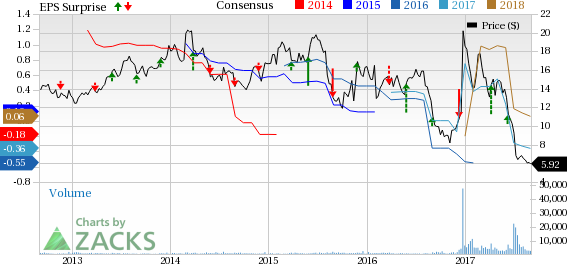

Fred’s, Inc. (NASDAQ:FRED) is slated to report second-quarter fiscal 2017 results on Sep 6, before the opening bell. The question lingering in investors’ minds is, whether this leading discount retailer will be able to post a positive earnings surprise again in the to-be-reported quarter. The company’s earnings have outpaced the Zacks Consensus Estimate in two of the trailing four quarters with a negative surprise in one quarter. This brings the company’s average to a miss of 0.61%.

Let us see how things are shaping up for this announcement.

Which Way are Estimates Treading?

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before the earnings release. The Zacks Consensus Estimate for second-quarter and fiscal 2017 has been declining over the last 30 days. While estimates for the second quarter widened from a loss of 16 cents to a loss of 18 cents, the same for the fiscal year widened from loss of 33 cents to a loss of 36 cents per share.

However, the Zacks Consensus Estimate of a loss of 18 cents per share for the second quarter remains flat from the prior-year quarter. Further, analysts polled by Zacks expect revenues of $507.4 million for the said quarter, down 4.2% from the year-ago period.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Fred’s is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Fred’shas an Earnings ESP of 0.00% as the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 18 cents. The company currently carries a Zacks Rank #4 (Sell). Note that Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Factors at Play

Fred’s has been posting dismal comps for quite some time now due to the sale of low productive discontinued inventory. Declining traffic trends are also hurting comps. We note that the company’s comp sales fell 0.8% in May 1.6% in June and 0.1% in July. In the preceding quarter, sales were also affected by the closure of 39 underperforming stores, which further dented August comp store sales, which dipped 0.5% year over year. Comparable store sales for August were negatively impacted by the continued increase in Generic Dispensing Rate as well as a 0.5% impact from the sale of low productive discontinued inventory versus August of last year.

Also, it seems that the company is yet to recover from the cancelled Walgreens Boots Alliance (NASDAQ:WBA), Inc. and Rite Aid Corporation merger. The Walgreens-Rite Aid merger was important to the company, as it would allow Fred’s to buy 865 Rite Aid stores. The acquisition of these stores would have positioned Fred’s Pharmacy as the third-largest drugstore chain in the nation after Walgreens and CVS Health (NYSE:CVS) Corporation. Additionally, Fred’s would have had greater negotiating power and would have also improved its healthcare growth strategy. The cancelled merger, however, led to higher selling, general and administrative expenses mainly due to higher professional, legal, banking and integration planning fees incurred in connection with the announced agreement to acquire Rite Aid stores and the development and implementation of the company's growth strategy.

We note that the company has been witnessing improved growth in Retail Pharmacy adjusted script comps and year-over-year progress in sales trends in the Specialty Pharmacy business, as the company continues to execute the Fred’s Pharmacy healthcare transformation. The company is also closing underperforming stores and has been upgrading technical knowhow, improving supply chain and is focusing on its health care strategy in relation to execution of the Fred’s Pharmacy transformation.

However, Fred’s sluggish traffic trends and declining comps remain its woes and is well reflected in the share price of the company. If we look into the past three months’ performance of Fred’s, we note that the stock has significantly declined 54.7% in comparison to the industry, which declined only 7.7% in the said time frame.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Big Lots Inc. (NYSE:BIG) has an Earnings ESP of +26.11% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kirkland's Inc. (NASDAQ:KIRK) has an Earnings ESP of +15.62% and a Zacks Rank #2.

Best Buy Co. Inc. (NYSE:BBY) has an Earnings ESP of +2.80% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Fred's, Inc. (FRED): Free Stock Analysis Report

Kirkland's, Inc. (KIRK): Free Stock Analysis Report

Original post

Zacks Investment Research