The Energy Select Sector SPDR ETF (NYSE:XLE) is in focus for many investors and traders as we approach the end of 2017. But is this fund worth owning?

Technical analyst Taki Tsaklanos from Investing Haven points out the important technical level to watch for this ETF, which has bounced back considerably from its yearly lows amid crude oil’s price recovery:

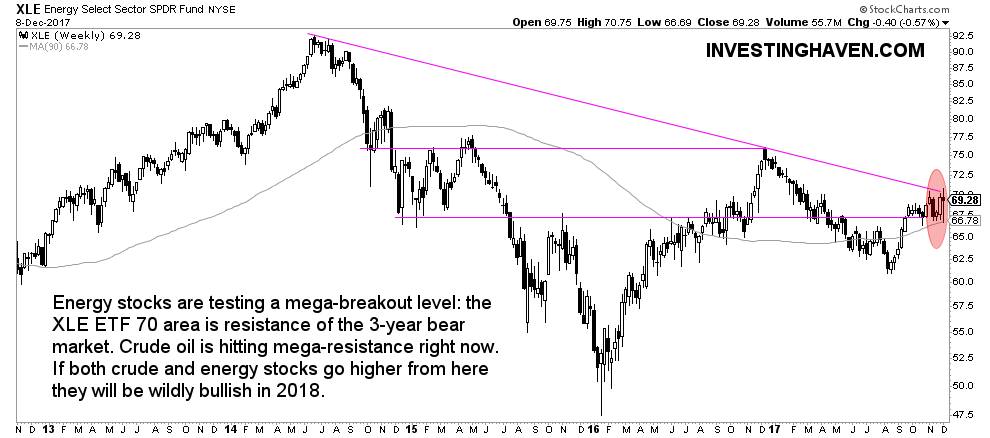

The breakout in energy stocks will only take place once the 70 point level in XLE ETF is broken to the upside. Moreover, after a breakout, there is a high probabily that prices come down to test the breakout point again, which, in the case of energy stocks, is 70 points in XLE.

Admittedly, XLE is very close to a breakout. It is a pressure cooker because, all previous attempts to break out (92 points in summer ’14, 76 points in December ’16) were different than the shape we see today. That in and on its own is not a valid signal, it is of secondary importance. That is how we read the chart and the unfolding pattern.

Here’s Tsaklanos’ annotated chart:

XLE was trading at $69.82 per share on Monday morning, up $0.54 (+0.78%). Year-to-date, XLE has declined -6.10%, versus a 20.09% rise in the benchmark S&P 500 index during the same period.

XLE currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #13 of 36 ETFs in the Energy Equities ETFs category.