Per Reuters, Harley-Davidson, Inc. (NYSE:HOG) is expected to experience a period of continued weak sales, driven by low demand of new Harley motorcycles.

Recent researches show that millennials prefer buying less-expensive, used Harley-Davidson models or cheaper versions of other brands rather than going for new Harley-Davidson motorcycles. Also, the company’s ageing core customer group and low prices of Harley-Davidson’s used-motorcycles are other concerns it currently faces in the United States.

Owning a well-known brand at a low-cost budget encourage young Americans to buy used-motorcycles of the brand, Harley-Davidson, while paying their home and student loans. Per analysis, people are still interested in the brand, as they buy used-motorcycles, which definitely do not benefit the company or its shareholders.

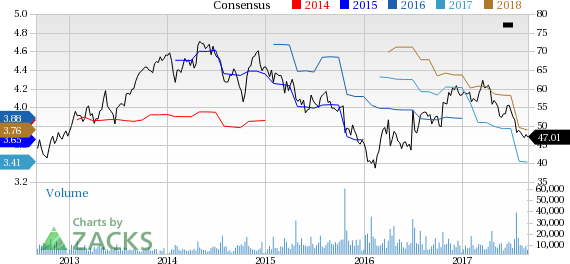

Harley-Davidson, Inc. Price and Consensus

These problems have led to its U.S. sales decline, contributing almost 60% of Harley-Davidson’s total sales. Last fiscal year, the U.S. sales hit a five-year decrease. Plus, last quarter, the same segment sales fell 9.3% to 49,668 motorcycles.

However, Harley-Davidson has been trying to recover and benefit from the growing used-motorcycle segment and reach new customers besides the existing lot. It also expects to gain from its brand loyalty from customers who purchase used-motorcycles from their dealership chains.

Price Performance

Harley-Davidson’s shares have plunged 19.8% in the last six months, substantially underperforming the 3% gain of the industry it belongs to.

Zacks Rank & Key Picks

Harley-Davidson currently carries a Zacks Rank #5 (Strong Sell).

A few automobile stocks worth considering are Allison Transmission Holdings Inc. (NYSE:ALSN) , Renault (PA:RENA) SA (OTC:RNLSY) and Toyota Motor Corporation (NYSE:TM) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has a long-term growth rate of 11%.

Renault has a long-term growth rate of 4.6%.

Toyota Motor Corporation has a long-term growth rate of 7%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Toyota Motor Corp Ltd Ord (TM): Free Stock Analysis Report

RENAULT SA (RNLSY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Harley-Davidson, Inc. (HOG): Free Stock Analysis Report

Original post

Zacks Investment Research