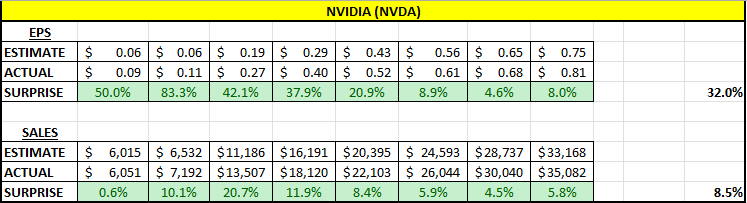

Nvidia (NASDAQ:NVDA) reported another stellar quarter, beating sales and earnings estimates. The company reported EPS of $0.81 (growth of 101% over last year), on sales of $35 billion (growth of 94% over last year).

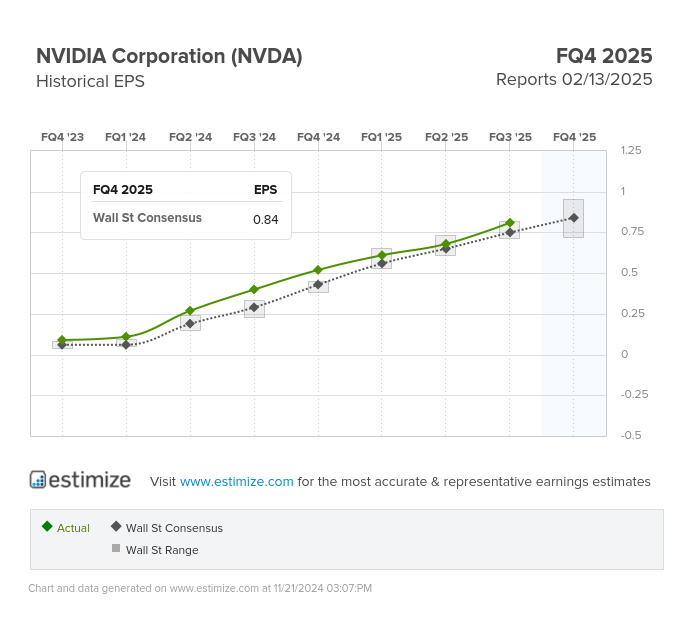

This blog has been all over Nvidia for years, when the stock price was still in the teens on a split-adjusted basis. They’ve been beating both sales and earnings estimates for quite awhile. But the last 3 quarters have seen a reversion to the mean.

Earnings for the last 3 quarters have beaten estimates by 8.9%, 4.6%, and 8.0% respectively (below the 8 QTR average of 32%), while sales have beaten estimates by 5.9%, 4.5%, and 5.8% during that same time frame (below the 8 quarter average of 8.5%).

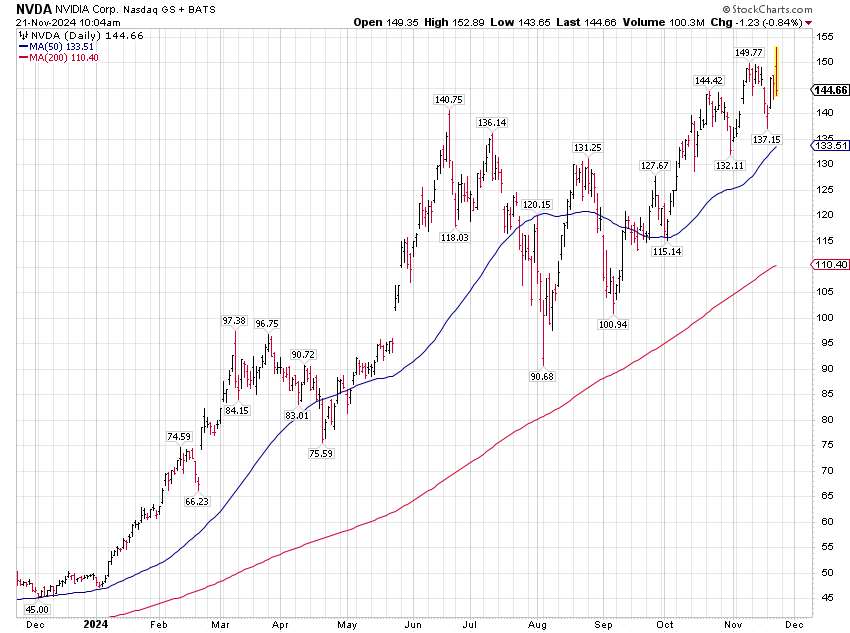

A reversion to the mean is to be expected, as a company can’t keep beating estimates by 50% to 80% forever. But this may explain the relatively muted stock price reaction compared to the recent past. Still, the stock is +195% this year after being up +240% last year. These type of price movements, especially with a $3 trillion company, are obviously quite rare.

So where do we go from here? Currently, the market is pricing in about 50% EPS growth and 55% sales growth over the next 4 quarters. While the price-to-earnings ratio on the forward 4 quarters estimates are a reasonable 37x. Compare this to the S&P 500, whose forward PE is 22.3x but on a growth rate of 11%. Meaning, even with this parabolic move in the stock, the price is not outrageous. As Nvidia’s expected EPS growth rate is almost 5x the market average.

But another way to look at it is the market has priced in so pretty lofty expectations (50-55% growth). This would explain the “beat rate” starting to come back to earth. The uptrend remains in tact for now. Watching the $135 area for potential support in the short term. But I wouldn’t even consider adding the position unless we got around the $120 level. The stock has experienced 2 separate 22% declines since the 2022 lows. From current levels, the $120 area would match those prior declines, coupled with the 200-day moving average, it could provide some confluence.

Historically, periods of outperformance tend to be followed by periods of underperformance. Don’t be surprised to see Nvidia (NVDA) consolidate some these monumental price gains in the future. But the company remains one of the best run companies in the most important industries of the future.