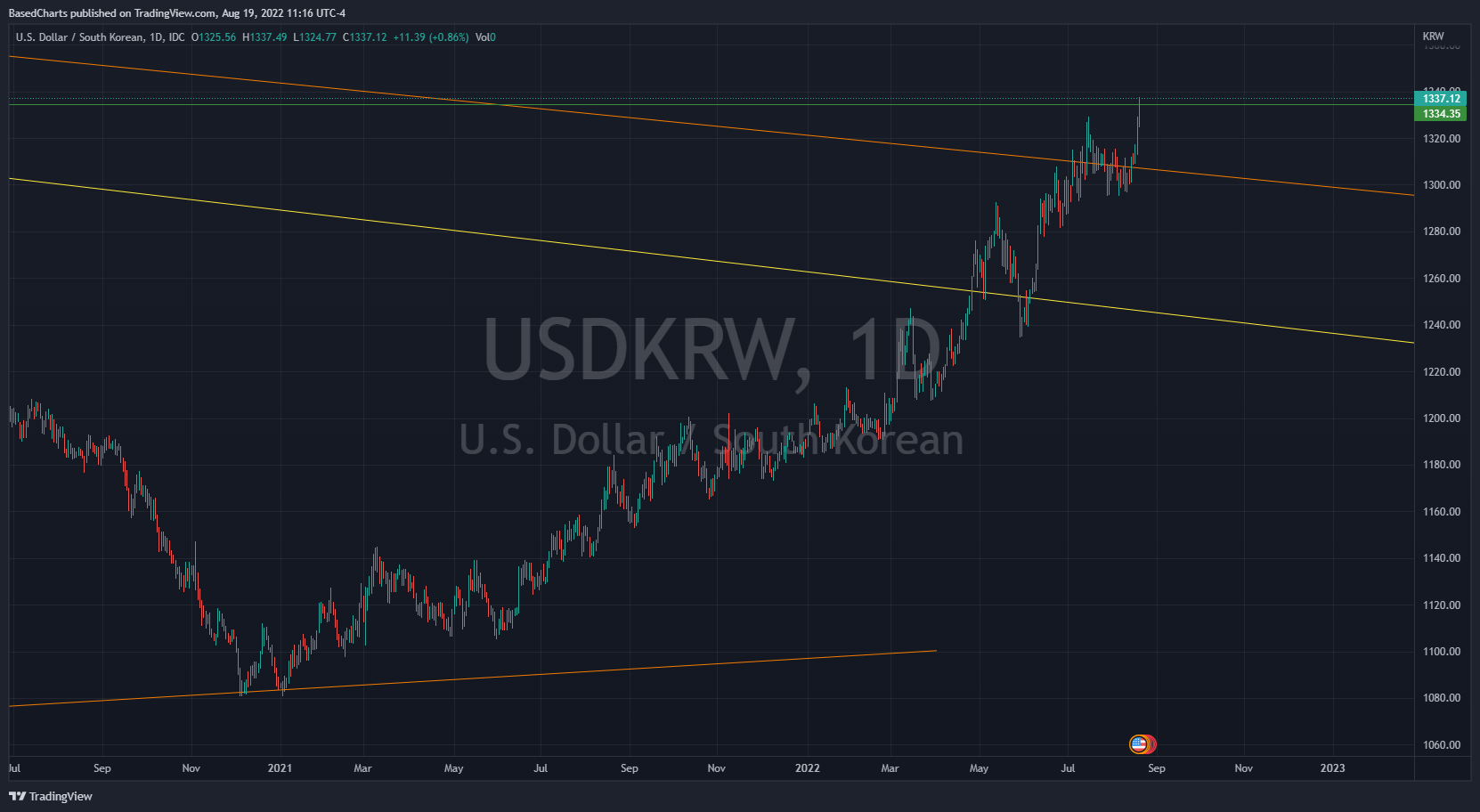

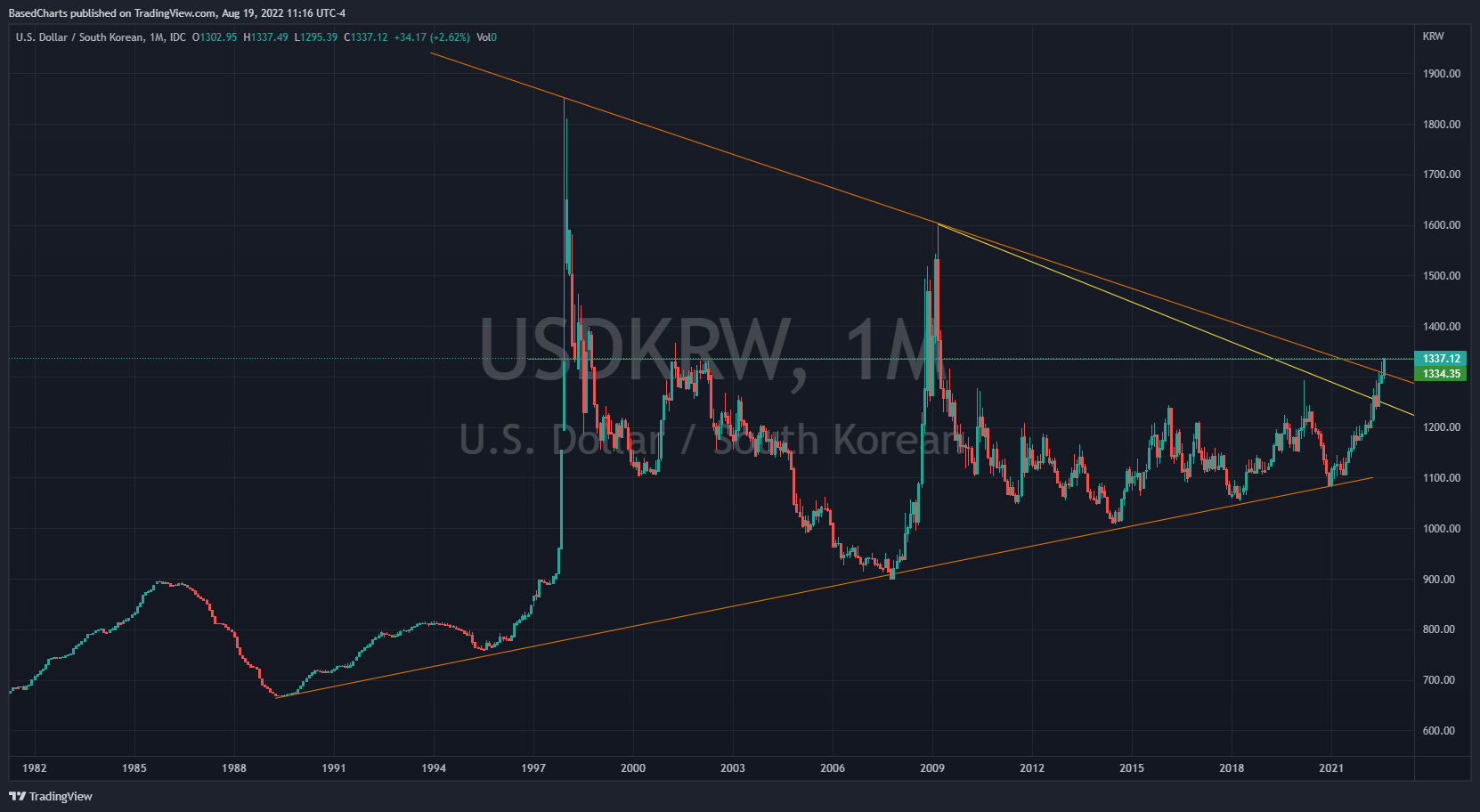

The Korean won has traded lower twice, in 1997 and 2008. Both moves were explosive. The question for traders is termination or follow through? If it follows through, there’s all manner of short targets because this is not an isolated chart. It has to be seen in concert with charts such as USD/JPY, EUR/USD, USD/CNY and so on. It has to be seen in context with stock charts such as EEM that are at long-term support.

A currency crisis can have several catalysts. A big one would be yuan depreciation. A breakdown in US stocks that triggered more dollar strength might do it. It’s an echo of the 1997 Asian Crisis more than the 2008 financial crisis.

Here is EEM sitting at long-term support. It’s like an inverse of USD/KRW. KRE has broken a long-term resistance line and EEM has broken a long-term support line.

I am putting on far OTM trades. My sense is the market knows all these risks, but is almost blissfully unaware given recent price action in U.S. stocks, along with the many investors focused on inflation and who think the U.S. dollar will crash as a result.

