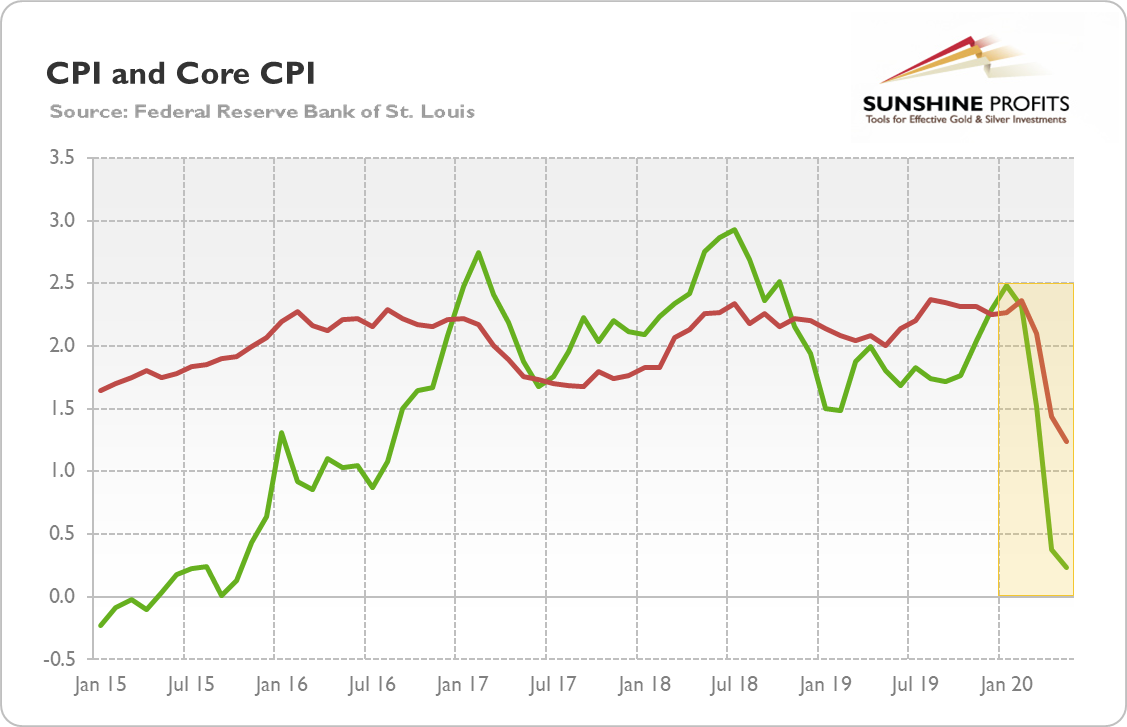

US CPI declined 0.1%in May, following a 0.8% drop in April. The decrease was mainly driven by decreases in energy, transportation and apparel prices. Core CPI also declined 0.1%, following a 0.4% drop in April. It was the third consecutive monthly decline, which happened for the first time in history of the index that starts in 1957. Compared with the previous month, we are seeing some stabilization of disinflationary forces, at least on a monthly basis.

The chart below shows these disinflationary trends.

Powell’s Press Conference and Gold

Fed Chairman Jerome Powell has said the central bank might consider targeting the yield curve, like the Bank of Japan. Such a strategy would ensure ultra-low interest rates for longer, which in turn supports gold.

Second, Powell signaled also that interest rates will remain low at least until the unemployment rate normalizes.

It means that even if inflation goes up, the Fed will not rush to tighten monetary policy if the unemployment rate is above the historical average rate. Given that inflation has recently declined, the Fed’s dovish bias is almost certain. And what is important here is that Powell expects significant slack in the labor market. In other words, the coronavirus crisis will lead to permanent job losses:

My assumption is that there will be a significant chunk -- chunk, well into the millions. I -- I don't want to give you a number because it's going to be a guess, but well, well into the millions of people who -- who don't get to go back to their old job and in fact, there isn't a -- there may not be a job in that industry for them for some time. There will eventually be, but it could be some years before we get back to those people finding jobs.

