Do you believe that the U.S. economy will experience a recession in 2023? Most signs point to it.

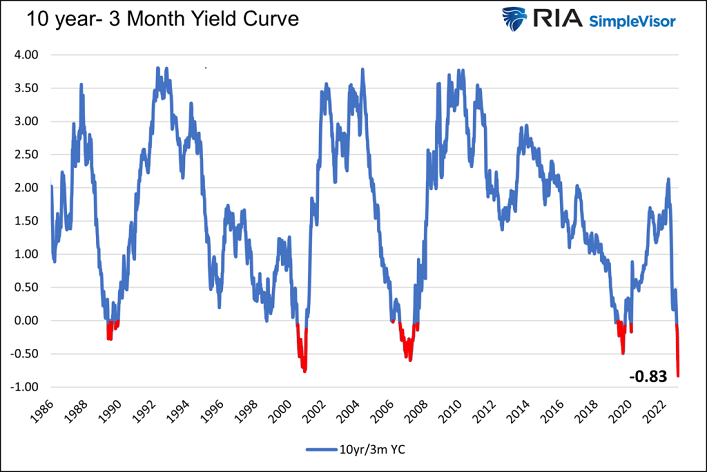

Rare are the circumstances when United States 10-year Treasury obligations yield more than three-quarters of a percentage point more than 3-month T-bills. The “yield curve inversion” practically screams recession.

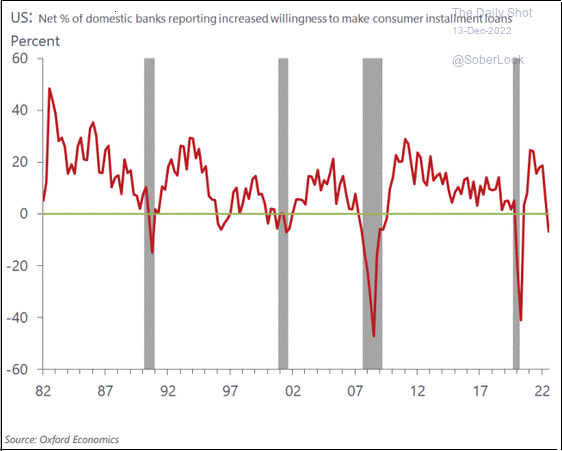

In a similar vein, banks are less and less willing to lend to consumers. Higher borrowing costs are difficult. Limited access to those dollars is even more detrimental to economic growth.

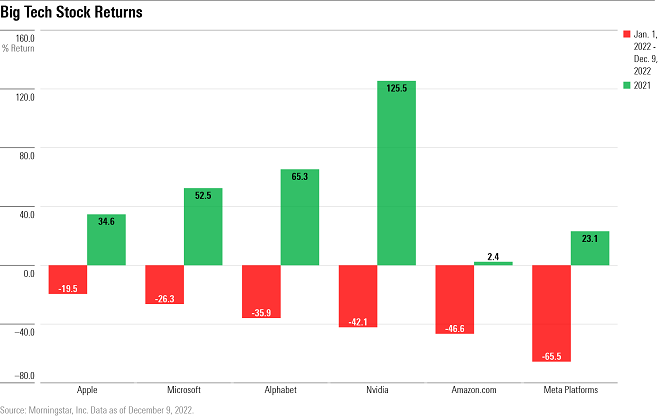

If one accepts the premise that to beat inflation, the Federal Reserve wants the U.S. economy to succumb to recessionary pressure, then one should prepare a portfolio accordingly. For example, buying the “Big Tech” stock dip is premature.

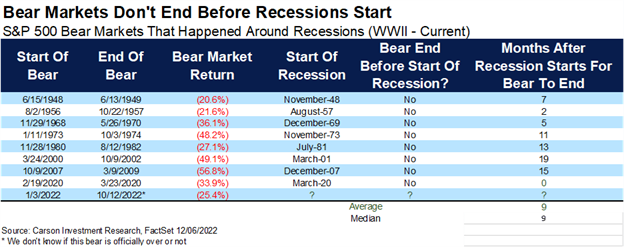

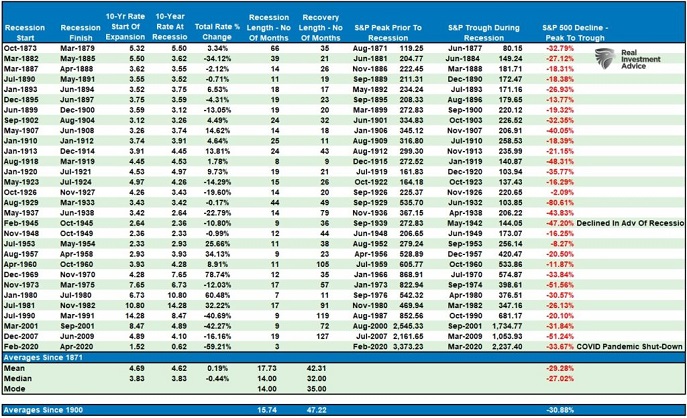

When might it make sense to snatch up prospective bargains? After the recession starts. The median time for a bear market to run its course is nine months after economic contraction begins.

Notably, October is the earliest a recession may have started. That implies we may not see the stock market lows until springtime of 2022 at the earliest.

Equally troubling, the current stock bear may see far more damage than 20% losses. In the first 11-12 months of the 3/2000-10/2002 and the 10/2007-3/2009 stock bears, prices fell roughly 19%-20%.

This is also true for the 1/1973-10/1974 bear. However, all three of these stock bears experienced close to 50% haircuts before the bottom was in.

Are we really going to see 50% price destruction as we did during the 2000’s tech wreck and the 2008’s financial crisis? The average loss for the S&P 500 in a recessionary period is 29%.

That would put the S&P 500 at the 3350-3400 level, approximately 12% lower from here.

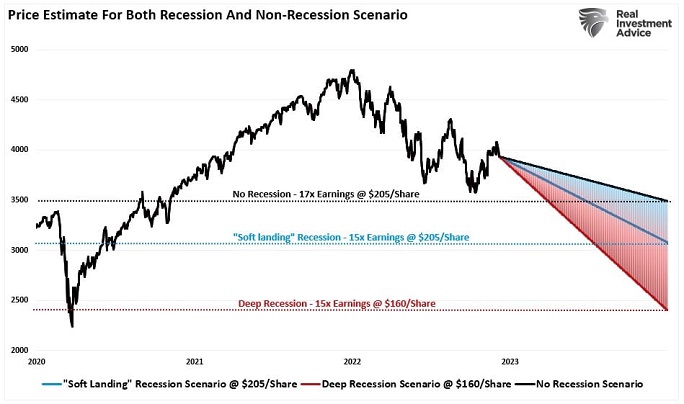

Lance Roberts at Real Investment Advice also breaks down possibilities from a valuation perspective. A mild recession might take the market closer to 3000, representing a top-to-bottom decline of approximately 37%.

A deep contraction? That might involve peak-to-trough decimation of 48%.

Granted, nothing is ever set in stone. The economy may escape a recession altogether, or the stock market may defy rationale and historical comparison.

On the other hand, investors should be mindful of present-day risks. They should also have an investment process for managing the risks of an overvalued, bubbly stock market.