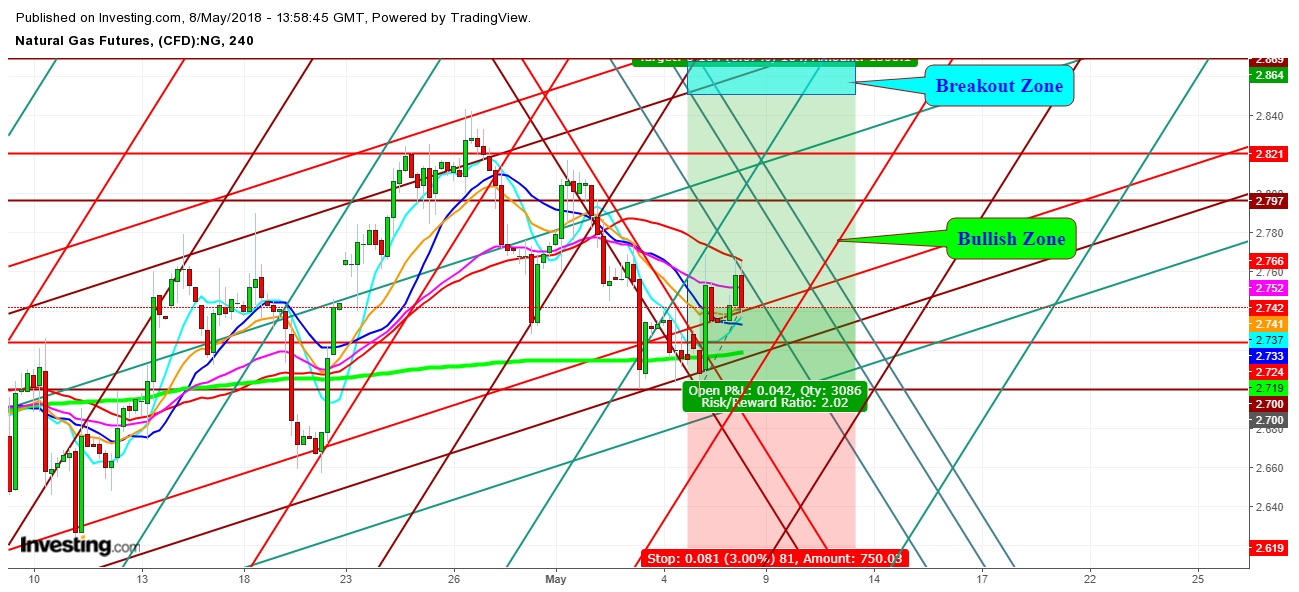

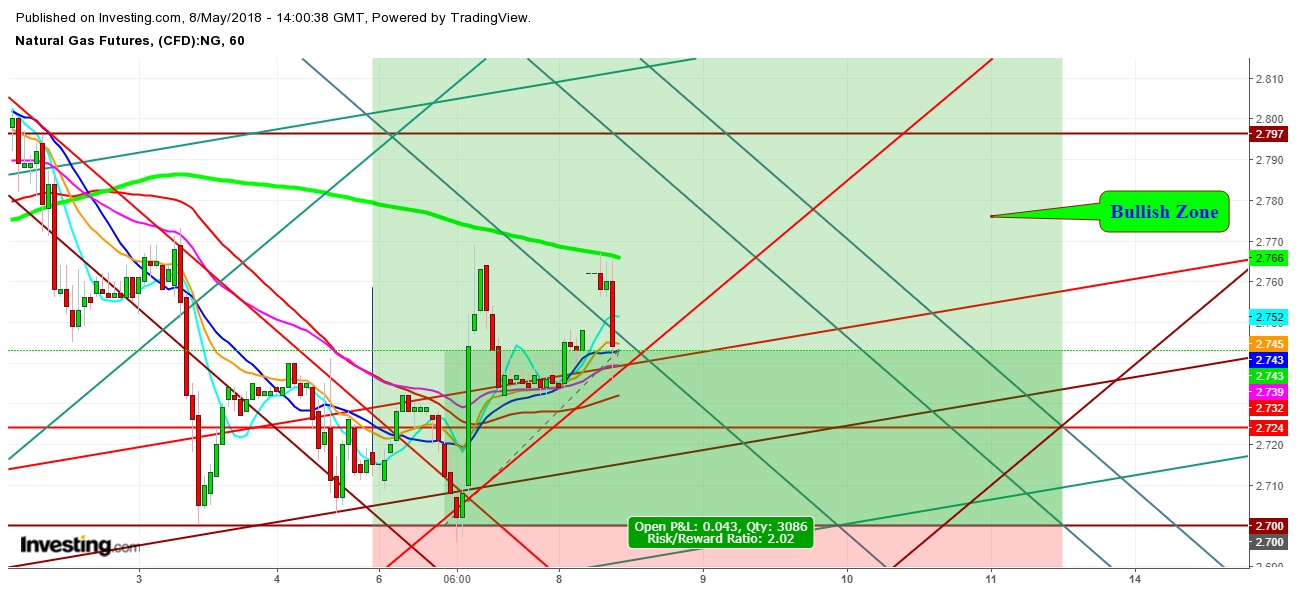

Since submission of my last analysis on analysis of the movement of Natural Gas futures on May 8th, 2018 at 10:00:00 in the same chart pattern in different time frames, I find amid the growing volatility, Natural Gas futures’ sustenance at the current level indicates NG bulls’ intention to have an eye towards breakout zone. No doubt till the final outcome from President Donald Trump on Tuesday, Natural Gas futures may see volatile moves but overall trend, if able to sustain above the level of $2.717, looks to be in favor of NG bulls during this week. Now, the main focus of Natural Gas futures look to be inclined more towards escalating geopolitical drivers rather than be with shifting weather announcements. I conclude that a move $2.777 on May 8th, 2018 at 11:50:00 will confirm the continuity of uptrend voyage of Natural Gas futures during this week amid escalating geopolitics.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.