Kathy Lien is the Managing Director of FX Strategy for BK Asset Management.

- Will the ECB Drive Euro to New Lows?

- Dollar Unfazed by Drop in U.S. Yields

- GBP: Why the August BoE Meeting is So Important

- AUD Trading Higher Ahead of Employment, Gold Prices Helping

- CAD Largest Trade Surplus Since December 2011

- NZD: Disappointing Labor Data will Keep RBNZ On Hold Until 2015

- USD/JPY Should be Trading Lower

Will the ECB Drive Euro to New Lows?

The euro ended the day unchanged against the U.S. dollar EUR/USD but not before dropping to a fresh 8-month low during the European trading session on the back of weaker economic data. Considering that speculative short positions hit a 20-month high last week, we suspect the rebound was driven by profit taking and position squaring ahead of Thursday’s European Central Bank monetary policy announcement. The ECB is widely expected to leave monetary policy unchanged but even when no changes are made, Mario Draghi’s press conference can trigger a big reaction in EUR/USD but only if the central bank sounds slightly more optimistic or slightly more dovish. Last month is a poor example because even though the EUR/USD collapsed after the rate decision (nothing new was revealed), the move was driven primarily by dollar strength and not euro weakness. That month, the dollar soared after non-farm payrolls grew 288k and the unemployment rate dropped to 6.1%.

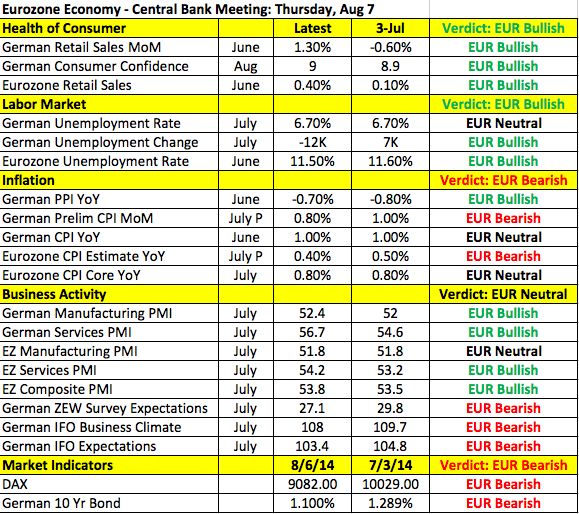

At the last meeting, Mario Draghi left the door open for additional easing but having just announced a series of measures in June, the chance of additional stimulus was slim. Only 2 months have past since that meeting so it is too early to expect the central bank to commit to more support for the economy especially as there have been both improvements and deterioration in economic activity since the last meeting. German factory orders plunged in the month of June along with the Retail PMI index in July but the following table shows that in Germany, consumer confidence is on the rise, retail sales rose strongly in June, labor market conditions improved while manufacturing and service sector activity grew at a faster pace. Investor and business confidence has fallen but that is not surprising given the geopolitical uncertainty. For the region as a whole, economic activity also accelerated but inflation remains low. Based on CPI alone the central bank needs to increase stimulus but the recent sell-off in EUR/USD and the record low hit by German Germany 10-Year bond yields Wednesday does some of the work for the ECB. The bottom line is that we don’t expect the ECB rate decision to hurt the euro much because there has not been enough deterioration to warrant a change of tone from the central bank. However the ECB will still maintain a dovish tone because of recent troubles in the banking sector and low inflation.

Dollar Unfazed by Drop in U.S. Yields

The U.S. dollar has been seemingly unfazed by the recent decline in U.S. yields. While 10-Year Treasury yields dropped below 2.5%, the dollar index rose to its strongest level in 10 months intraday. The divergence led many investors to wonder if this is a precursor to a bottom in yields and unfortunately we don’t think that is the case. The decline in the dollar is best looked at as a rise in Treasury prices because the demand for Treasuries and for the greenback represents a flight to quality. Investors are nervous about geopolitical tensions and weary of slower growth in Europe. Russia is amassing troops near Ukraine’s border and preparing a response to U.S. and EU sanctions. This uncertainty has driven yields lower even after Fed President Fisher, who is a voting member of the FOMC this year said he did not dissent at the last FOMC meeting because other Fed officials are coming in his direction. As one of the more hawkish members of the central bank, this can only mean that policymakers are opening to the idea of signaling plans to tighten monetary policy in late 2014 or early 2015. Wednesday morning’s narrower trade deficit also had very little impact on the dollar. USD/JPY ended the North American trading session at approximately the same price as its pre-trade level while the EUR/USD ended slightly higher. Thursday’s weekly jobless claims report should show continued improvement in the U.S. labor conditions.

