Overview:

- Stress in Greek financial markets is building

- Slowing global GDP and falling commodity prices are putting a strain on commodity-focused countries

- U.S. and global credit stress indices showing biggest negative divergence since 2011 and 2007

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.” —Former Fed Chairman Ben Bernanke, Testimony to U.S. Congress (March 2007)

As we all know, the U.S. subprime mess was more interconnected than most thought, spreading like a wild fire across the globe and was absolutely NOT CONTAINED. The excessive mal-investment in housing was as clear as day as was the coming nightmare when all of those teaser loans were about to be reset.

Investors will be faced with another potential subprime mess this year as Greece’s new elected party, Syriza, will try to renegotiate the country’s debt with its creditors. Greece has 323 billion euros in debt outstanding, or 175% of the country’s GDP. Of that, 246 billion euros is owed to other countries in the Eurozone, the ECB, and the IMF. Greece owes Germany 56 billion euros and Germany so far has rejected any notion of taking a haircut on that debt owed them.

Given the anti-austerity platform that Syriza ran on in the recent election, investors are understandably worried, which is being reflected in the financial markets. At the height of the 2011/2012 euro debt crisis, Greece 10-Year government bond yields soared to almost 40% and credit default swaps (CDS) on Greece 5-Year debt jumped to over 35000 basis points. Due to the various programs and bailout packages by the ECB and the IMF, fears eased and yields fell as well as Greek CDS numbers.

However, stress appears to be building in Greek financial markets again. Greek 10-yr bond yields are back above 10% and Greek 5-yr. CDS numbers have blown through 1,000 and are on their way to 2000. While not as high as in 2011-2012, Greece will certainly have to be monitored for worsening developments, which could lead to a global sell off in risk assets.

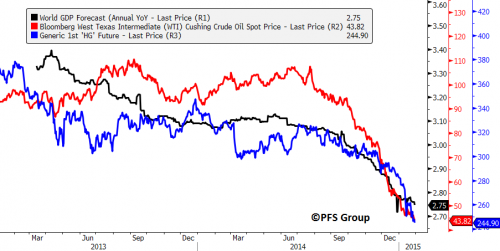

Rising financial stress isn’t “contained” to Greece as the current slowdown in global growth as well as sharply falling commodity prices are being felt across the globe. World GDP 2015 growth forecasts have been sliding for two years now but recently took a sharp turn lower last fall alongside the decline in oil and copper.

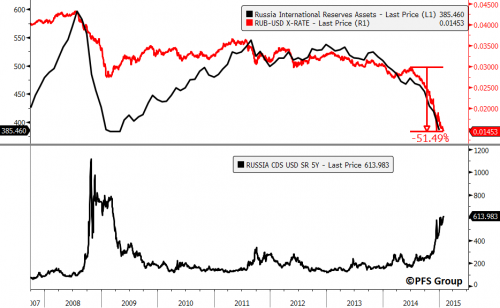

Particularly feeling the pain from falling oil prices is Russia, which has seen its currency fall against the USD by more than 50% in just the last few months. Foreign exchange reserves are being depleted quickly and are back to levels seen in 2009. Given the deteriorating conditions in Russia, investors are pricing in a higher probability of default as CDS on Russian debt are blowing out to over 600 basis points and nearing the highs of 800-1000 seen at the depths of the 2008 financial crisis.

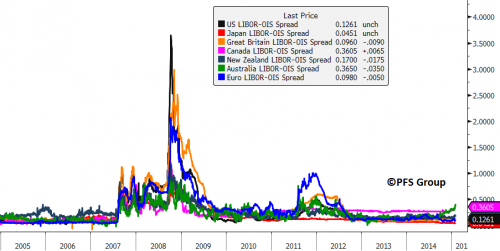

It isn’t just sovereign countries like Russia feeling the strain from declining global growth and the steep fall in commodity prices—banks within commodity-focused countries are beginning to show signs of stress as well. One measure of credit risk within the banking sector is the LIBOR-OIS spread, which absolutely exploded in the middle of 2007 and provided a major red flag of coming financial stress for anyone paying attention. The spread for various countries remained elevated and exploded even further in late 2008 before coming down prior to the market bottom in early 2009. With global reflation in 2008-2009, the spread came down across the globe until 2011 when the Greek/Euro debt crisis heated up. While in the 2008 crisis, U.S. banks saw the highest spread (north of 4% at one point) it was the Euro spread that blew out the most in 2011 to over 1%.

