-

With over 90% of companies having reported Q2 earnings, S&P 500® EPS growth stands at 10.8%

-

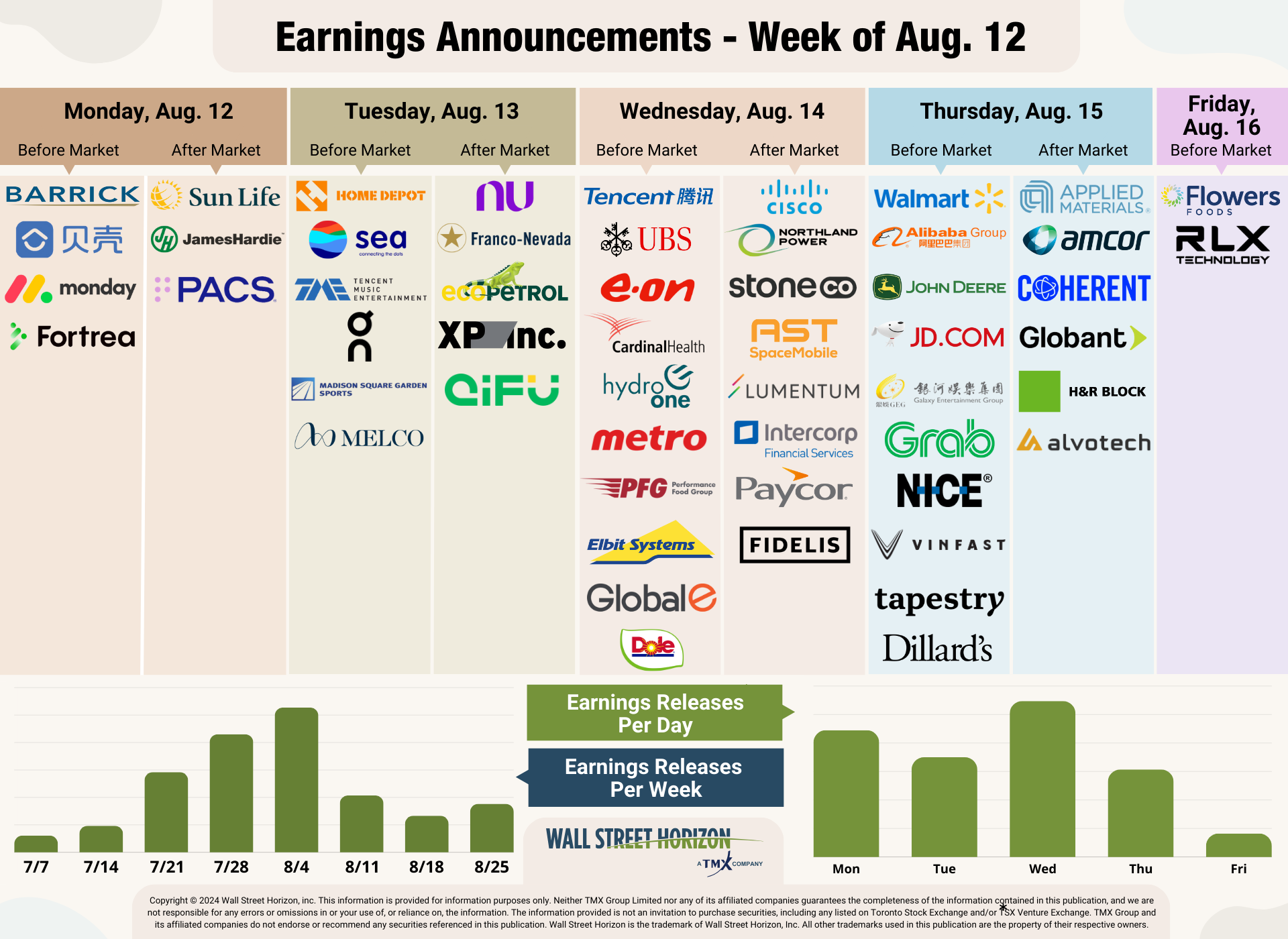

The retail earnings parade kicks off this week with results from Walmart, Home Depot, Tapestry and Dillard’s

- Outlier earnings for the remainder of the season: Agilent Technologies, Bath & Body Works, AutoDesk

Last week started with the biggest market sell-off for the S&P 500 and DJIA in two years and then continued with a 4-day rally which brought indexes back to their best trading day in two years. Rising initial jobless claims which contributed to the Monday sell-off showed improvement on Thursday, coming in at 233,000, a decline of 17,000 from the prior week.

We also saw some decent earnings reports on the consumer front, with results from Costco (NASDAQ:COST), Restaurant Brands (NYSE:QSR) and Under Armour (NYSE:UA) all coming in better-than-expected.

But to that end, a new report by TransUnion found that the average credit card balance in the US is now $6,329, up nearly 5% from last year. The story remains that the consumer may be stretched, and this week we’ll get results from Walmart (NYSE:WMT) and Home Depot (NYSE:HD) for a closer read on the consumer.

