- With a rate cut nearly certain in September, a key question remains.

- What comes next after the Fed begins cutting?

- We'll try and look at history to find answers to that.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

As you check your portfolio, you might be wondering how things will play out after the Federal Reserve's expected rate cut on September 18. With under a month to go, it's natural to be curious about what might happen next.

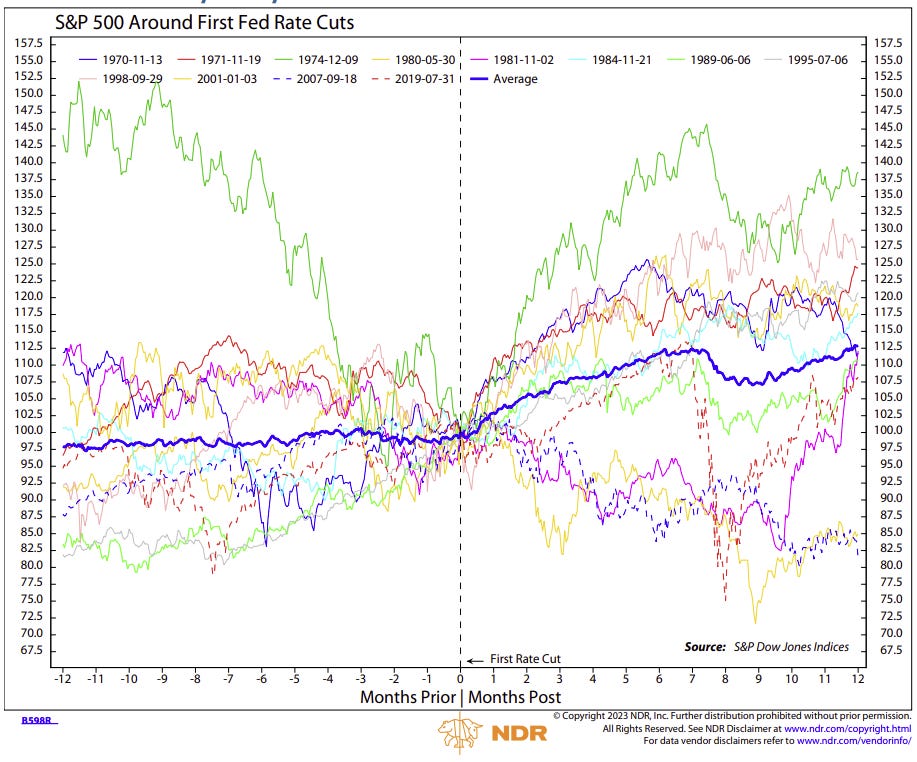

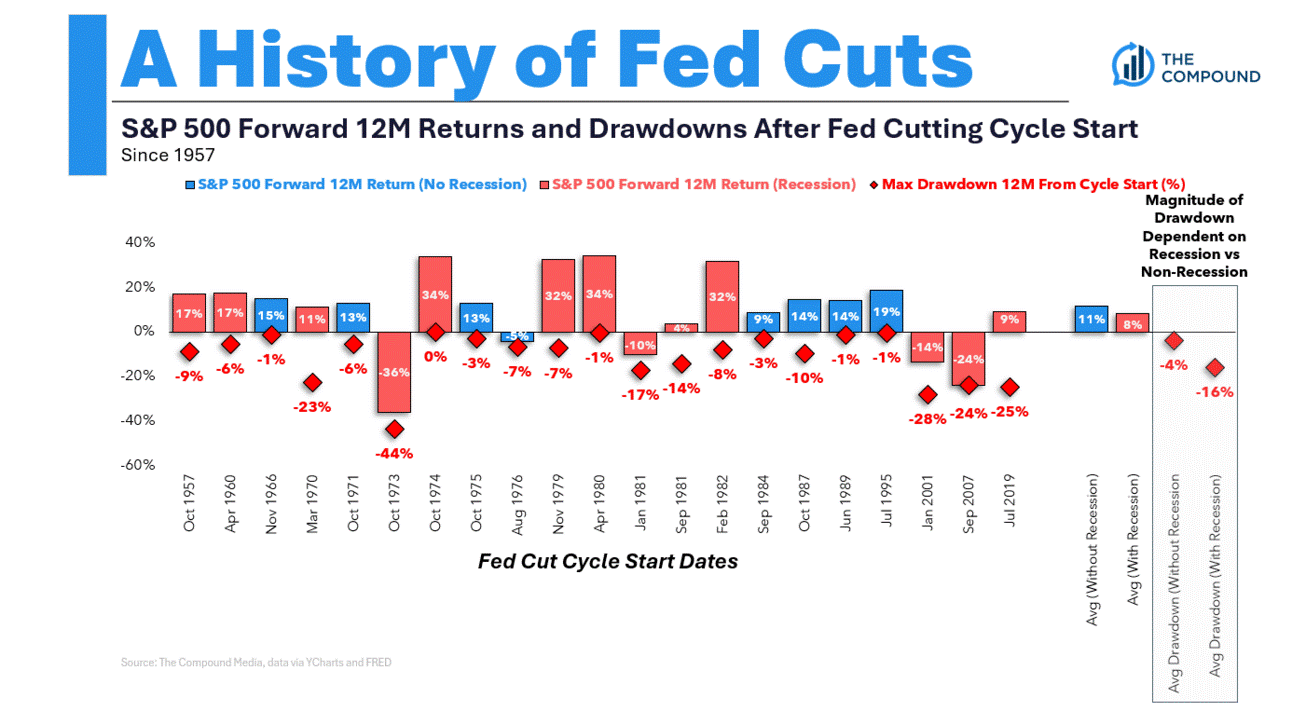

The answer? It’s not exactly straightforward. Historical data shows that equity performance following a Fed rate cut can vary widely.

A big factor is whether the Fed is cutting rates in response to a recession or as a proactive move to normalize policy. Recession, in particular, is a wild card here.

Looking at the data, the S&P 500 has risen in 16 out of 21 rate-cut cycles—about 76% of the time. When there's no recession, the average gain is around +11%.

During recessions, the average gain drops to +8%. However, drawdowns do happen. On average, we see declines of -4% without a recession and -16% with one. Some drawdowns even exceed -20%.

Since 1900, the U.S. has been in recession roughly 22.4% of the time.

But as things stand, there are a couple of reasons to belive in the bullish case.

2 Data Points That Support the Bullish Case After Cuts

1. New Highs for the Dow Jones Industrial Average

The Dow Jones Industrial Average recently hit a new all-time high. Historically, such milestones reduce the likelihood of a recession, occurring only 8.9% of the time after new highs.

The last instance of a new high during a recession was in late 1982, which preceded a strong bullish market.

2. High-Yield Bonds Signal Risk on

The high-yield bond ETF JNK remains near two-year highs, signaling a risk-on sentiment among investors. During times of fear and uncertainty, these bonds typically suffer.

Their current strength suggests confidence in the market and supports the notion of a sustained bullish trend.

Bottom Line

While history offers some guidance, the real impact of the upcoming Fed rate cut will depend on the current economic landscape and how investors react.

The strong performance of the Dow and high-yield bonds suggests that optimism still lingers, but staying vigilant is key. Markets can be unpredictable, especially with recession risks in play.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.