Interest rates are slowly rising. Earnings are raging. Sentiment is in the toilet. And stocks are falling. We knew last year we would get 3 rate increases and now with debate about a 4th markets are getting crushed? I find it hard to believe that 25 bp is more than rounding error in any model. Rising rates alone cannot be the cause of ‘markets in turmoil.’ The macro guys will tell you that valuations are stretched. Blow out earnings should help that right? Two ways to lower PE ratios, lower price (its happened) and raise earnings (also happening). Yet stock prices keep falling. Sentiment is a big thing.

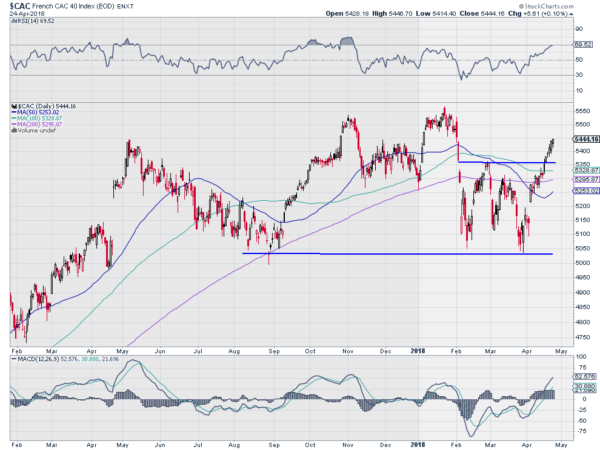

There is one bright spot though. France. May in Paris is a great thing and I would love to be there. Walking the gardens in front of the Louvre along the Seine. But I will have to be satisfied with watching the French markets instead of the architecture. That is fine as the French market appears to be shaking off this global malaise and leading to the upside. The chart below tells the story.

The CAC 40 made that same peak in January that all markets did. It fell to a low in February and then made another low at the end of March. But it is not struggling now as other markets fall back. Instead it has made a higher high and is driving toward that January high. It has momentum on its side. The RSI is strong in the bullish zone with the MACD rising. Would it be ironic if it was the French that lead the world markets higher?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.