With 91% of S&P 500 companies having reported earnings results for Q2, the current blended EPS growth rate is 10.8%, according to FactSet, a decrease from 11.5% in the week prior. Thus far 78% of companies that have reported have surpassed analyst profit estimates, while only 59% have beaten on revenues.

CEO Uncertainty Remains High as Q2 Earnings Season Comes to a Close

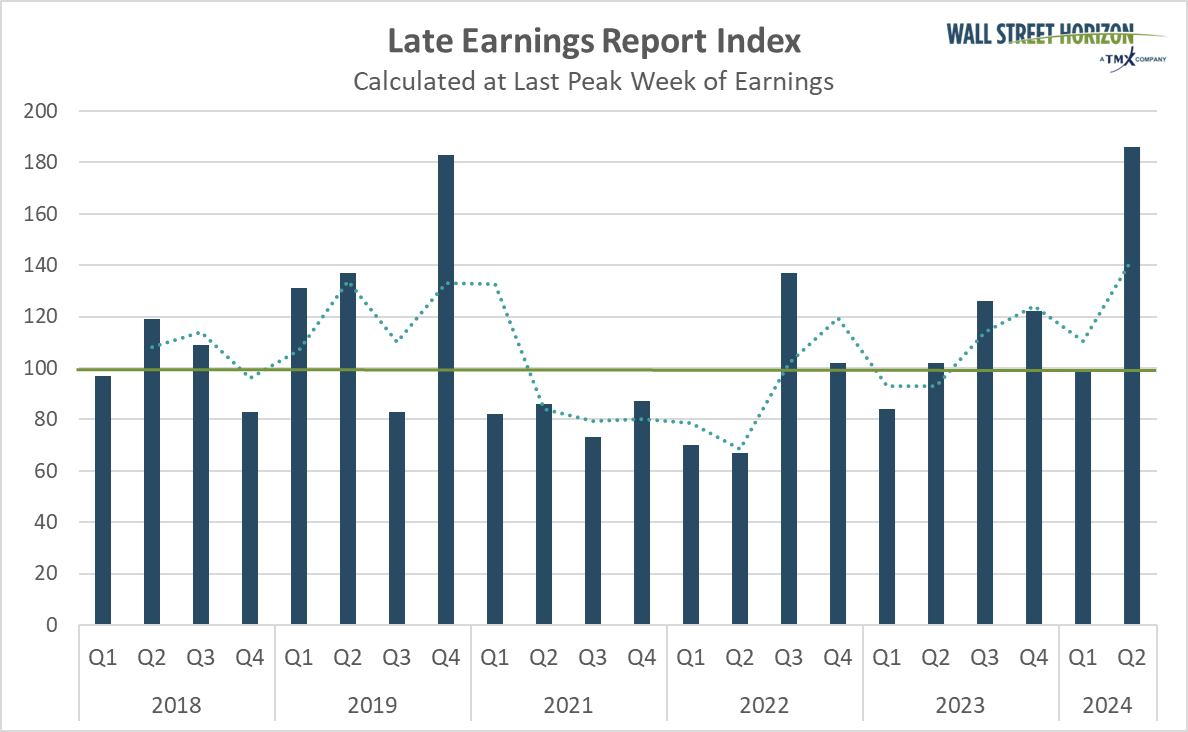

After falling to its lowest level in its nine years of existence for the Q4 earnings season, the Late Earnings Report Index, our proprietary measure of CEO uncertainty, ticked back up during the Q1 earnings season, and then moved even higher for the Q2 season that is just wrapping up.

The LERI tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The official post-peak season LERI reading for the Q2 reporting season (data collected in Q3) stands at 186, well above the baseline reading, suggesting companies continue to feel less certain about economic conditions than they did at the beginning of the year. As of August 9, 2024 there were 151 late outliers and 73 early outliers.

Source: Wall Street Horizon

Retail Parade on Deck

This week begins what’s often referred to as the retail earnings parade portion of the reporting season. We’ve already heard from some consumer-focused companies, specifically restaurants, and consumer staples, which showed consumer spending continues to cool and that shoppers are more discerning and value-driven. Add to that a softening labor scenario, with unemployment rising to 4.3% in July, the highest level since 2021.

This week the retail party gets started with results from Home Depot (HD), Walmart (WMT), Tapestry (NYSE:TPR) and Dillard’s (DDS).

Source: Wall Street Horizon

Outlier Earnings Dates for the Remainder of the Q2 Season

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.

For the remainder of the Q2 earnings season there are only three S&P 500 companies with confirmed outlier earnings dates, all of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Agilent Technologies (NYSE:A), Bath & Body Works (BBWI), and Autodesk (NASDAQ:ADSK).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Agilent Technologies (A)

- Company Confirmed Report Date: Wednesday, August 21, AMC

- Projected Report Date (based on historical data): Tuesday, August 13, AMC

- DateBreaks Factor: -3*

Agilent is set to report their FQ3 2024 results on Wednesday, August 21, over a week later than expected, later than usual, and the latest they’ve ever reported for the quarter. This also appears to be their first Wednesday report since 2019, favoring Tuesday reports for the last four years.

