As the Dow is quickly approaching the 25,000 level, some might find it hard to remember that in the very near past, it traded sideways for 21 months.

The question is, why didn't the index make any progress for more than a year and half? Part of the reason could be a key Fibonacci extension level.

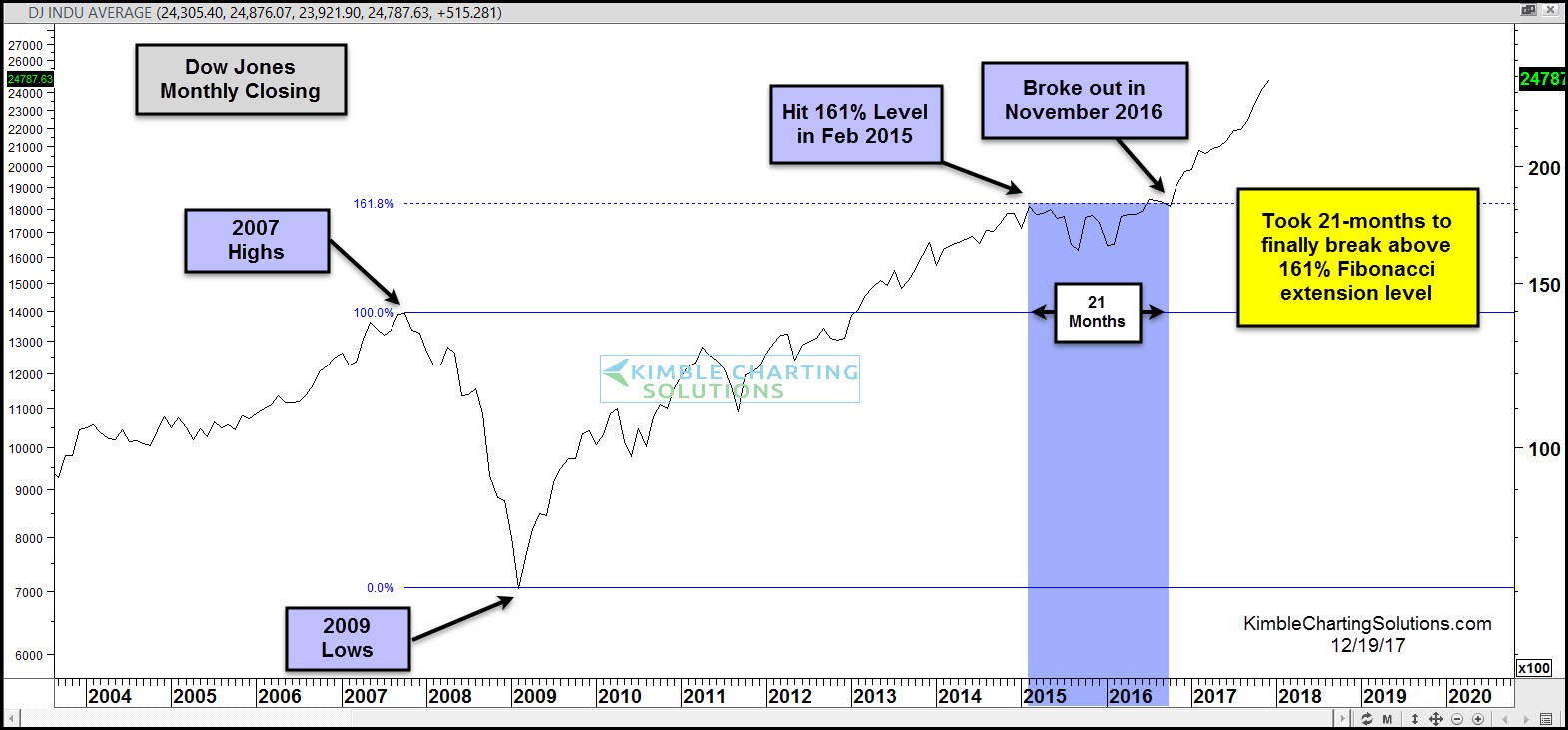

Below looks at the Dow Jones Industrial index over the past 13 years, where the Power of the Pattern applied Fibonacci Extension levels to the weekly closing highs in 2007 and weekly closing lows in 2009.

If you had applied a Fibonacci extension level to the Dow at the 2009 lows, it would have suggested that if the Dow broke above the 2007 highs, it might find the 18,000 zone as a form of resistance in the future. In February of 2015, the Dow hit this level for the first time, then proceeded to chop sideways for the next 21 months. It took nearly a year and a half to finally break above the 161% level, which took place near last year's election (November 2016).

