Investing.com’s stocks of the week

Since the final outcome of Trump Trade War - Part II flashed on the screen with the news that the US President had pulled the United States out of an international nuclear deal with Iran, I find that the WTI Crude started to feel the negative impact of this announcement, rather than be in favor of higher price expectations. The reason can only be that the governments of France, Germany and the United Kingdom all said on Tuesday they wanted to stick to the deal and similar sentiments are prevailing in Asia too. I find that the WTI Crude Oil looks to be the next Aluminum now.

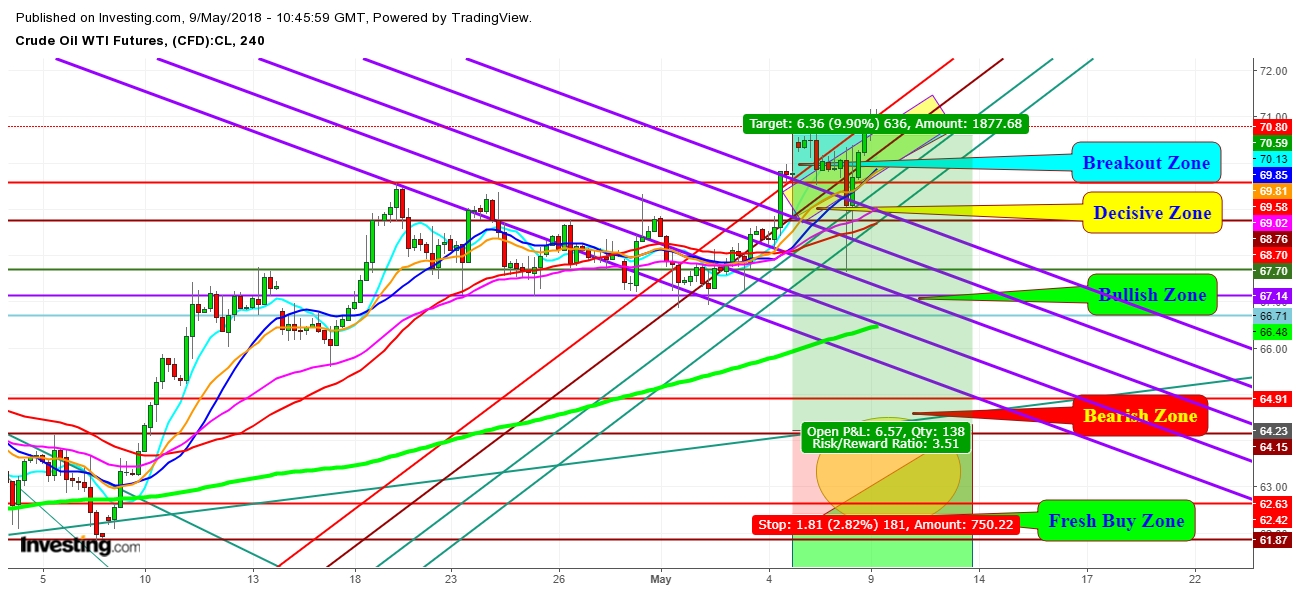

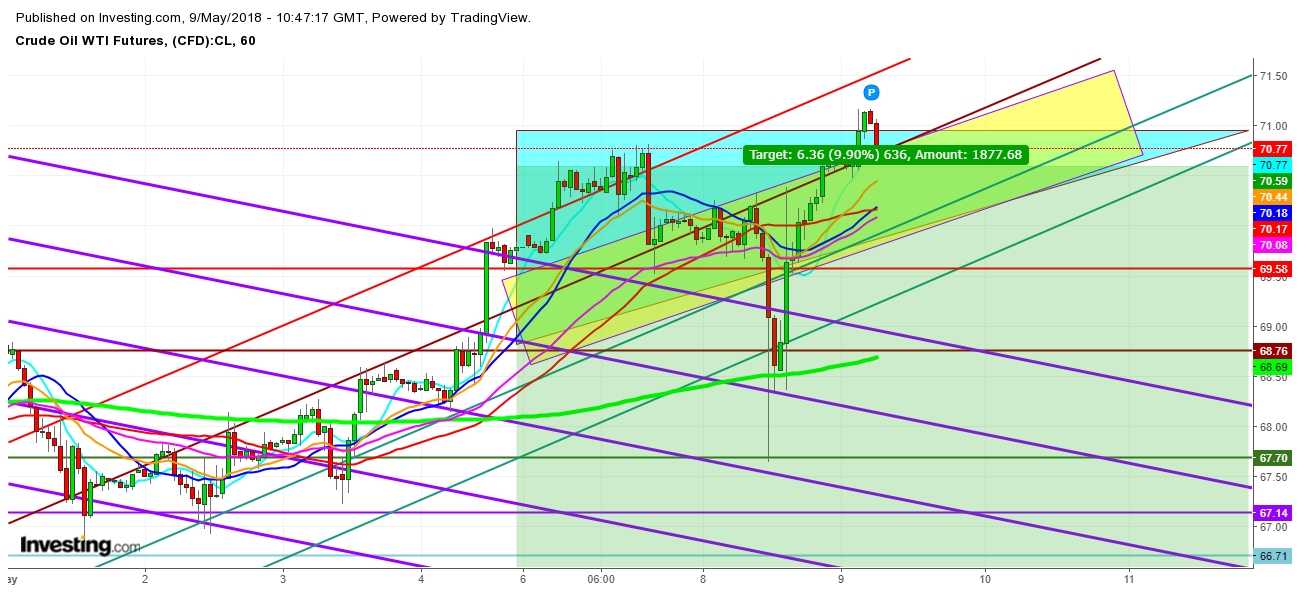