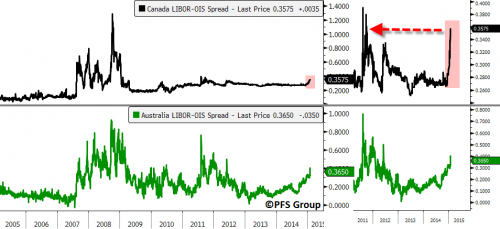

Currently, the banks experiencing the greatest stress are coming from commodity-focused counties like Australia and Canada. The Canadian bank LIBOR-OIS spread is exploding higher and almost at the highs seen in 2011 while Australian LIBOR-OIS spread is also closing in on the highs from 2011 as these two countries feel the pain from falling commodity prices and weakening economies.

Looking at the LIBOR-OIS spread for the U.S. banking system shows little signs of stress. However, the same cannot be said for other areas like the junk bond market and increased volatility in the stock market. Bloomberg’s Financial Conditions Index (FCI) for the U.S. tracks the overall level of financial stress in the money, bond, and equity markets to assess the availability and cost of credit. Typically, it either leads or tracks the movement of the S&P 500. Right now we are seeing a pretty significant divergence—not as drastic as in 2007 but still unnerving.

The FCI peaked in early 2007 and took a sharp turn south while the S&P 500 kept marching higher before beginning to stall in the summer and fall. In hindsight, the credit markets were sending a pretty loud siren that all was not well and eventually the stock market listened as it plunged late in 2007 and sharply in 2008. The FCI was sending another loud message late in 2008 but this time it was a far different tone. Financial stress peaked in October 2008 and the financial markets began to heal even though the stock market continued to plunge into 2009 with the FCI serving as a great signal of a coming market bottom. While it didn’t give a warning of the 2010 top it did improve significantly ahead of the overall market bottom and has more or less confirmed the market’s move until this past year. Since last summer the FCI has been trending downward, which needs to be monitored.

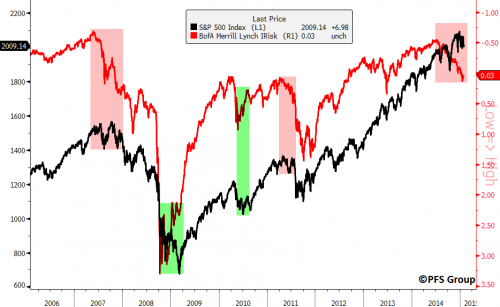

Similar to Bloomberg’s FCI is BofA/Merrill Lynch's IRisk Index, which is a global measure of market solvency and liquidity risk in the financial system. We are seeing the third biggest divergence in the last decade (see red shaded boxes) with the IRisk Index experiencing an even sharper decline than Bloomberg’s FCI since last summer. This is warning that the market is currently on shaky ground.

Summary:

“Rule No.1: Never lose money. Rule No. 2: Never forget rule No. 1” —Warren Buffett

We are currently witnessing building financial stress across the globe, which is likely stemming from concerns over Greece’s recent election results as well as turmoil in both commodity and currency markets. While credit markets are deteriorating we’ve yet to see this spillover into equity markets, which is setting up the biggest bearish divergence since 2011 and 2007. This highlights that investors should be on high alert in case equity markets play catch up with the deterioration in the credit markets and we could be in store for a global sell off much like we had in October of last year, where defense is the name of the game.

While I believe investors should remain on high alert in the near-term for a market decline, in my next article I will be outlining why investors should also be ready for a reacceleration in global growth and risk assets looking further out.