After benefiting from an increase in demand following the COVID-19 pandemic, medtech company, Agilent, has been dealing with a multi-month slowdown in orders of their laboratory supplies and equipment. Earnings growth has been declining since Q4 2023, and revenue growth since Q3 2023. The company announced in June they were laying off 3% of their staff, that’s on top of the layoffs they announced at the end of 2023.

Bath & Body Works (BBWI)

- Company Confirmed Report Date: Wednesday, August 28, BMO

- Projected Report Date (based on historical data): Wednesday, August 21, BMO

- DateBreaks Factor: -2*

Bath & Body Works (NYSE:BBWI) is set to report Q2 2024 results on Wednesday, August 28, a week later than anticipated. This also pushed results into the 35th week of the year, while for the last decade they have always reported Q2 results on the Wednesday of the 34th week of the year. This would be the latest Q2 report ever for BBWI.

A slowdown in consumer spending may not bode well for discretionary retailers such as Bath & Body Works, the last two quarters have seen no revenue growth, while impressive bottom-line growth continues. However, that could be coming to an end. According to data from FactSet, the sell-side is expecting an EPS drop of 10% for BBWI in Q2.

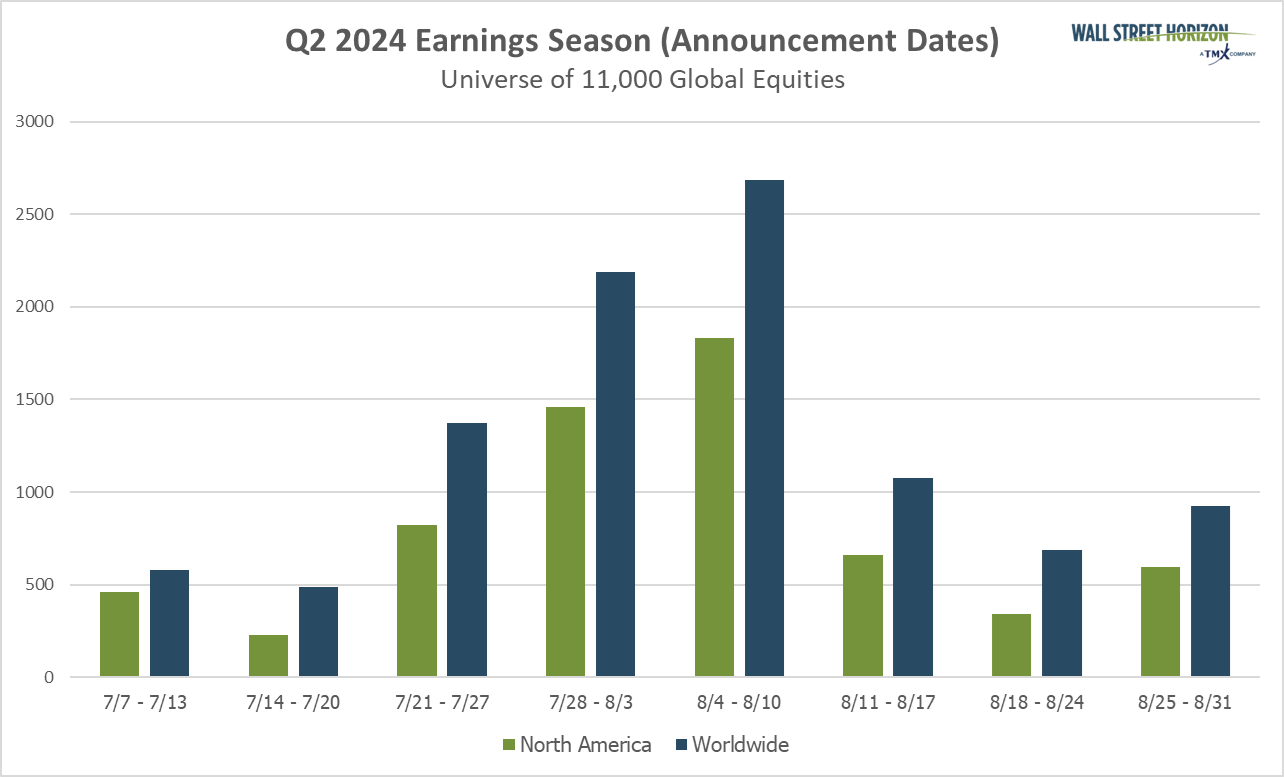

Q2 Earnings Wave

The Q2 2024 earnings season will continue to thin out from here, with only 1,681 companies expected to report this week. Thus far 61% of companies from our universe of 11,000 have reported results.

Source: Wall Street Horizon