We Tend To Make The Same Mistakes Over And Over

If you are perplexed by the post-election strength in U.S. stocks, it may be helpful to take a giant step back. From The Wall Street Journal:

Many of the financial mistakes people make are caused by a fundamental shortcoming: They can’t see the big picture. In behavioral economics circles, this is known as “narrow framing”—a tendency to see investments without considering the context of the overall portfolio. Many people are vulnerable to it.

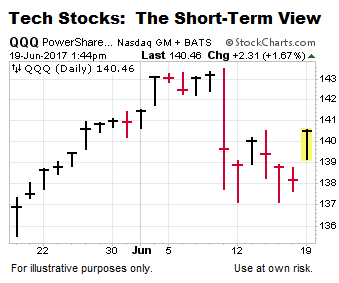

Technology stocks provide an anecdotal example of narrow framing. As shown in the chart of the NASDAQ 100 ETF (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) below, the short-term view has been marked by unsettling volatility.

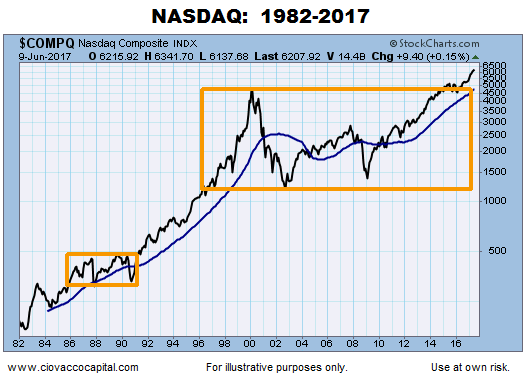

However, if we look at the NASDAQ from 60,000 feet, we see a much more encouraging picture. The narrow view says “tech stocks have gone up for years and may be in a bubble”. The longer-term view says, “the NASDAQ was able to make it back to the highs made in 2000, and recently broke out of a 20-year period of consolidation.”

The Three Most Important Questions For Investors

This week’s video looks at long-term economic and financial market evidence to address the question “does history support the notion that the world is on the brink or that things tend to gradually get better over time?” The video covers numerous charts to assist in combating the human tendency to focus on narrow timeframes.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Short-Term Focus Can Be Harmful

With smart phones and computers making balances, quotes, and P/L accessible 24-7, it is easy to fall into narrow framing mode. From The Wall Street Journal:

The easiest way to achieve your long-term goals, and avoid focusing on short-term losses, is to check your portfolio less often. While it’s now possible to get instant updates on the latest swings of the market, this additional information can lead to narrow framing. This is what the best investors do: They seek out the big picture. And then, once they’ve found it, they remember not to look at it too often.

What about earnings and valuations? Both are reasonable areas of concern. While the conclusions may surprise some, a review of historical facts from January 2017 moved those concerns out of showstopper territory.