If there is one thing that I have been seeing more of than “2015 predictions”, it’s the notion that indexes will suffer next year. The theory being that quantitative easing and a flight to benchmarking have lifted the major indices to all-time levels. Active managers and stock pickers have been left out in the cold as disjointed fundamentals have created a void between high flying stocks and those that can’t seem to catch a break.

Case in point, hedge funds have had another rough year with the separation between the “haves” and the “have nots” becoming even more prominent. A recent Wall Street Journal article noted that the average hedge fund has risen just 3.5% this year through the start of December. Some have done exceedingly well and others have had concentrated positions in areas that virtually fell apart.

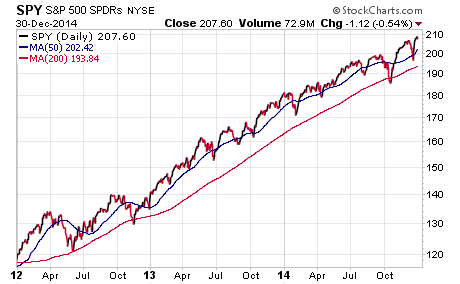

As a result of this institutional under-performance, psychological pressures to perform are causing big money to chase the major indices higher. No one wants to get left behind, so everyone is buying the SPDR S&P 500 ETF (SPY) or some equivalent.

SPY is up nearly 15% this year and has continued to persevere in the face of adversity. Just last week, investors poured $37 billion into U.S.-based stock funds despite the fact that they are trading at lofty valuations. According to ETF.com, SPY alone has garnered almost $24 billion in new assets this year. That’s a massive inflow as both retail and institutional investors look to put money to work before we roll over into 2015.

This disconnect between stock picking and indexing might well be peaking, but indexes will not be the demise of the financial markets.

ETFs that follow passive indexes can provide market correlation, trend indication, and other useful data for millions of investors. They are simply a tool to be used to diversify and simplify your investing endeavors. The ultimate decision on how to position your portfolio should be given careful consideration and is one where active management can actually make a difference in difficult situations.

There will likely be additional bumps in the road in the form of traditional stock corrections, interest rate volatility, commodity missteps and other unforeseen events. In order to weather those conditions, you will need a plan to step out of underperforming asset classes and hone in on areas showing the best overall relative strength.

2015 may well usher in a new era in the markets where things like risk management, trend following, and asset allocation are key to a successful outcome. Gains may be harder to come by, but there will still be opportunities for strategic investors to make well-planned decisions with their portfolio rather than leave things on auto-pilot and “hope for the best”.

For investors in fixed-income, taking a hard look at the overall structure of your holdings and how they perform under various credit and interest rate cycles will be critical for a successful outcome. A Fed rate hike and subsequent repositioning by portfolio managers in response to a flattening yield curve will be just some of the variables in play for 2015.

As always, having a disciplined investment approach and implementing it decisively will produce superior results.