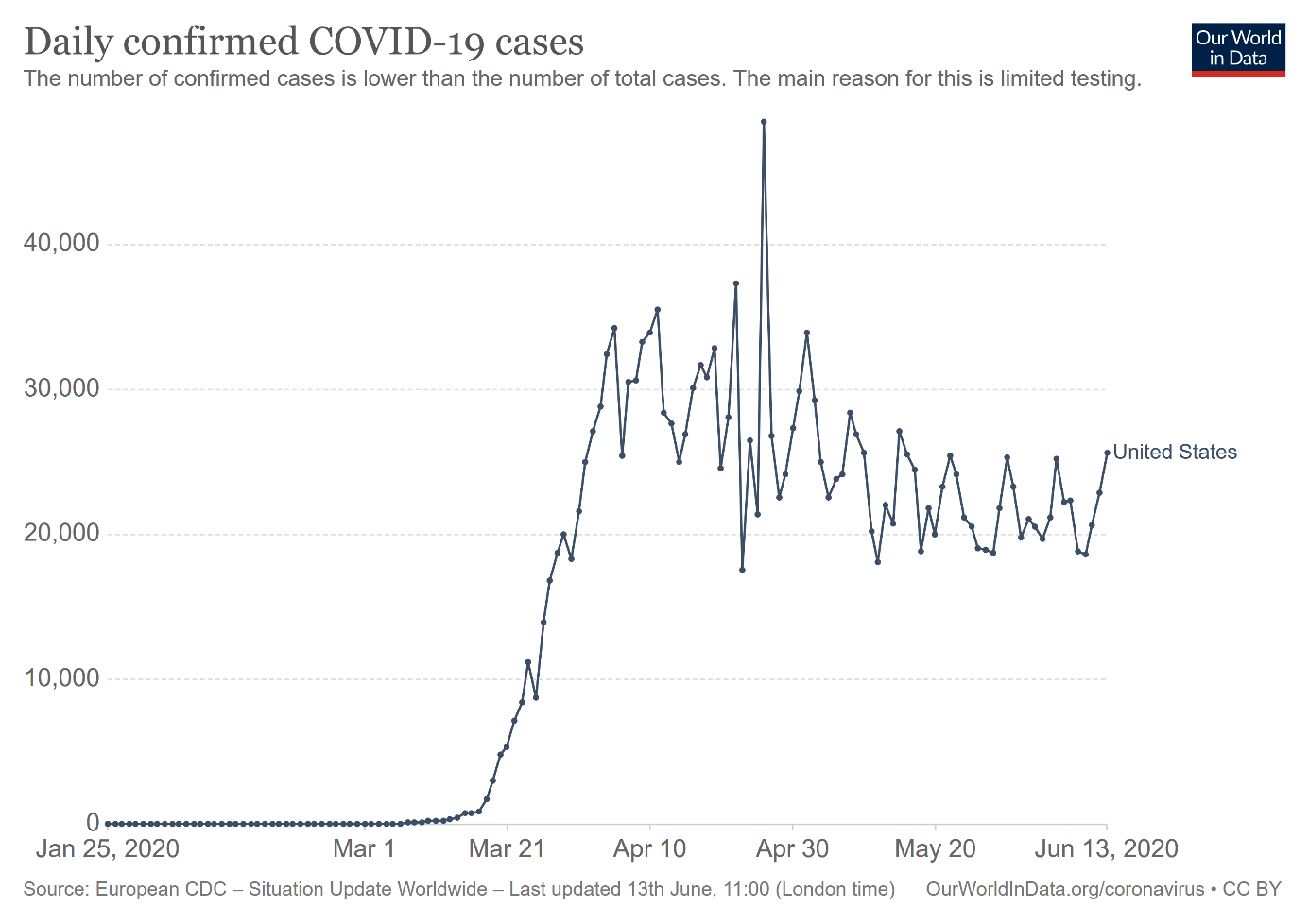

Third, Powell is worried about a second wave of coronavirus. He believes it might be another factor behind the gradual recovery, which might not necessarily be a V-shaped one.

I think, that if a -- if it happens -- you know, the -- the issue would be, first of all, people's health, but secondly, you could see a public loss of confidence in -- in parts of the economy that will be already slow to recover, so it could hurt the recovery, even if you don't have a national level pandemic, just a -- just a series of -- of local ones -- of local spikes could -- could have the effect of undermining people's confidence in traveling, in restaurants, and entertainment, anything that involves getting people together in small groups, and feeding them, or flying them around, those things could be hurt. So, it would not be a positive development, and I'll just leave it at that.

And Powell might be right. As the chart below shows, the number of the US daily cases is still rising:

Implications for Gold

What does it all mean for the gold market? Powell’s most recent press conference indicated that there is still a long way to recovery proved something of a shock for many stock market investors. Many have also started to worry about a possible second wave of infections. As a result, last week both the Dow Jones and the S&P 500 indexes suffered their biggest weekly percentage declines since March. Weaker risk appetite should be positive for safe-haven assets such as gold. Moreover, lower inflation with an uncertain outlook for recovery implies a dovish Fed and ultra-low interest rates are here to stay, for now, which, from a fundamental point of view, should also support gold.