Last week, I wrote about John Chambers, the CEO of Cisco Systems (NASDAQ:CSCO), and his desire to be at the forefront of the so-called Internet of Everything.

Indeed, the coming wave of internet-connected devices will change the world as we know it, while minting many fortunes along the way.

For investors, that means we need to find the companies that are best-positioned to capitalize on this massive trend – and it doesn’t hurt if they’re paying a reasonable dividend in the meantime, either.

Lucky for us, Cisco isn’t the only well-positioned tech giant that’s trading at a discount right now…

In fact, a second large-cap technology company is looking like a solid “Buy” – Qualcomm (NASDAQ:QCOM) Incorporated.

Qualcomm is an American global semiconductor company that designs and markets wireless telecommunications products and services. The company is the world’s leading patent holder in advanced 3G mobile technologies.

Like Cisco, Qualcomm sports a massive market cap of over $100 billion, so it’s not exactly a hidden gem. Yet even though the company is a household name, many don’t realize that it’s been rapidly increasing its dividend in recent years. In fact, the company’s five-year dividend growth is a whopping 147%.

Currently, QCOM pays a $0.42 quarterly dividend, good for a yield of 2.34%. That’s higher than the S&P 500, as well as the average for S&P 500 technology companies. What’s more, the company has consistently raised its dividend every four quarters – which means its next announcement, which will likely come in April, should include a dividend hike.

A Favorable Settlement

Of course, in our search for income opportunities, we want to keep our focus on cheap dividend growers. Fortunately, Qualcomm is also trading at a discount right now.

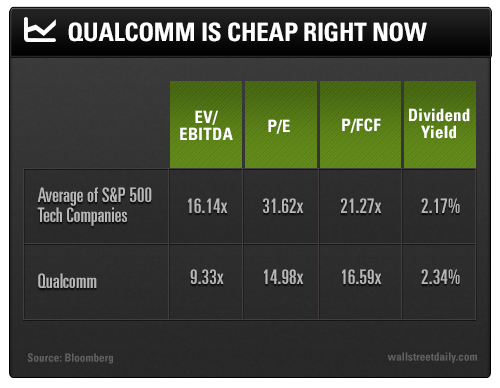

Check out the chart below, which compares Qualcomm to other S&P 500 technology companies:

As you can see, Qualcomm is trading at a significant discount across the board – plus it has a higher dividend yield than its peers.

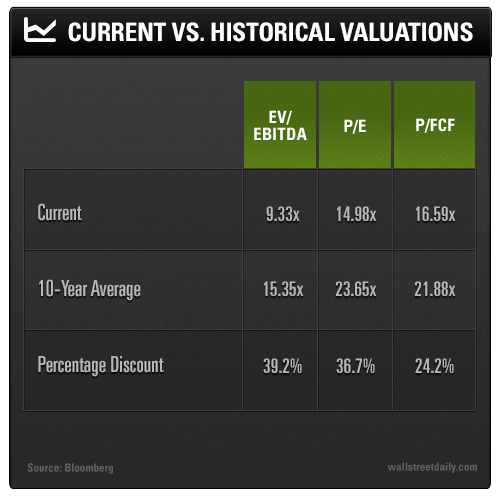

What’s more, Qualcomm is trading at a discount to its 10-year average for all of these metrics, as well, as demonstrated in the chart below:

Now, there’s one big reason why share prices are depressed at the moment: Qualcomm was facing an antitrust suit in China for allegedly overcharging customers for licensing agreements.

With news that the company could face a fine of $1 billion or more – plus the potential that China could limit Qualcomm’s licensing business in the future – it’s not surprising that investors were feeling uneasy.

Luckily, it seems that the cost of even the worst-case scenario has been priced into Qualcomm’s shares, which are down about 4% in the last 12 months and down about 9% since their high on July 23, 2014.

Better yet, the case was just settled on February 9, and Qualcomm got off relatively easy. The company will pay $750 million to the Chinese government (which is less than the anticipated fine), and it must also forfeit a portion of royalty revenue on its 3G and 4G devices. More importantly, it won’t face any sanctions that would limit its ability to grow revenue going forward.

A Sunny Outlook for Qualcomm

Ultimately, Qualcomm seems well positioned for the future.

For now, it’s a cash flow giant, with $7.2 billion in free cash flow in the last 12 months. In that same period, QCOM paid $2.7 billion in dividends – which leaves plenty of room for stock buybacks or a dividend hike.

And going forward, Qualcomm is set to take advantage of the Internet of Things.

In the latest earnings report, CEO Steve Mollenkopf noted that the company has a “broad set of products and equipment” with Qualcomm solutions inside that will be used in smart homes, smart cities, mobile healthcare, and wearables.

As the trend of internet-ready devices continues to grow, Qualcomm should be riding high. In the meantime, investors can buy shares at a discount and enjoy the rapidly growing dividend.

Good investing.