Per an analyst with Piper Jaffray, Netflix Inc (NASDAQ:NFLX) could have more than 160 million subscribers overall with 100 million internationally by 2020.

Citing Google (NASDAQ:GOOGL) search data analysis, analyst Michael Olson, as quoted by CNBC, stated that search trends show that Netflix is likely to witness domestic and international growth of 16.2% and 78.3%, respectively. The data, even if is overstated, indicates that the company's subscription growth is heading in the right direction.

Olsen estimates 42% and 10.9% increase in domestic and international subscribers, respectively in the third quarter of 2017. He further added that Netflix is well positioned to gain over 164 million users globally by 2020.

"Our 2020 year-end subscriber estimate of 164 million worldwide assumes 64 percent domestic and 19 percent international share of broadband subscribers (excludes China from addressable base). While this level of penetration (domestically) is higher than most comparative subscription entertainment products, we believe the content/value ratio offered by Netflix is, and will continue to be, higher than other relevant comparative offerings”, added the analyst.

Original Content Drives International Expansion

Netflix has been drawing strength from its growing portfolio of original content. This apart, it remains focused on international expansion as it battles maturing domestic subscriber growth.

In the last reported quarter, crediting “our amazing content”, Netflix added 5.2 million subscribers, much more than the expected 3.2 million. Netflix said it added 4.14 million net new additions overseas, taking the total international user base to 52 million in the quarter.The company remains confident of adding more and more subscribers as the trend of binge viewing catches up fast. Netflix has over 104 million subscribers globally.

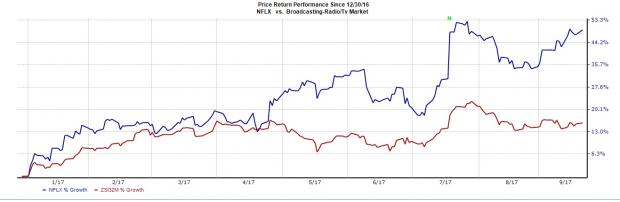

Given this, shares have displayed a solid run at the bourses this year. Shares of Netflix have gained 49.2% year to date, significantly outperforming the industry’s15.8% rally.

The company has been doing really well in North America, Latin America and Europe. Although it is expanding in India and Japan, it has a lot of room for expansion in other Asian markets too. In order to grow in the Asian market, which has very good prospects, the company needs to expand regional programming.

The company has a whopping budget of $6 billion (2017) and $7 billion (2018) for original content. Such enormous spending can dent the company’s profitabilityin the near term but we believe that Netflix’s expanding international content portfolio will rapidly drive subscriber growth. This will further boost the stock in the rest of 2017.

Also, it needs to maintain such sky high budgets to fend off competition from other established players like Amazon (NASDAQ:AMZN) Prime, Hulu and Time Warner’s HBO. Reportedly, Amazon will be spending $4.5 billion on content this year. Tech giant Apple (NASDAQ:AAPL) and social networking giant Facebook (NASDAQ:FB) also plan to invest $1 billion each in original content over the next year.

Zacks Rank

Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Promising Stock Picks to Keep an Eye On

With news stories about computer hacking and identity theft becoming increasingly commonplace, the cybersecurity industry looks like a promising investment opportunity. But which stocks should you buy? Zacks just released Cybersecurity: An Investor’s Guide to Locking Down Profits to help answer this question.

This new Special Report gives you the information you need to make well-informed investment choices in this space. More importantly, it also highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research