Buckle Up

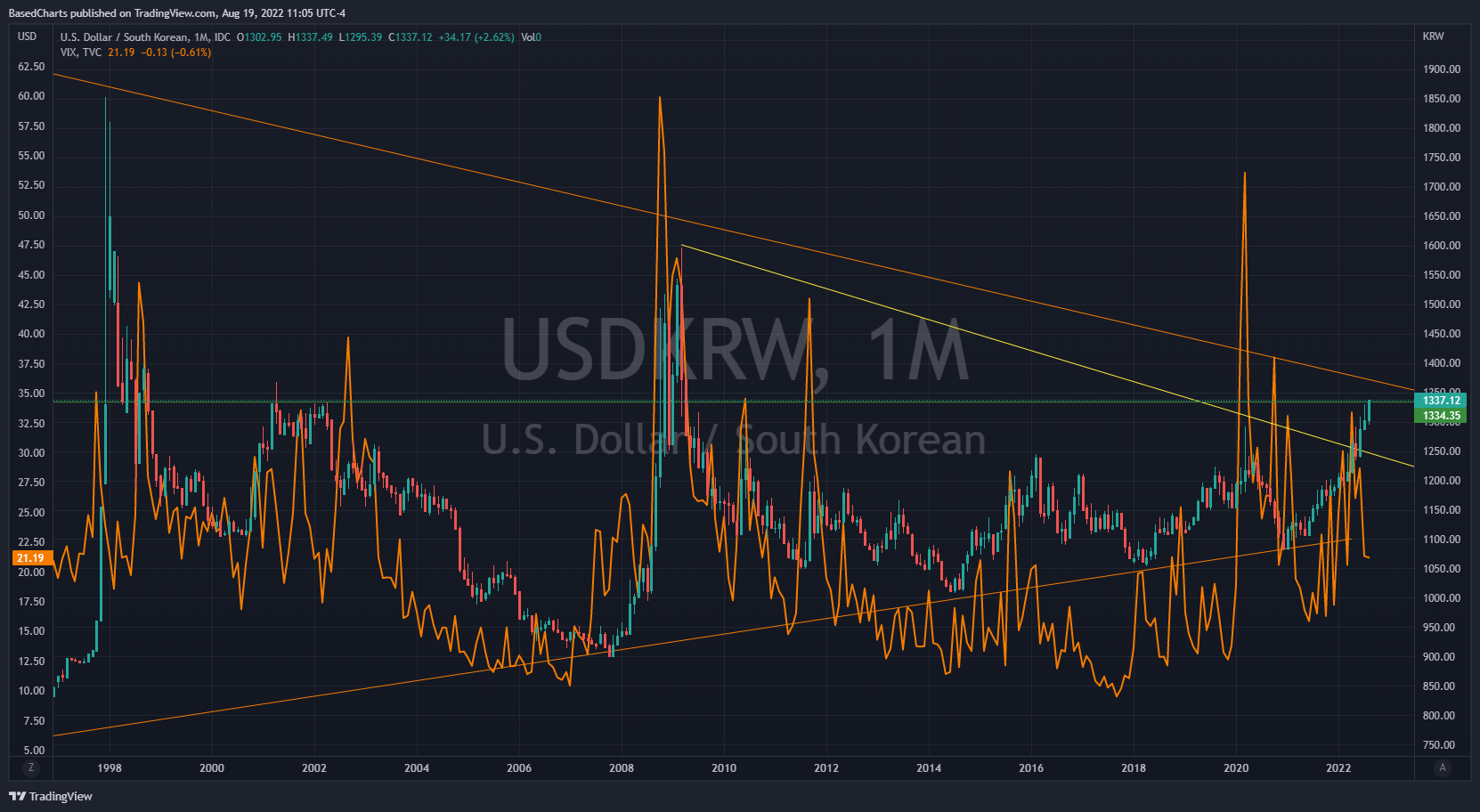

If the currency markets start driving events, a chart such as USD/KRW or USD/CNY is far more important than a chart of the S&P 500. Here is the VIX overlaid with USD/KRW. I’m not interested in the VIX here so much as the gap between VIX and USD/KRW. That gap is going to close if USD/KRW keeps running.

