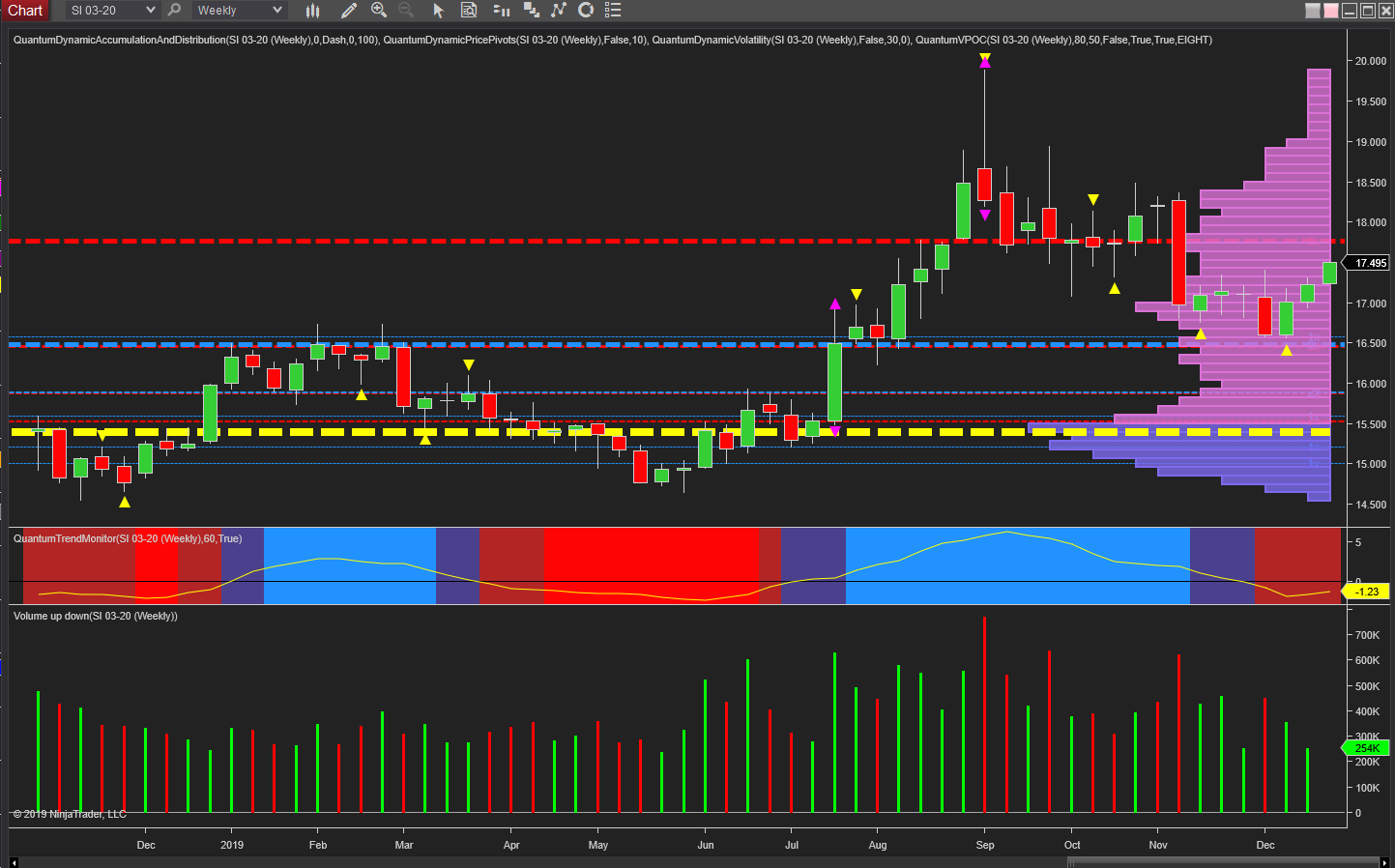

Let’s now turn our attention to the precious metals, and rather than consider gold, move to silver which has had a roller coaster year, but is managing to close the year higher. The defining price action here was executed in the summer months, with the industrial metal climbing fast over several weeks only for the price action in early September to bring the move to a shuddering halt with a cluster of signals of weakness combining at this point.

First we had the candle itself with a deep wick to the upper body and on its own, signaling strong selling and therefore weakness ahead. This was confirmed by associated volume which was the highest of the year by some distance and so reinforcing the strength of selling during this week. The volatility indicator was also triggered in this timeframe – an unusual occurrence on a slower timeframe chart and signalling congestion or a reversal as a result.

The indicator considers average true range and is triggered when price action moves outside this range. And finally we had a pivot high (yellow triangle) posted on this candle adding further to the expected weakness which duly arrived driving the metal lower, before the minor rally we are currently witnessing in December. So, where next for silver, and by extension gold?

For silver, and from a technical perspective, there are two key levels. One above and one below the current price of $17.47 per ounce. Below at $16.50 per ounce, we have a cluster of two support levels, one blue and one red. Whilst individually they are relatively weak, together as a cluster they offer a strong platform of support and one which already came into play in late November and early December with the two bar reversal.

An excellent springboard is therefore in place. However, above we have resistance ahead at $17.70 per ounce and denoted with the red dashed line of the accumulation and distribution indicator. Still, this is relatively light, and assuming we see good volume in the new year, coupled with a falling U.S. dollar, this may help to propel the metal higher, on towards $18.50 per ounce, with the potential to move to the highs of this year of $19.89 per ounce given the light volume awaiting on the volume point of control histogram.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI