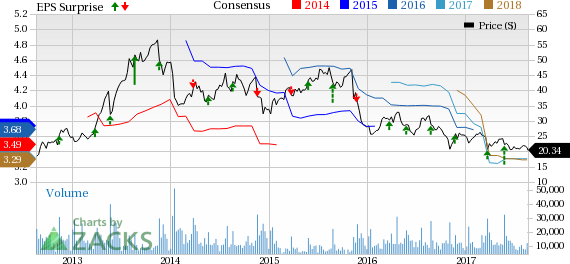

GameStop Corp. (NYSE:GME) is slated to report second-quarter fiscal 2017 results on Aug 24, after the closing bell. In the preceding quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 28.6%.

Notably, the company surpassed the Zacks Consensus Estimate with a positive earnings surprise of 10.2% in the trailing four quarters. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question lingering in investors’ minds now is whether GameStop will be able to post positive earnings surprise in the quarter to be reported. The current Zacks Consensus Estimate for the quarter under review is 15 cents, compared with a year-ago earnings of 27 cents. We note that the Zacks Consensus Estimate has been stable in the past 30 days. Analysts polled by Zacks expect revenues of $1,620 million, compared with $1,632 million reported in the prior-year quarter.

We note that the stock has underperformed the industry in the past three months. The company’s shares have declined 11.7%, while the industry has gained 13.7%.

Factors at Play

We expect GameStop to report positive earnings surprise on account of sturdy performance of Technology Brands and Collectibles. The company’s foray into the collectibles and licensed merchandising category, along with Technology Brands has been profitable. During the fiscal first quarter, the collectibles business sales surged 39.1% to $114.5 million driven by robust sales of Pokémon-related products. The company added nine Collectibles stores during the quarter, taking the total count to 95 stores. GameStop expects to enhance collectibles business to approximately $650-$700 million during fiscal 2017.

However, the company earnings is likely to witness a year-over-year decline as challenging retail landscape, aggressive promotional strategies, waning store traffic and delay in launch of "Red Dead Redemption: 2" and less visibility for the demand of Nintendo Switch for the entire year is a cause of concern. We note that the company’s bottom-line continues to decline year over year. Earnings per share had declined 2.9%, 12.9%, 9.3% and 0.8% in the first, second, third and fourth quarters of fiscal 2016. In first-quarter fiscal 2017, it declined 4.5%.

What the Zacks Model Unveils?

Our proven model shows that GameStop is likely to beat earnings estimates this quarter. A stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. GameStop’s Earnings ESP of +0.31% and a Zacks Rank #3 make us reasonably confident of an earnings beat. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +3.23% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots, Inc. (NYSE:BIG) has an Earnings ESP of +0.72% and a Zacks Rank #2.

Lowe's Companies, Inc. (NYSE:LOW) has an Earnings ESP of +0.23% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Gamestop Corporation (GME): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research