To answer the question in the title: No. Nothing goes up forever. It may seem so, but that is often because our emotions take over replacing reason and rational thinking. So, spoiler alert: Get ready for a bigger correction.

Why?

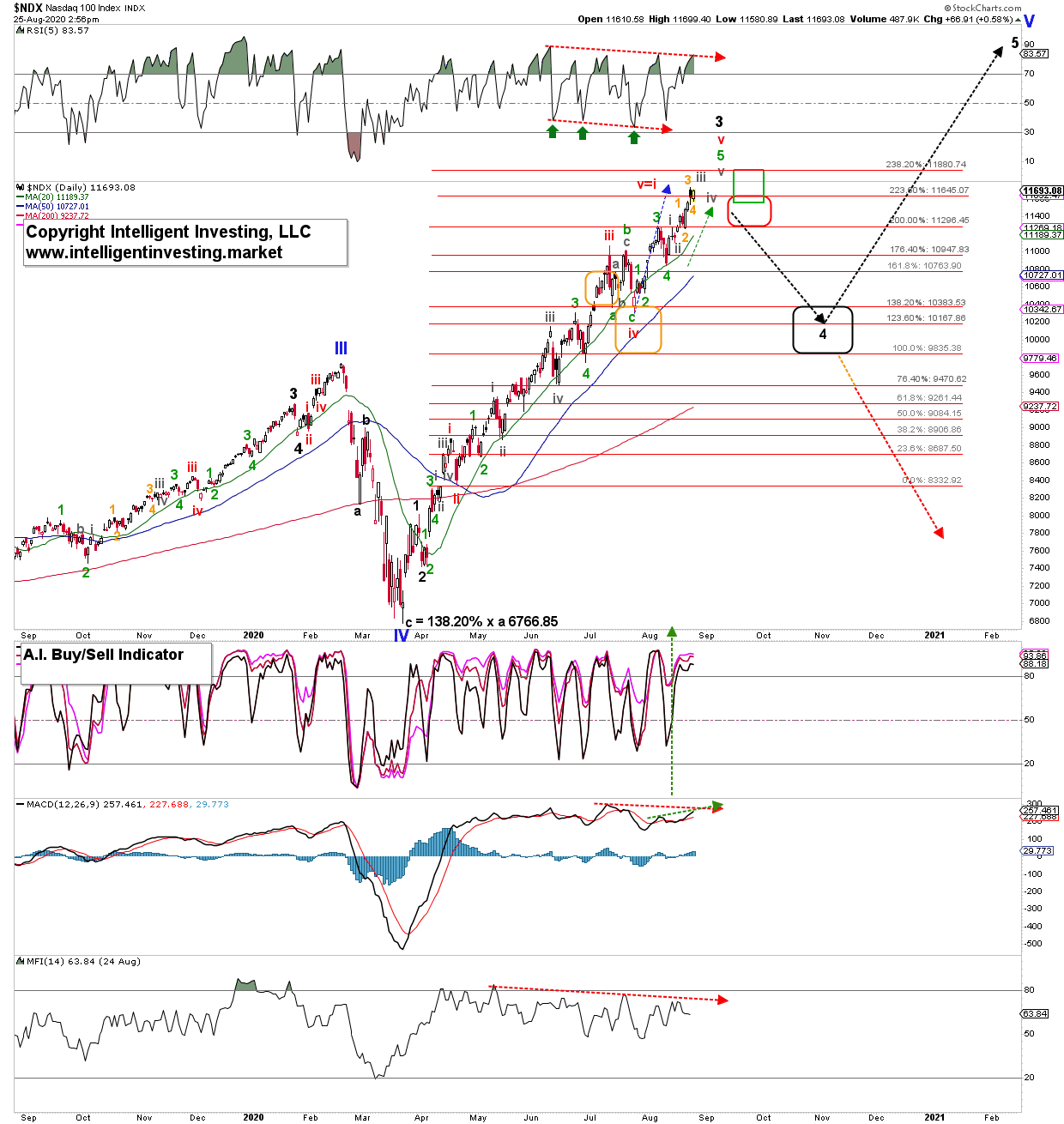

Over the past three weeks, I have kept you updated on the progress of the Nasdaq 100 (see my articles here, here and here). For weeks, my ideal upside target zone has been $11,600-11,700. We have arrived! Besides, last week I found:

“The index could even move as high as $11,880, but for now, I find that less likely.”

Well, what I find less likely is not necessary what the market thinks of it, too. It now appears the NDX is heading for this higher target as green wave-5 is experiencing a subdividing third wave: grey wave-iii is made up of five smaller (orange) waves. Allow me to explain.

Last Thursday’s low (orange wave-2) overlapped with the prior week’s high (grey wave-i) and then the market continued to rally. In an impulse, the first and fourth waves do not overlap, and thus that low was not a (grey) wave-iv, but the start of a subdividing (grey) wave-iii. This is how the Elliott Wave Principle (EWP) can help tell what to expect. Subdividing waves occur often in the third or fifth waves. Thus, so far, so good. However, one simply can not know beforehand which of the two waves will subdivide. And even then, also both waves can subdivide. That is why all one can do is anticipate, monitor and adjust if necessary.

Figure 1. NDX100 daily candlestick chart with EWP count.

Bottom line: I anticipate the NDX to complete a few more smaller fourth and fifth waves over the coming days and, as I told my premium members repeatedly over the last week or so, expect a more important top by late-August early-September, followed by a rough two months for stocks in general heading into the U.S. Presidential Election. So far, this path appears to be still travelled by the market, and I see no reason to change my point of view.

Last week I concluded:

“Thus upside reward is, in my humble opinion, at this stage, 1.9 to 4.4%, and downside risk 8.8 to 13.6%.”

So far, the index has added 2.8% since last week’s update, which is proving my upside reward window to be correct. With the new price data at hand, I can now update this to:

Upside reward is, in my humble opinion, at this stage, around 1.5 to 2.5%, and downside risk is around 10 to 15%. As usual, know your timeframe, trading/investing style, and always act accordingly.