The last year we saw the kind of correction we had in the 4th quarter of 2018 was in 2016, with the S&P 500 bottoming in Q1 ’16. Here is the chronology of S&P 500 earnings growth by quarter in 2016:

- Q4 ’16: +7.8%

- Q3 ’16: +4.3%

- Q2 ’16: -2.1%

- Q1 ’16: -5%

Here is the progression of S&P 500 revenue growth in 2016:

- Q4 ’16: +4.2%

- Q3 ’16: +2.6%

- Q2 ’16: -0.3%

- Q1 ’16: -1.7%

(Source for both internal spreadsheet with data from IBES by Refinitiv)

In 2016, we had the first Brexit vote in the summer of 2016, and then the surprise election of President Trump in the fall of 2016, neither of which will repeat this year.

When looking at forward quarter’s earnings estimate growth for 2019, the 4th quarter is looking particularly strong:

- Q4 ’19: +9.3%

- Q3 ’19: +2.9%

- Q2 ’19: +3.2%

- Q1 ’19: -1.1%

What’s interesting if you look at the “This Week in Earnings” data from IBES by Refinitiv, which is the source of a lot of this blog’s data, is that the 4th quarter expected S&P 500 earnings growth isn’t seeing the kind of negative revisions that are typical at this time of year for forward quarters.

Here is the progression pr change in the Q4 ’19 expected S&P 500 earnings growth the last 5 weeks:

- 3/1/19: +9.3%

- 2/22/19: +9.7%

- 2/15/19: +9.7%

- 2/18/19: +9.2%

- 2/1/19: +10.2%

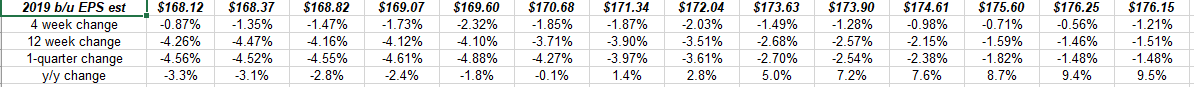

Here is another little tidbit picked up from the spreadsheet this week: since the 4-week change in the S&P 500 2019 EPS estimate seems to have played a particularly coincidental role with the top in the S&P 500 in September ’18, this week “4-week change” was the smallest decline in that metric since since December 14 ’18:

Summary / conclusion: There is some decent evidence that there is a bottoming happening in expected 2019 S&P 500 earnings but like 2016, it might take more time to play out. The 4th quarter of 2019 is looking particularly healthy, especially for the Financial sector, which usually implies that the capital markets will be healthy in Q4 ’19, which will also be lapping the 4th quarter of 2018 at that point.

To answer the headline question, “yes, I think we do see an improvement S&P 500 earnings growth as we move through 2019.”