As a blogger and investment adviser, I spend a fair amount of time on social media sharing my ideas with others and absorbing new concepts. I find that the community of the well-respected traders and investment guru’s that I follow has opened my eyes to unseen opportunities as well as potential pitfalls. All told, the sum of this engagement has been a productive use of my resources in vetting the path for the portfolios I manage.

One prescient tweet from @NorthmanTrader on Twitter today spoke of the nature of the markets at this juncture.

I think that is a fair assessment of the seemingly endless divergences we have seen in 2014. Portfolio managers have been confounded by the continued strength in broad-based equity indices such as the SPDR S&P 500 ETF Trust (ASX:SPY) and PowerShares QQQ (NASDAQ:QQQ), while many individual stocks and traditional high beta small caps have failed to make any headway.

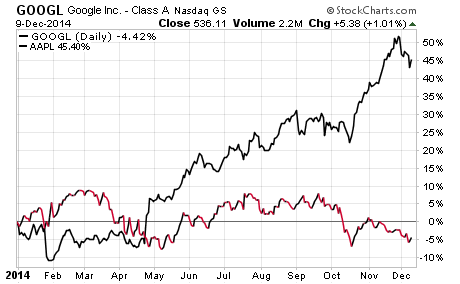

If you’re a stock picker, the difference between the 45% rise in Apple Inc and the 4% decline in Google Inc this year probably has you scratching your head. Aren’t stocks in a similar segment like technology supposed to move in a similar fashion? The 50% relative performance divergence between these two mega-cap companies can make or break your year depending on your asset allocation.

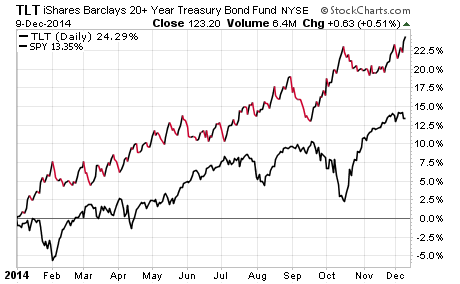

Another matchup of endless speculation is the strength in bonds with equities sitting near all-time highs. Bonds are generally regarded as a flight to quality mechanism that only trade with such strength during periods of duress in the stock market. Yet here we sit with the iShares Barclays 20+ Year Treasury (ARCA:TLT) having hit a new 2014 closing high with gains of more than 24% this year.

Stock bulls have bemoaned how that can keep happening when the economy appears to be on sound footing and the Fed is contemplating its first rate hike in half a decade. They relish the opportunity for interest rates to rise and capital to come spilling back into cash, stocks or other areas of the market.

Bears on the other hand point to falling interest rates and rising bond prices as the pre-eminent deflation threat alongside tanking commodity prices. They speculate that stocks have very little room for error at this point and the Fed-induced risk taking will end badly.

So which argument is right and how long can these disjointed correlations last?

The simple answer is that the market can stay irrational much longer than you can stay solvent. Things don’t always move in a logical fashion and fighting the trend is a sure way to lose real money or opportunity cost. While losing real money is more difficult, both events can be equally frustrating.

For my clients, I’m employing a sensible mix of dividend-paying equity and tactical fixed-income ETFs, along with some select closed-end funds that are showing relative strength. I believe that you need to place a portion of your portfolio in a number of different asset classes to enhance diversification and be prepared to make strategic changes as markets evolve.

Those that have held on to cash or been focused on managing risk have underperformed in recent years. However, risk management will once again become an important part of your overall portfolio framework when these trends decouple.

The market loves to challenge us in unique ways and playing to the strengths of low-cost, diversified ETFs rather than picking individual stocks is why many investors have welcomed these vehicles in their portfolio. I look forward to the opportunities that will present themselves next year and will be navigating these markets with a steady hand.