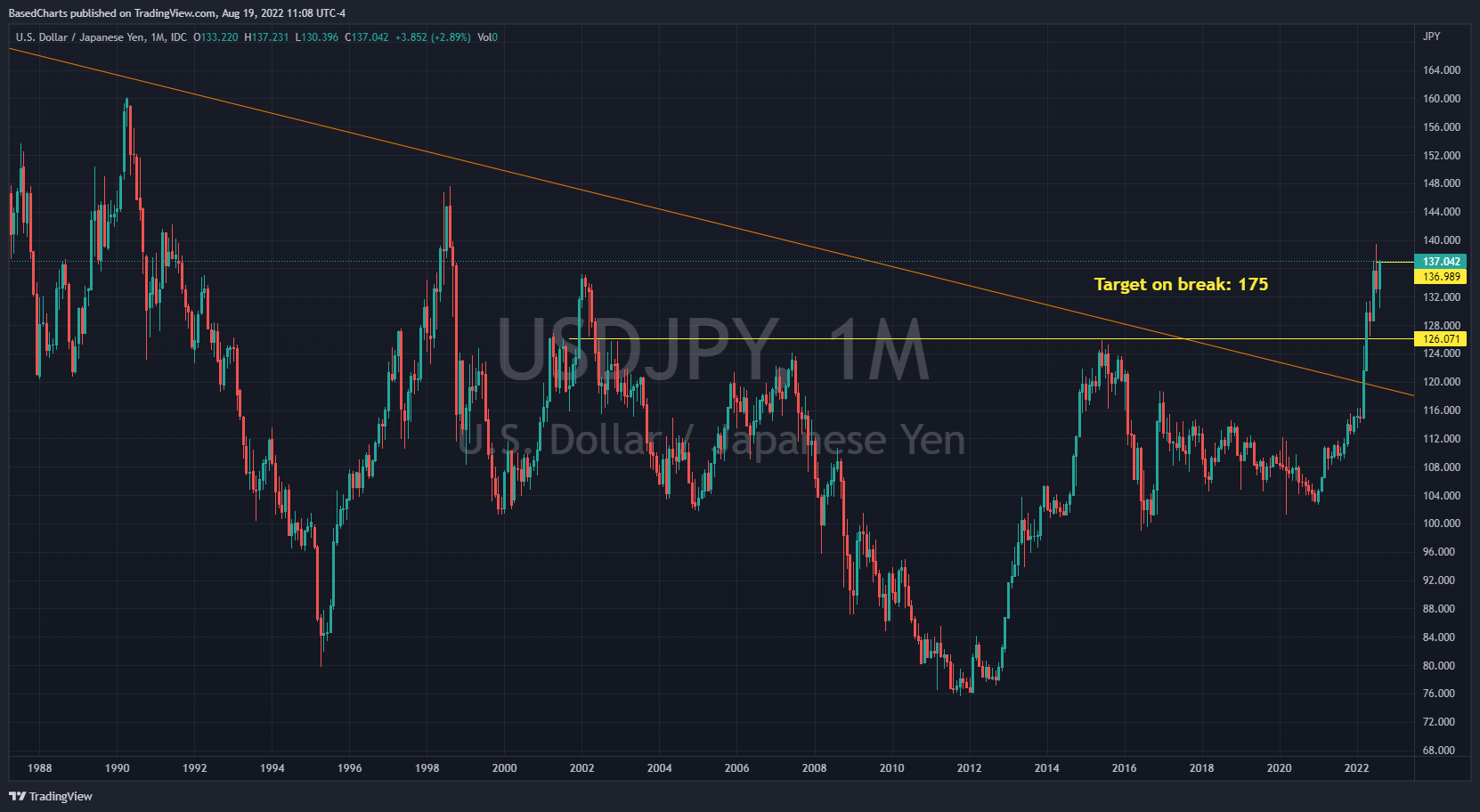

Here’s USD/JPY trading at its highest level since the Asian Crisis.

