Wingstop Inc. (NASDAQ:WING) just released its fourth-quarter and full year 2017 financial results, posting adjusted earnings of $0.17 per share and revenues of $28.3 million. Currently, Wingstop is a Zacks Rank #3 (Hold) and is down over 8% to $42.90 per share in after-hours trading shortly after its earnings report was released.

WING:

Beat earnings estimates. The company posted adjusted earnings of $0.17 per share, beating the Zacks Consensus Estimate of $0.16 per share.

Beat revenue estimates. The company saw revenue figures of $28.3 million, topping our consensus estimate of $27.39 million.

Wingstop’s Q4 revenues jumped 14.3% year-over-year. On top of that, the chicken wing chain’s system-wide sales increased 15.6%, while domestic same-store sales rose 5.2%.The company’s adjusted net income climbed 14.6%.

Looking ahead to fiscal 2018, Wingstop now expects to post adjusted earnings of roughly $0.75 per share, which falls well below our current estimate of $0.82 per share.

“In 2017, the Company celebrated key milestones with the opening of our 100th international location, 14 consecutive years of same-store sales growth, and the launching of a quarterly dividend, further driving the point that our business model is strong and our team members and business partners are among the best in the business,” CEO Charlie Morrison said in a statement.

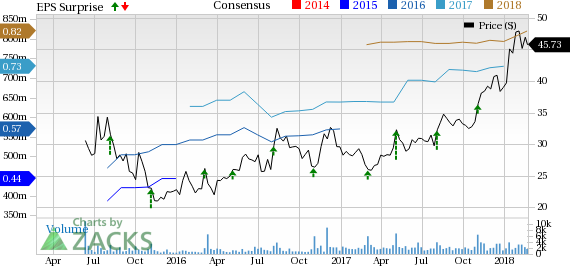

Here’s a graph that looks at WING’s Price, Consensus and EPS Surprise history:

Wingstop Inc. franchises and operates restaurants. The Company's operating segment consists of Franchise segment and Company segment. It offers cooked-to-order, hand-sauced and tossed chicken wings. Wingstop Inc. is headquartered in Dallas, Texas.

Check back later for our full analysis on WING’s earnings report!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Wingstop Inc. (WING): Free Stock Analysis Report

Original post

Zacks Investment Research