The matter of Janet Yellen’s succession has been troubling experts and individual investors alike over the past few weeks. With President Trump nearly certain to nominate Fed governor Jerome Powell as the central bank’s next Chairman, it is important to consider what his approach toward heading this crucial institution would be like.

Such considerations gain greater importance when you reckon that he is an outsider of sorts, yet largely likely to follow in Yellen’s footsteps on policy matters.

Powell Likely to Continue on Yellen’s Path

An establishment insider for an extended period and a lawyer by training, Powell would be the first Fed Chair since the legendary Paul Volcker not to possess a doctorate in economics. However, he tends to focus on the details, having the reputation of walking into meetings with a mass of material.

The former under-secretary has also had the opportunity to oversee all of the Fed’s 12 regional banks. Such vast administrative experience will stand him in good stead when he takes over the most coveted job in the world of economics.

Powell is largely expected to stick to the policy path which Yellen has taken. Though he has not taken on a very public role during his tenure at the Fed, he has largely backed Yellen’s strategy of gradually raising rates. This is the approach that he is likely to maintain as the Fed Chair.

Predictable but Good for Business?

And yet, market watchers and industry experts at large believe that he will be good for the United States’ business environment. His predilection for deregulation has been known for some time now with Powell often emerging as the only voice opposing excessive regulation. Powell has stressed on several occasions that excessive regulations, however well intentioned, may end up preventing the economy from achieving its full potential.

So the former private equity executive will likely emerge as a voice of moderation given Trump’s continuous assaults on allegedly burdensome regulations holding back much needed credit flow. What is likely to ultimately emerge is a Fed Chair who sticks to Yellen’s path on monetary stimulus yet loosens banking regulations.

In fact one criticism of Powell is that he has more experience on regulation than on monetary policy. But this could actually work to his advantage in the Trump era where regulations are viewed as an unnecessary encumbrance to progress. In the past Powell has said that he is in favor of making changes to regulations. Such an approach is likely to favor financial stocks, in particular, banks.

Bank Stocks to Watch

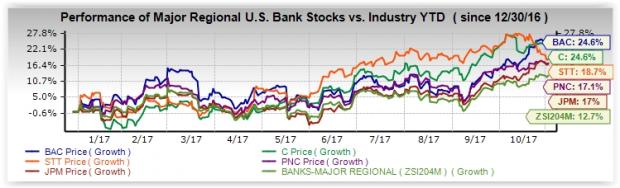

With Trump already having taken several steps to loosen regulations, the appointment of Powell could be another shot in the arm for the financial industry. The banking sector has turned in strong performance this year, as is visible from the gains made by several key sectoral indexes. The bBanking sector benchmark, KBW Nasdaq Index, has gained 10.8% year to date.

Meanwhile, the Zacks Major Regional Banks industry has gained 12.7% over the same period. Below we examine the third quarter earnings performance of some of the largest U.S. banking stocks which investors are likely to focus on in such a scenario.

Bank of America Corporation (NYSE:BAC) (NYSE:C) reported third-quarter 2017 earnings of 48 cents per share, which outpaced the Zacks Consensus Estimate of 46 cents on Oct 13. The figure was 17% higher than the prior-year quarter. The Zacks Rank #3 (Hold) stock has gained 24.6% year to date.

Citigroup Inc. (NYSE:C) delivered a positive earnings surprise of 7.6% in third-quarter 2017 on Oct 12, on prudent expense management. Earnings per share of $1.42 for the quarter easily outpaced the Zacks Consensus Estimate of $1.32. The Zacks Rank #3 stock has also gained 24.6% year to date.

State Street Corporation (NYSE:STT) posted third-quarter 2017 operating earnings of $1.71 per share, which handily outpaced the Zacks Consensus Estimate of $1.61 on Oct 23. Also, the figure was up 26.7% year over year. The Zacks Rank #3 stock has gained 18.7% year to date.

The PNC Financial Services Group, Inc. (NYSE:PNC) reported a positive earnings surprise of 1.4% in third-quarter 2017. Earnings per share of $2.16 beat the Zacks Consensus Estimate of $2.13. PNC Financial has gained 17.1% year to date. The stock has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

JPMorgan Chase & Co. (NYSE:JPM) reported third-quarter 2017 earnings of $1.76 per share, which easily surpassed the Zacks Consensus Estimate of $1.67. Also, the figure reflects an 11% rise from the year-ago period. The Zacks Rank #3 stock has gained 17% year to date.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

PNC Financial Services Group, Inc. (The) (PNC): Free Stock Analysis Report

State Street Corporation (STT): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Original post

Zacks Investment Research