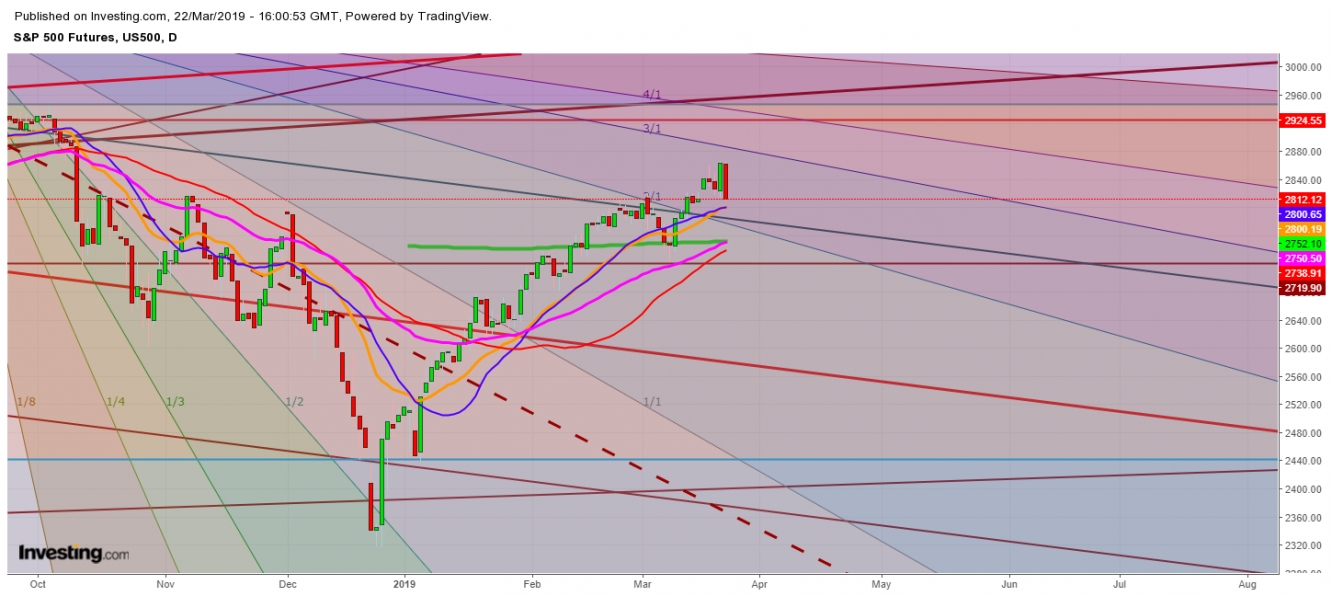

On analysis of the movements of S&P 500 on Friday amid growing fear of global slowdown concerns, I find this Wall Street fall may result in a chain reaction, which is likely to continue amid plethora of further reports to dig out the real reason behind this steep fall. It my be from a decline in the European manufacturing sector and from after effects of tariff trade war tussle between the U.S. and China. But one reality will remain in place; and that is the advent of a global equity-market-crash in 2019. I tried to analyze the primary indicators well in advance in my last analysis on March 17th, 2019, but all primary symptoms look to be in the right place.

Watch my commentary on global equity-markets crash of 2019.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.