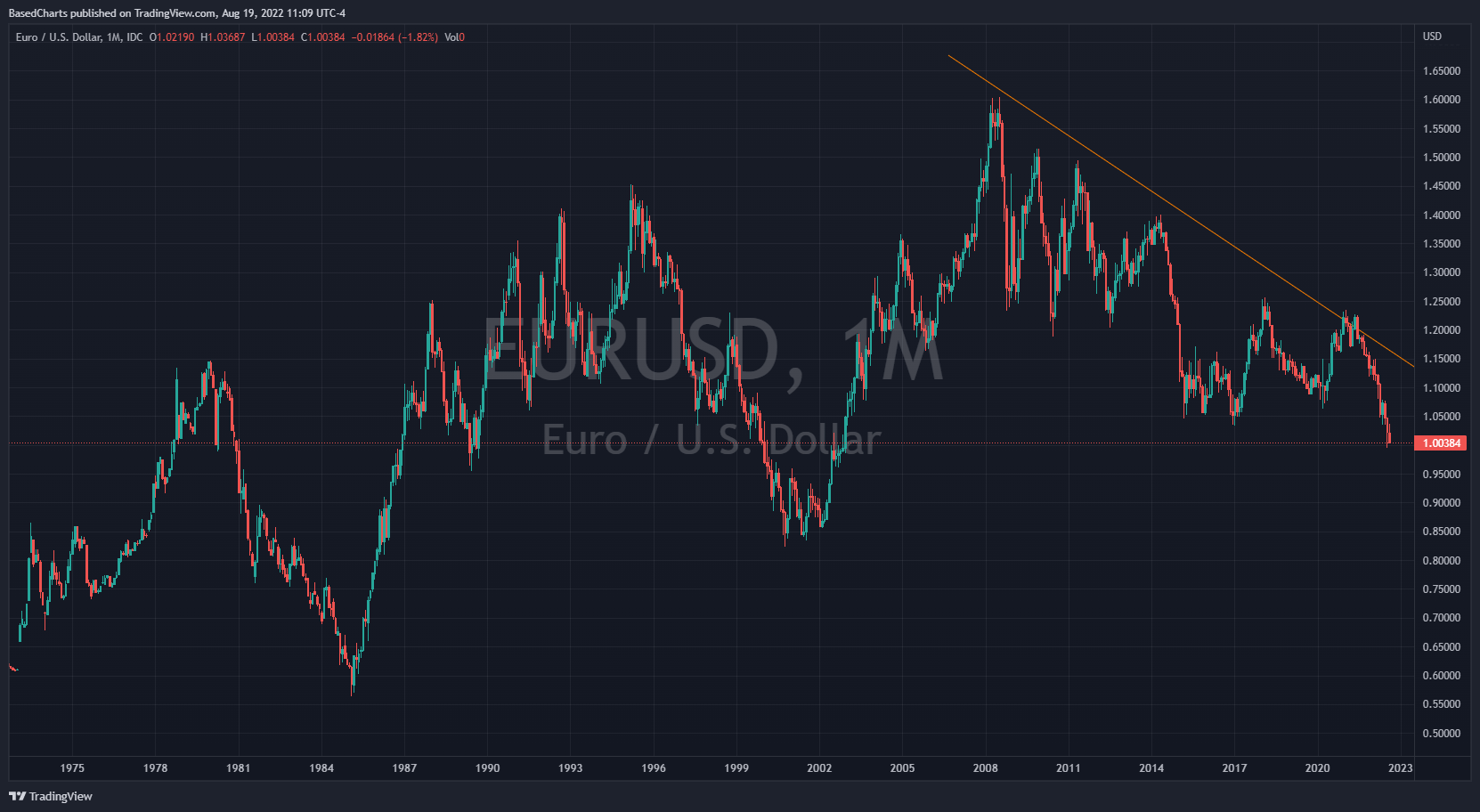

The euro is also weak.

I could write a lot on the macroeconomics of it, but look at the charts. It simplifies everything. View all the charts in concert. If they keep breaking down or breaking out in a way that is favorable for the US dollar, eventually an uncontainable crisis starts unfolding. China stayed out of 1997, and even helped the situation by holding the yuan steady and acting as a bulwark, but they are much closer to the profile of a country that suffers in this type of crisis than one that can act as a white knight. Would the U.S. and China work as equal partners in a bailout, or would China and Russia instead take advantage of what would be seen as a major breakdown in the U.S.-led global economic order?

You can make up your own mind about how you see this all resolving. My view is as follows: when charts of major assets get this extreme and break long-term support or resistance levels, it doesn’t matter what plays the role of domino. Either the market bearishness has topped out or chaos is coming this autumn. This is as close to a binary setup as one gets in the markets.

I can see both sides of the situation, but what interests me is that asymmetry. Going long might be the best trade, but it would require taking on more risk for more reward. Whereas going short here, if correct, has a very asymmetric payout such that a small capital outlay in OTM puts could deliver large gains. Plus it’s a target rich environment with everything from emerging markets to commodities to high-yield bonds getting hammered in a bearish resolution.