For the countless complexities in this market, it really comes down to this simple shape:

Due to unprecedented manipulation, interference, and “stimulus”, the market managed to carve out a basing pattern. It broke out. In merely three days, it had shot its proverbial wad and thus, flaccid and ashamed, began to wither away. It has returned to its base, ready for its make-or-break decision. That decision, of course, is utterly dependent upon the whores in Washington deciding whether or not to plunge the country another $2 trillion in debt that will never be repaid in order to buy political points.

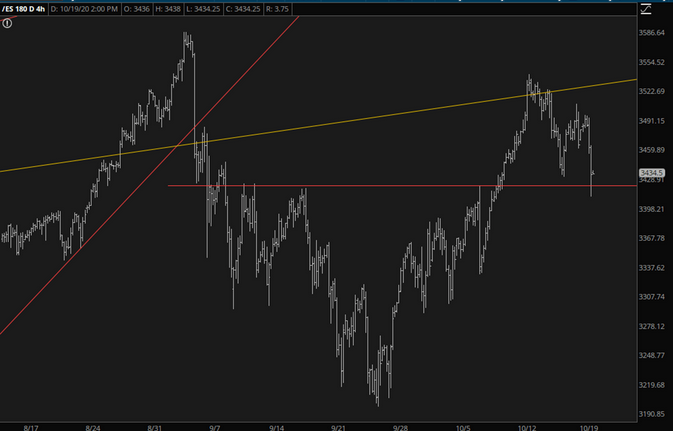

The S&P 500 Futures chart shows more detail. We actually did poke our way a little bit below the breakout zone during Monday’s depths.

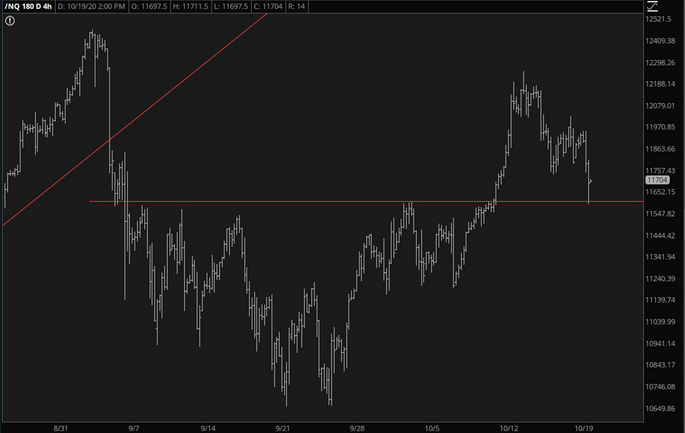

We did the same with the Nasdaq 100, but in both cases, the pattern pretty much held. It will take a lot more selling pressure to crush the pattern than it did to simply travel back toward its top.

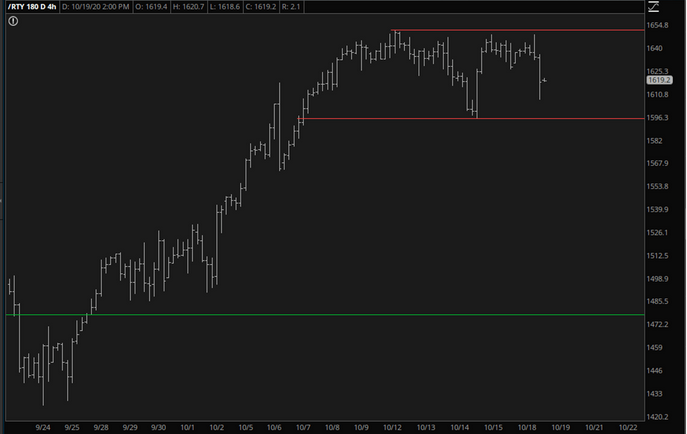

Of more interest to me is the small caps, whose pattern is really a range as opposed to a specific shape. We would need to break that lower red line to get things cooking. We didn’t even threaten it on Monday.

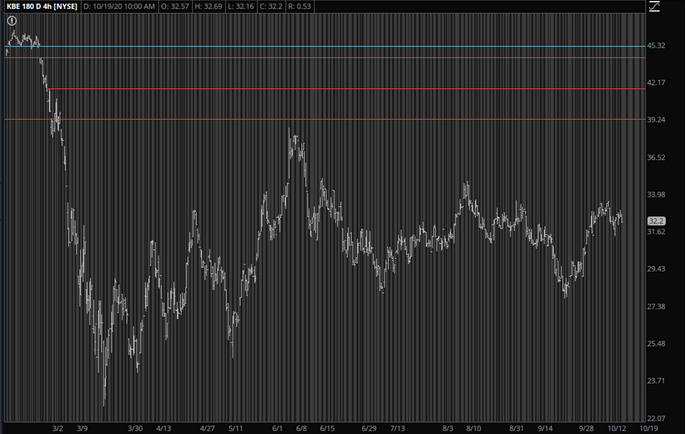

Oddly, the one chart that means more to my portfolio than any other is SPDR® S&P Bank ETF (NYSE:KBE) – – the banks. It’s strange, because not that many of my shorts are financial, but it seems to be incredibly tightly-correlated to KBE. In any case, this ETF has been meandering aimlessly for weeks now.

Anyway, we’re all gamblers at this point – – at least those of us with any positions at all. Will they or won’t they? It’s anyone’s guess. And frankly, even if the Tuesday “deadline” comes and goes, there is absolutely no reason to believe that they won’t keep trying to keep these stupid negotiations going on right up until Election Day itself.