GBP: Why the August BoE Meeting is So Important

After a two-day relief rally, the British pound resumed its slide against the U.S. dollar. As we warned in Tuesday’s note, the rest of this week’s U.K. economic reports will not be kind to sterling. While the service sector continues to grow, the manufacturing sector is struggling. This morning’s industrial and manufacturing production reports confirm that output is weakening and unfortunately we expect the same loss of momentum in trade activity (due on Friday). This highlights the challenge for the Bank of England who will make a monetary policy announcement Thursday. Since the size of their Quantitative Easing program and interest rates are expected to remain unchanged, it should be a nonevent for sterling. However, the August meeting is an important one because the central forecasts, which will be included in the Quarterly Inflation Report next week will be discussed. There’s a growing belief that certain members of the monetary policy committee will push and possibly even vote for earlier tightening. The manufacturing sector is losing momentum and wage growth has been soft but spare capacity within companies is declining. Some policymakers believe that it would be prudent to raise rates early to ensure that the process is smooth and gradual. Earlier this week, the Shadow Monetary Policy Committee said the central bank should raise rates immediately and while there’s zero chance of a rate hike in August, there’s definitely more hawkish chatter that could make its way into next week’s Inflation Report. Of course, we will get none of that Thursday but it is important to think ahead.

AUD Trading Higher Ahead of Employment, Gold Prices Helping

All three of the commodity currencies traded higher against the greenback Wednesday. AUD was supported by the rise in Gold prices but traders are also positioning for a stronger employment report. According to the Performance Indices, the manufacturing sector saw stabilization in the labor market with the employment sub-index rising 4.7 points to 50.2. This is the first reading above 50 in 7 months and represents a sign of gradual improvement in labor market conditions. While service sector activity slowed in July, the employment sub-index also rose 1.3 points to 47.7 and taken together, these reports suggests that we should see a mild uptick in job growth. The Australian economy in general seems to be holding up well thanks in large part to the recovery in China. Reports that government stimulus and resurgent demand for Chinese exports is paving the way for a summer rebound is also positive for Australia’s economy. Stronger job growth should drive AUD/USD above 0.9350 while weaker numbers could drive it towards 0.9250. Meanwhile the Canadian dollar received a boost from stronger trade data. The country’s trade surplus rose to C$1.86 billion, the highest level since December 2011. May numbers were also revised up to a surplus of 0.58 billion from a deficit of -0.15 billion. Exports rose 1.1% while imports fell 1.8%. If the rest of this week’s economic reports also beat expectations, the rally in USD/CAD should come to an end. The IVEY PMI index is scheduled for release on Thursday followed by the Canadian employment report on Friday. The New Zealand dollar enjoyed a late recovery after having fallen to a fresh 7-week low on the back of a disappointing labor market report Tuesday night. While the unemployment rate dropped to 5.6% from 5.9%, employment rose by a mere 0.4% in the second quarter versus 0.9% in the first quarter. The participation rate also dropped to 68.9% from 69.2% and average hourly earnings growth slowed to 0.5% from 0.7%. This means the main reason for the improvement in the unemployment rate is the drop in participation, which the Reserve Bank will not see as a positive shift in New Zealand’s economy. Between the drop in dairy prices and softer labor market conditions, we are almost certain that the RBNZ will leave rates unchanged for the rest of the year.

USD/JPY Should be Trading Lower

With the Nikkei falling another 1% and 10-year U.S. Treasury yields closing in on its May low of 2.44% USD/JPY should be trading on the 101 and the not 102 handle. The last time yields were this low was on July 17th when USD/JPY hit a low of 101.13 and on May 28th when USD/JPY was trading near 101.80. While we are not far from those levels, they are much closer to the bottom than the top of the currency pair’s recent range. Whenever USD/JPY decouples from U.S. yields, the break in the correlation does not last for long and in this case, we believe that USD/JPY is due for a correction because the Fed is not expected to provide any fresh insight into their monetary policy plans for another 2 weeks at the earliest. Even though U.S. stocks avoided steep losses, the risk aversion caused by the sell-off in European and Asian equities drove the Japanese Yen higher against all of the major currencies. Although both the leading and coincident indices rose in the month of June, the market ignored the news. The Ministry of Finance’s portfolio flow report was scheduled for release Wednesday evening and like the leading index, it was not expected to have a meaningful impact on the Japanese Yen.