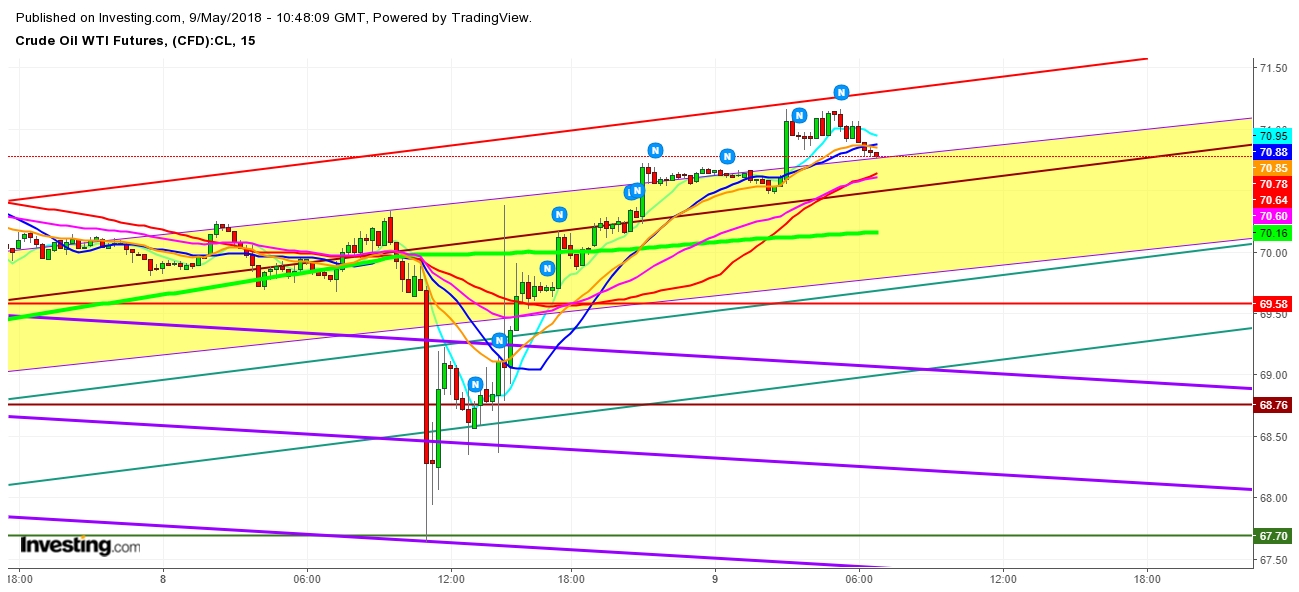

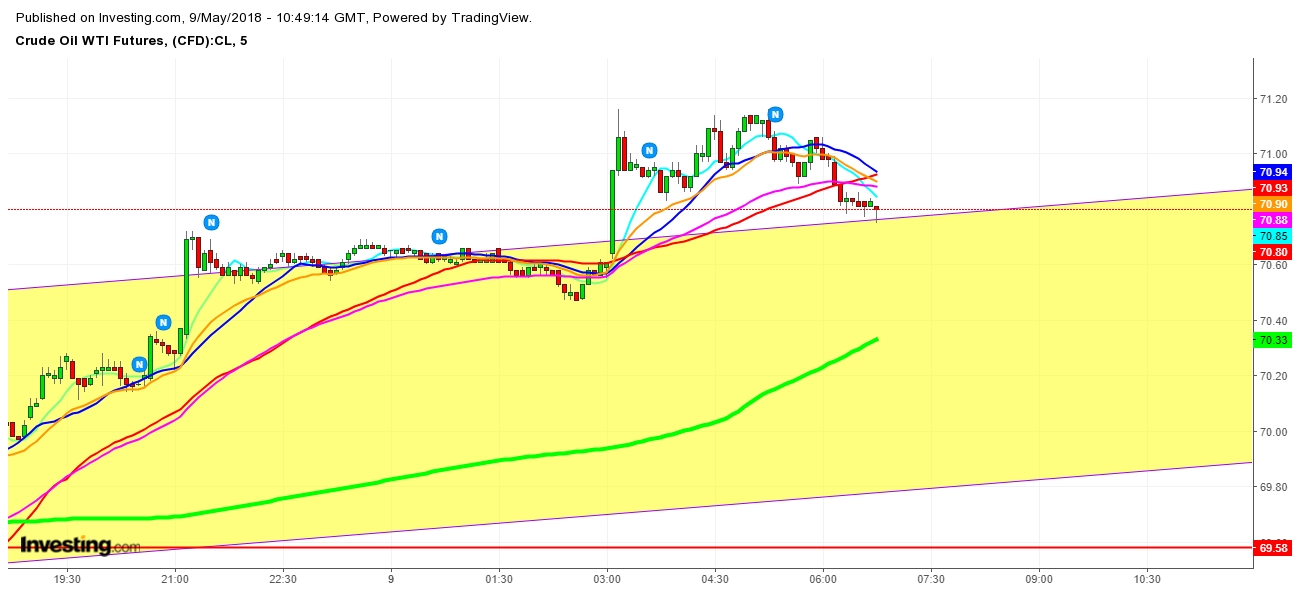

On analysis of the movement of WTI Crude Oil futures on May 9th, 2018 at 06:45:00 in the same chart pattern, in different time frames, which I noted in my last analysis, I find that the WTI Crude futures are currently facing liquidation pressure as the prevailing geopolitical moves are evident enough to be turning in favor of bears as the WTI Crude Oil futures facing stiff resistance at the level of $71. And, further course of action of the WTI Crude futures look to follow the movement patterns of Aluminum futures’ behavior following Trade War - I.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.