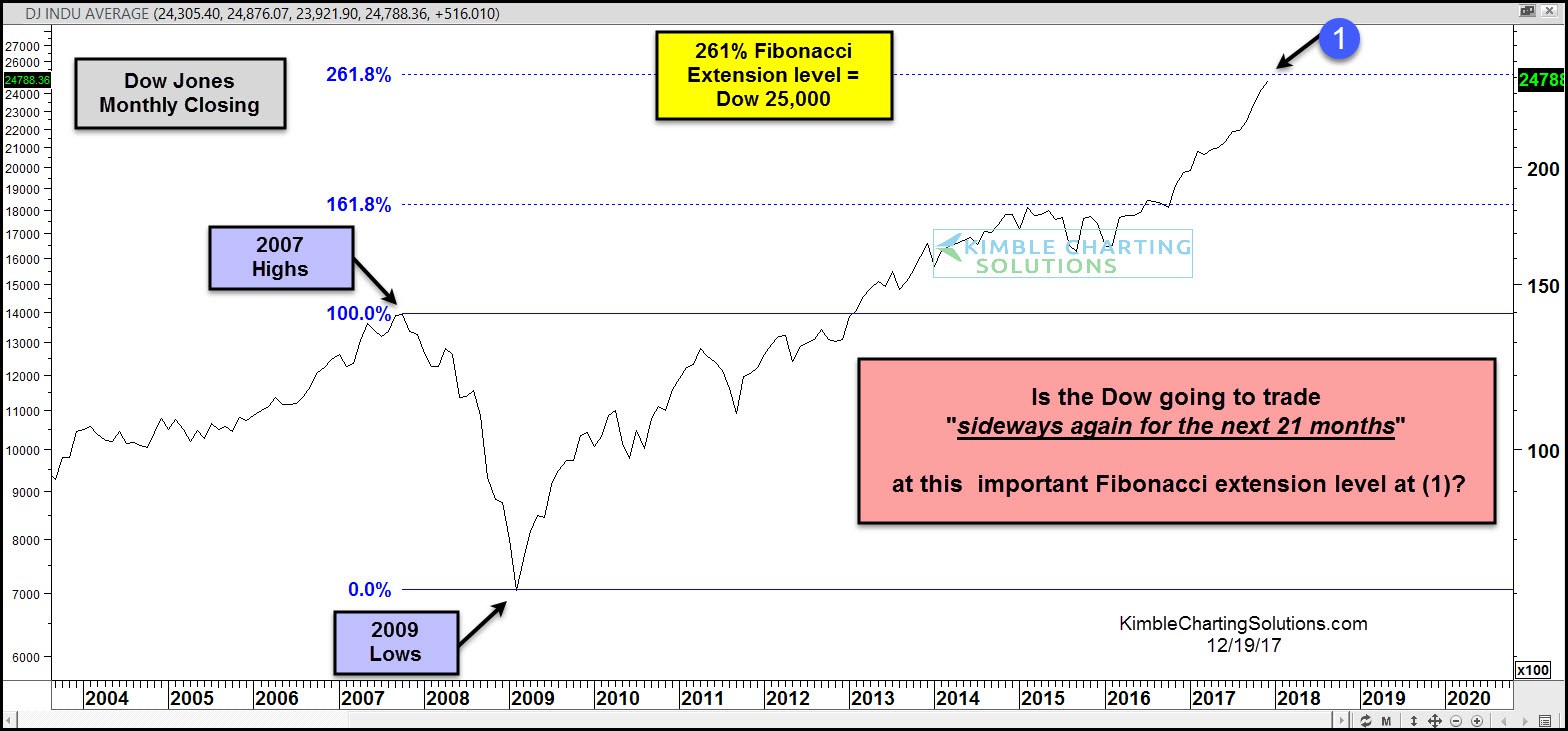

Below looks at an update of the Dow with the next Fibonacci extension level (261%) applied.

The sharp rally since last November now has the Dow quickly approaching the Fibonacci 261% Extension level, which comes into play at the 25,000 zone at (1) above.

Will this key extension level based on the 2007 highs and 2009 lows cause the Dow to trade sideways for another 21 months? I doubt that many thought the 161% level would become a resistance zone for the Dow at the time and it is understandable to question if the Dow will find the 261% level as resistance as well.

No doubt, the trend is up and the Advance/Decline line shows NO signs of slowing at this time. Remember that this move took place at the 161% level and we could be within a couple of percent of another key extension level right now.

We will see over the next few months if this time is different.